This Week in Vertical Tech

SimGym, GDPVal, AI Industry Penetration, and more

Good morning,

There’s a chance this week will be looked back on as one of the most important weeks in vertical software. We got more tractable signals on the economic value of base model improvements and we saw what might be the coolest AI product release of the year with big ramifications for how vertical software will innovate going forward.

So let’s dive in:

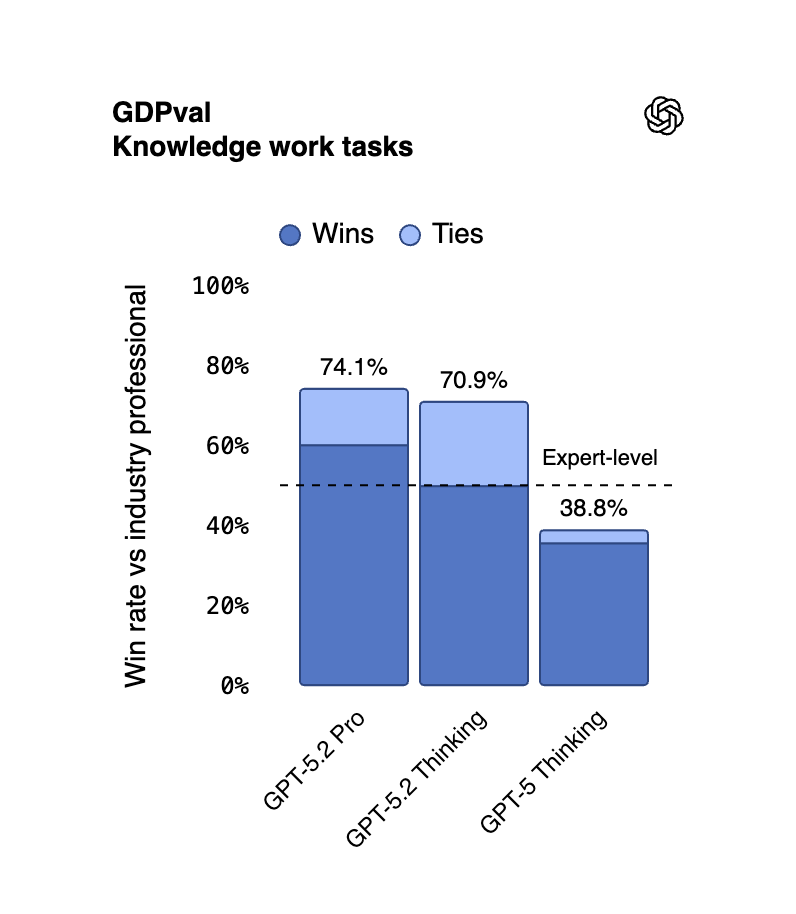

GPT-5.2 is crushing the evals, including GDPVal

The current model trope is that they crush on evals across math, science, and coding and then are dramatically less powerful in real knowledge work situations.

OpenAI has been hard at work here creating GDPval as an index of economically valuable capabilities and then training models around knowledge work problems that matter: financial modeling, nursing scenarios, and more.

Based on the reported results, GPT-5.2 looks like one of the first models that, given the right context, performs meaningfully better out of the box on real knowledge-work tasks.

In my view this indicates two things:

If you can define the necessary knowledge work pattern, labs and service providers essentially have zero limitations on getting models to solve the knowledge work capability gap through a combination of mid-training and post-training techniques.

It also highlights the continuing importance of AI operating inside of systems and databases. Ultimately, base model improvements are incredibly desirable from the perspective of vertical software. And further base model improvements are likely to imply far more partnerships with vertical software companies and vertical AI companies in order to achieve more economically useful activity and then distribute it.

In short, the natural deployment path for AI in the majority of industries lies within systems of record and systems of action.

There’s much more that could be said here, but I’ll leave it for next week when we do predictions for 2026.

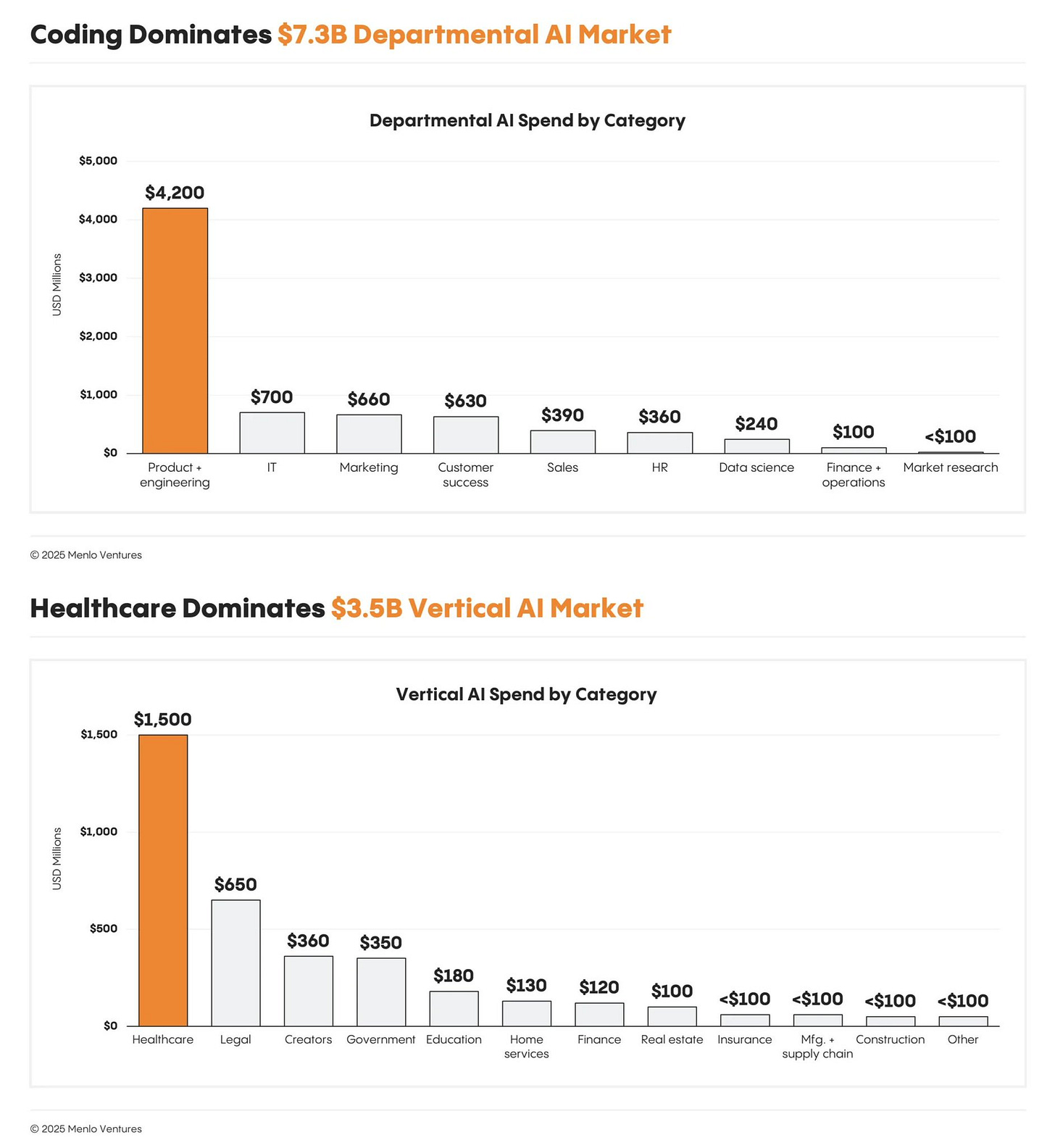

AI penetration in vertical and functional categories is still nascent

A couple graphs for you:

Menlo catalogued functional and vertical revenues.

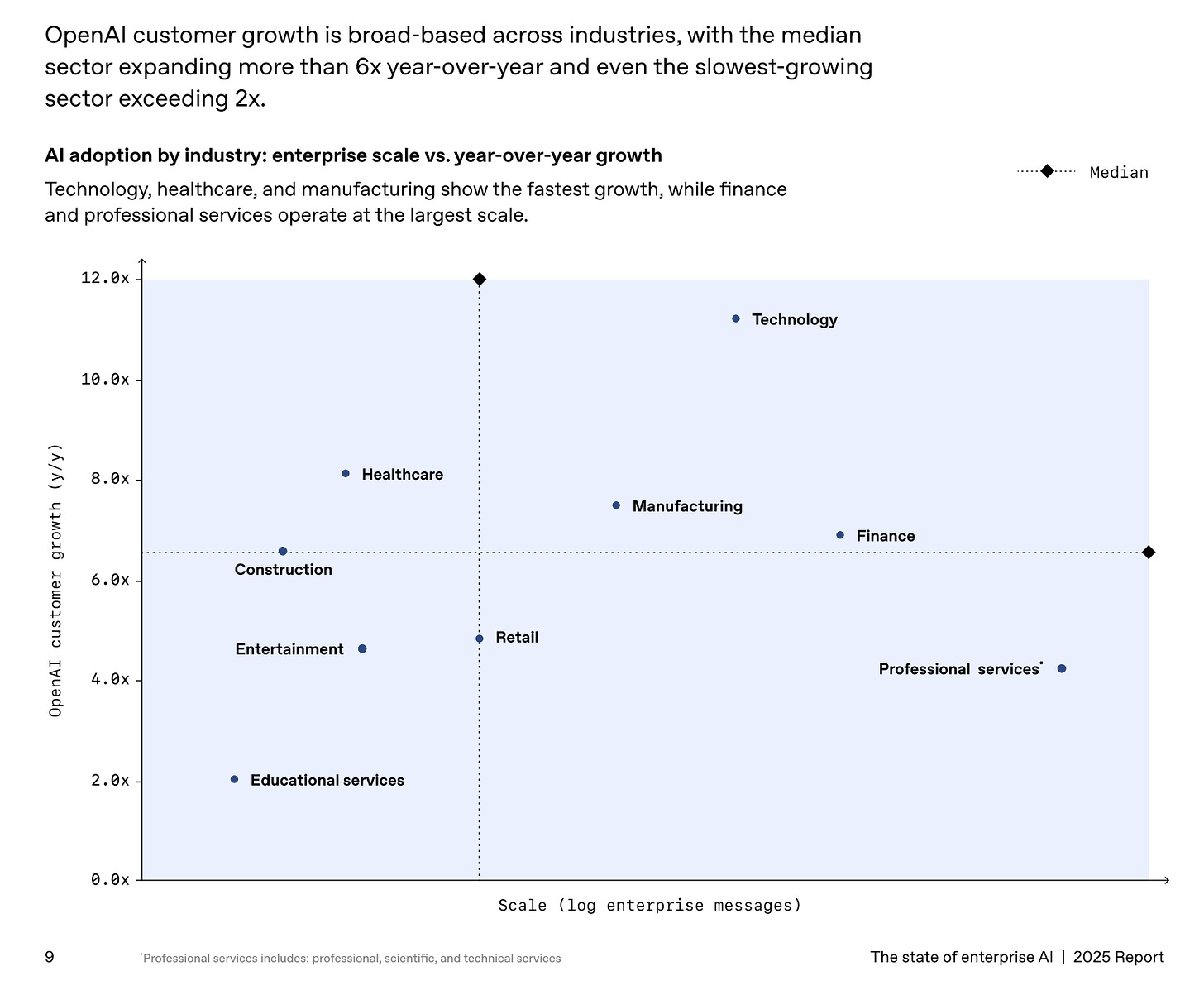

OpenAI released their report on the State of Enterprise AI.

Can we use these two graphs to determine some interesting takeaways around where dollars and builders will be headed? Likely yes.

First, manufacturing looks like an industry ready for some breakout vertical AI solutions. Despite absolute dollars being low, the number of interactions with models inside the industry is growing well above the median.

Second, construction has meaningful interest from enterprise customers, but both the dollars being spent and the value being realized are low across the industry.

In short if we measure the labor spend in nearly all these industries vs. the current AI spend, it’s appropriate to say that we are still in Year Zero for AI adoption in the vast majority of industries even with extraordinary growth rates. From a demand perspective, this doesn’t look bubbly, especially with models continuing to steadily improve.

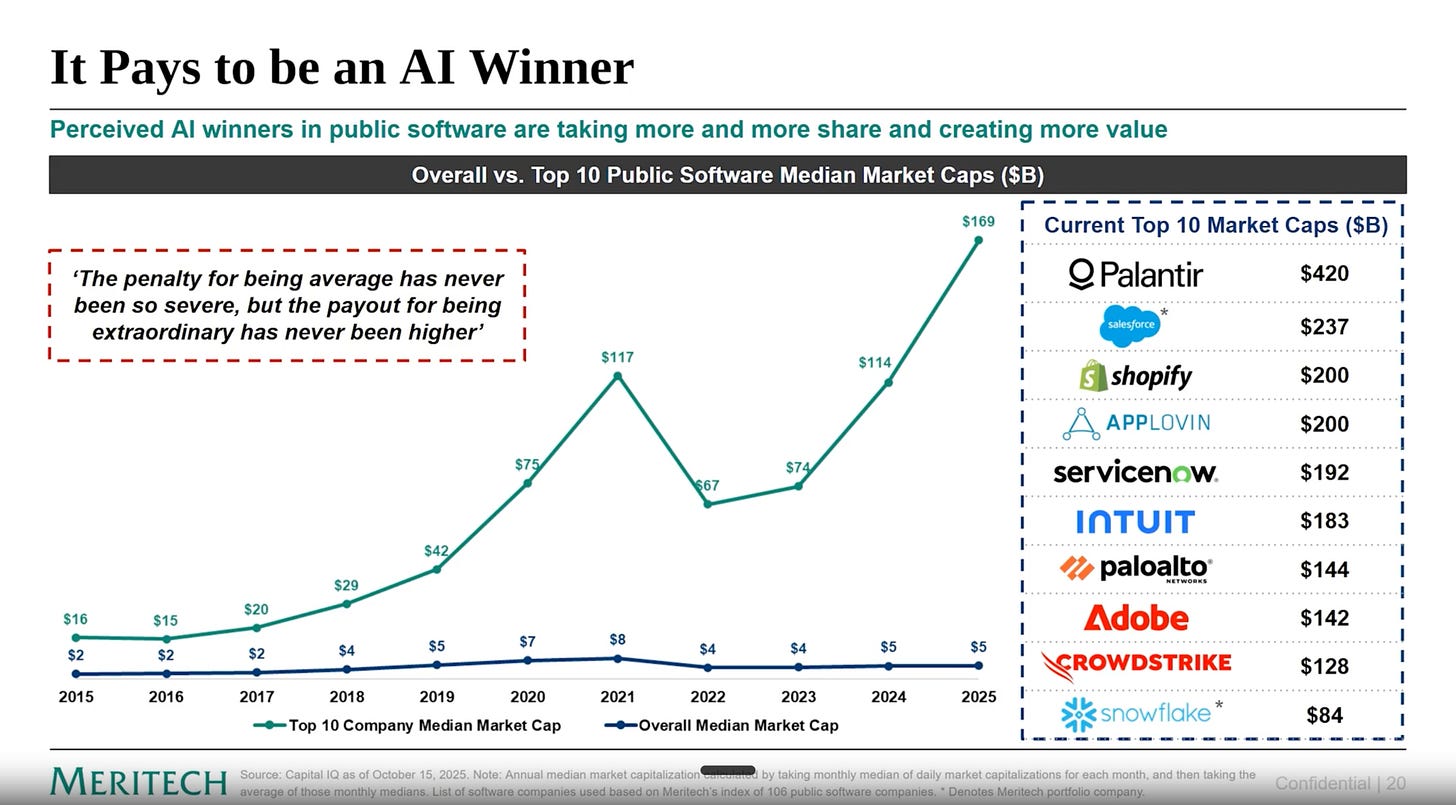

Is Vertical Software Undervalued?

Meritech put together a 2025 Markets Update highlighting the emerging gap between software winners and losers in the AI world.

I’ll highlight some slides here:

In the public markets, AI winners are growing market cap at extraordinary rates.

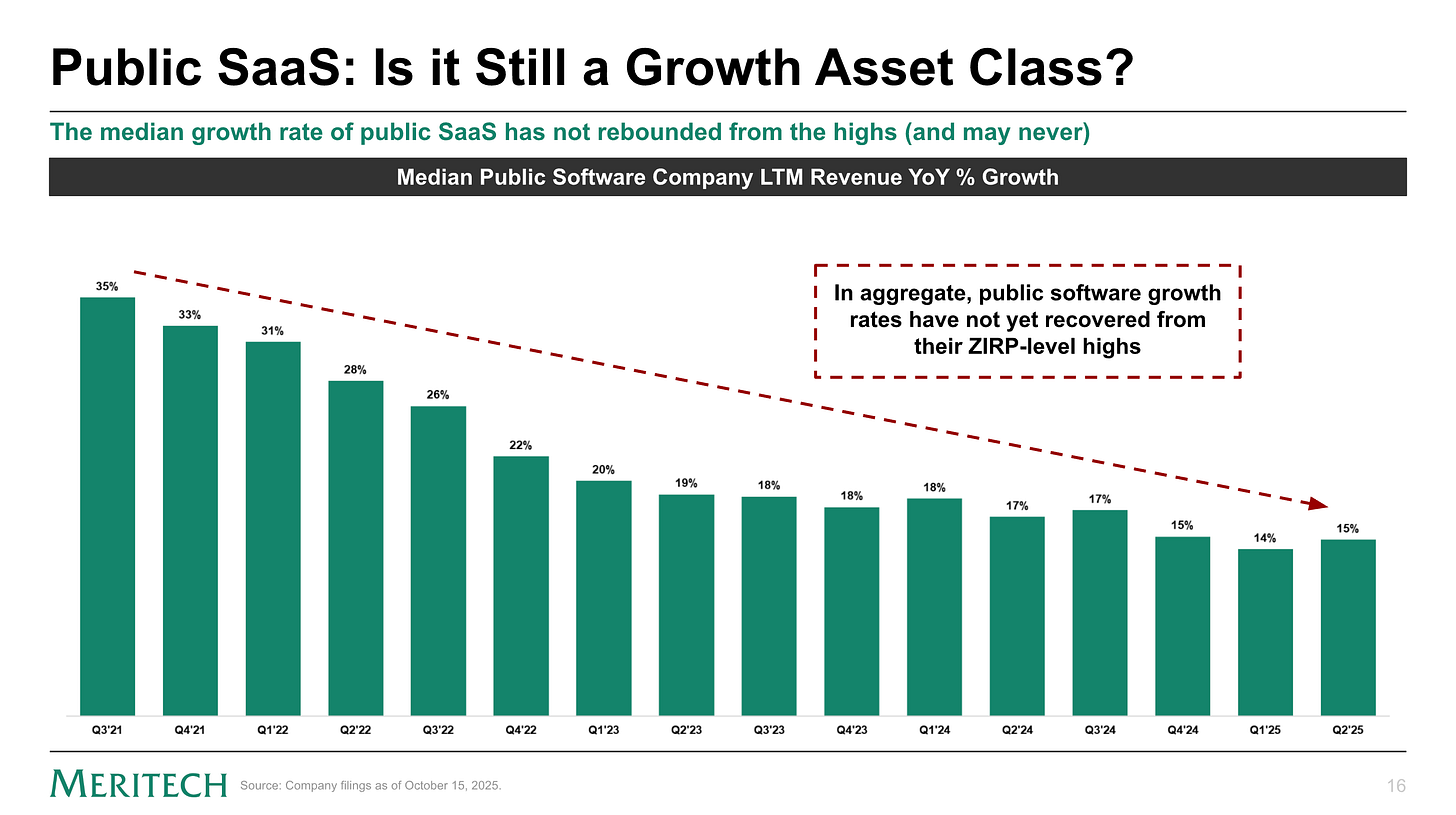

Public SaaS is hovering around 15% growth rates.

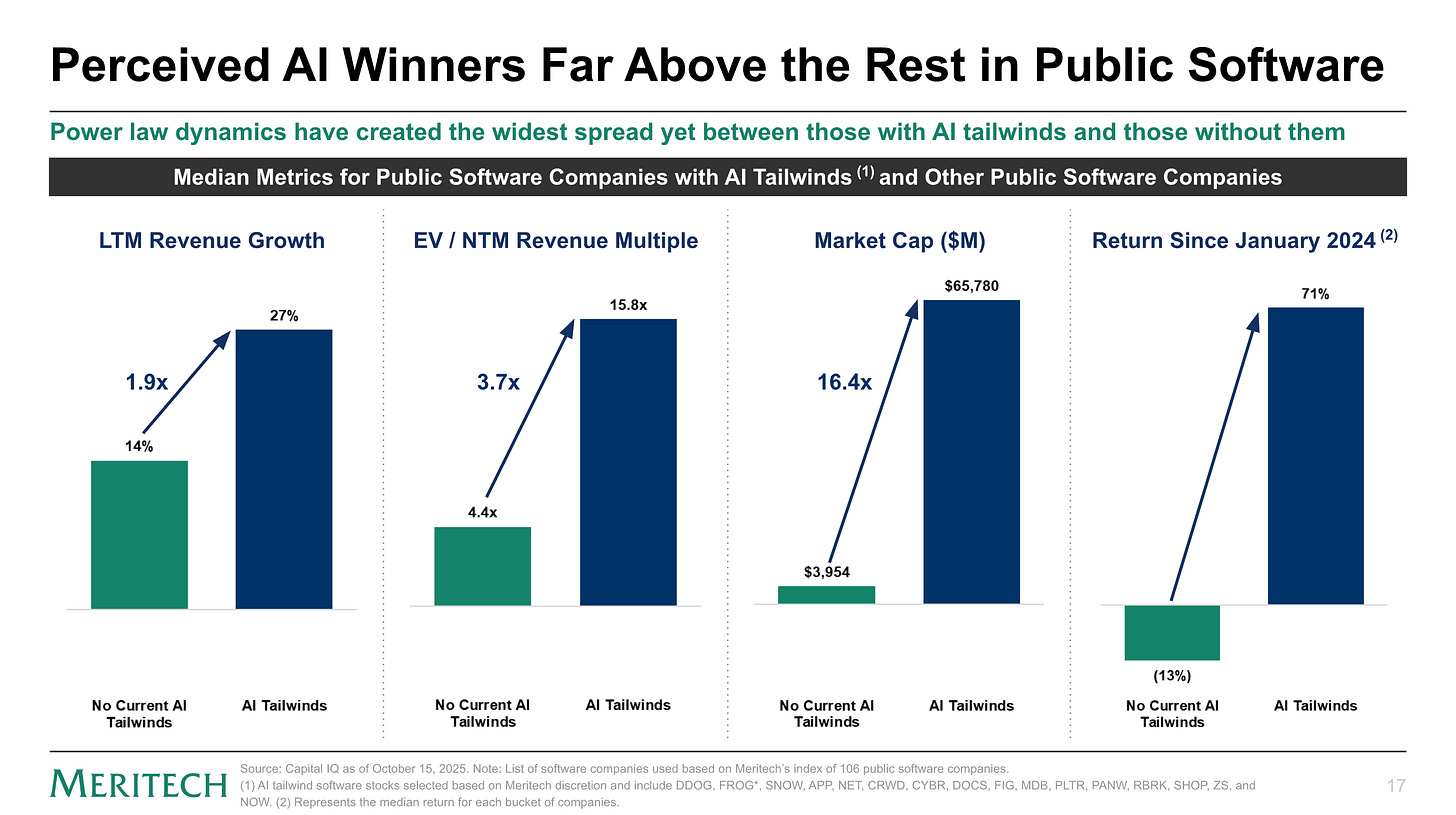

AI Tailwinds are everything. Companies with AI tailwinds are growing faster, with higher multiples, and greater market caps.

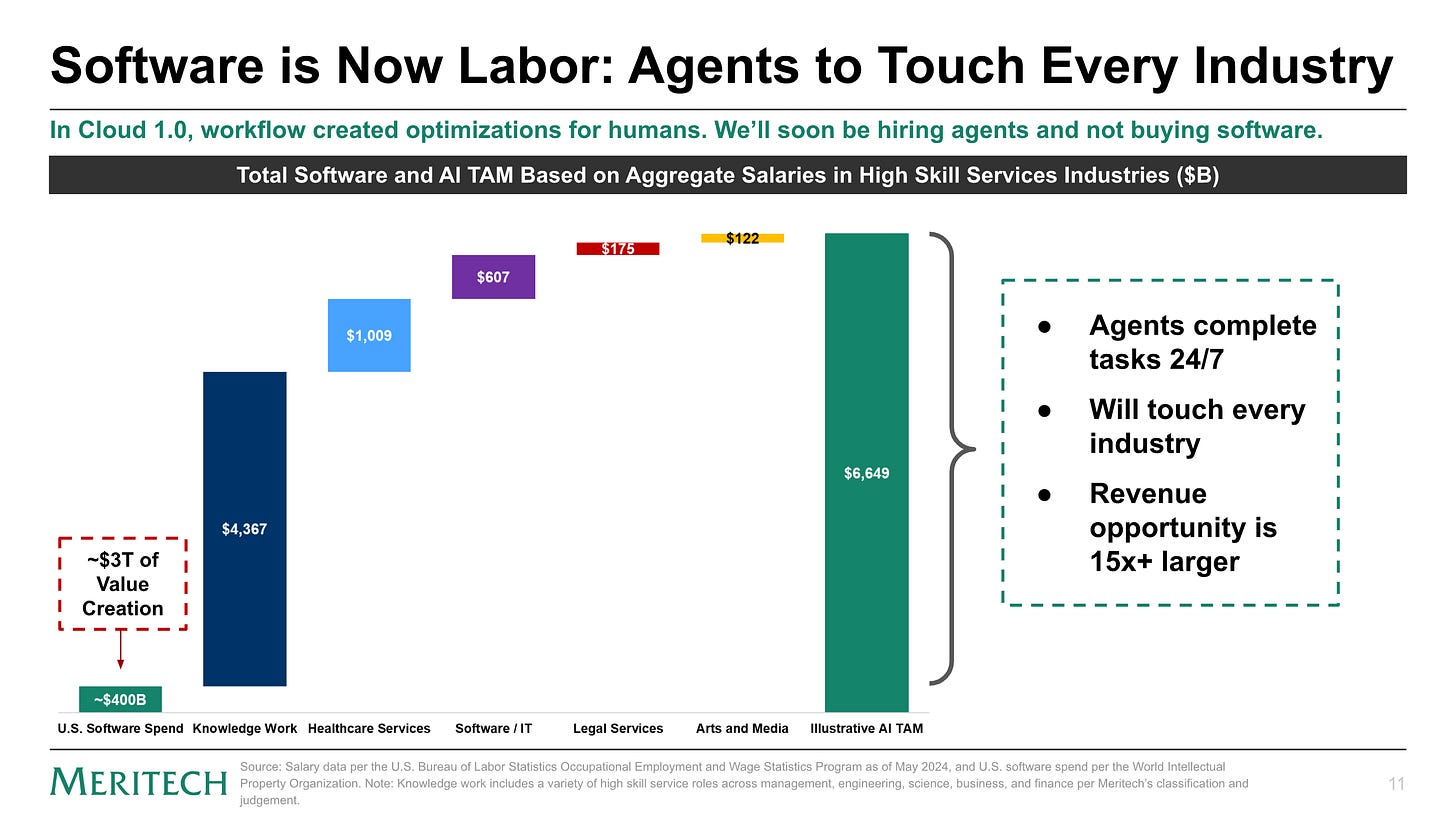

The Labor Thesis is still present.

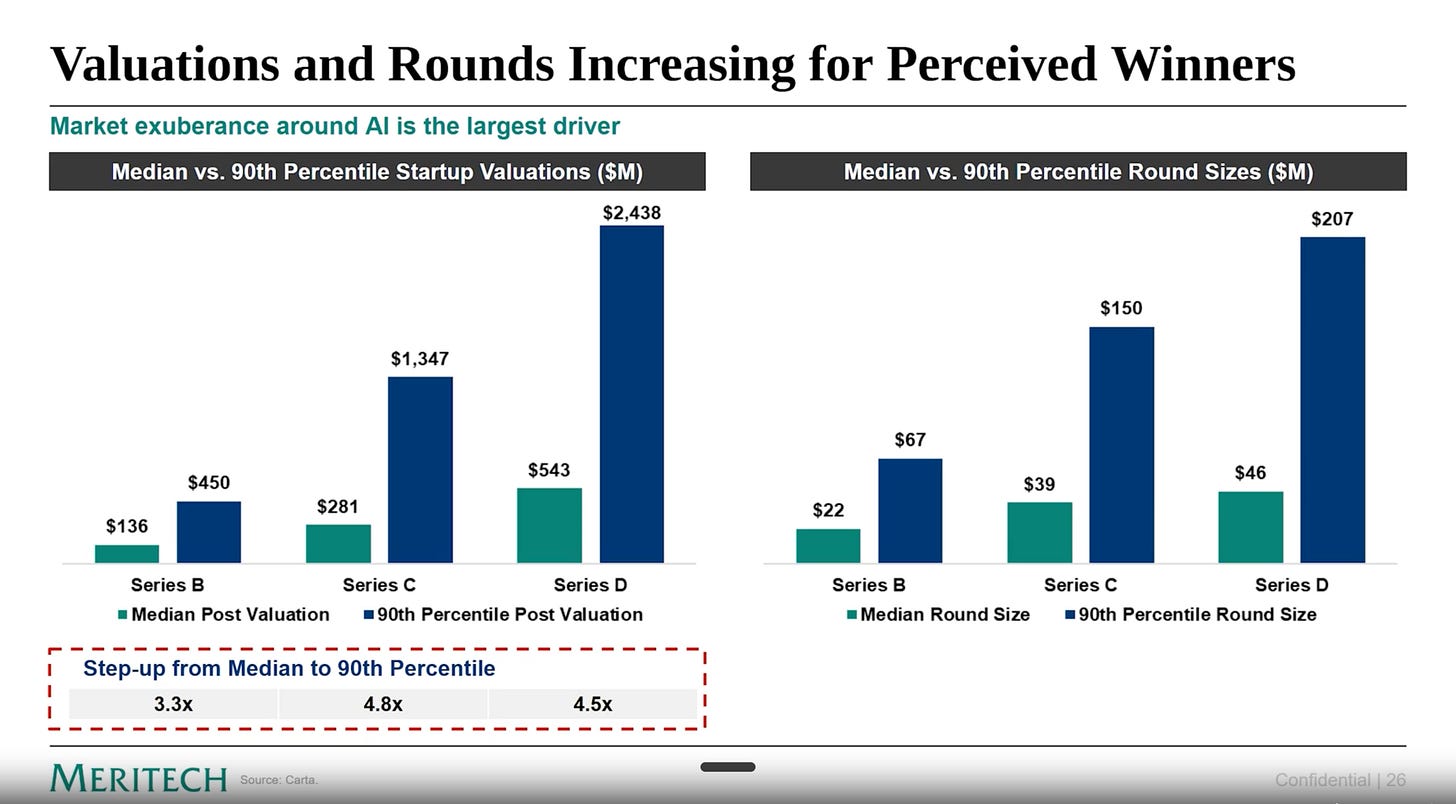

Lastly, in the private markets, it’s AI or bust.

Does this spread between SaaS companies and AI valuations open up arbitrage opportunities?

Jesse Tinsley, acquirer of Mainstreet and other software products, thinks the answer is yes.

Everyone is talking about AI saying SaaS is dead is well… dead wrong…

The Biggest winners will take Legacy SaaS companies and turn them into AI first companies.

Why legacy SaaS?

1) niche training data

2) refactor everything

3) capture instant distribution (revenue and customers)

4) skip 4-5 years to build and capture market share

The pace paradox suggests buying vs building right now and the tradeoff isnt even close.

I largely agree. Again, we will leave it for 2026 predictions, but I think this is going to become one of the largest stories of 2026: the realization that existing vertical software companies and systems of record more broadly are not going away.

SimGym

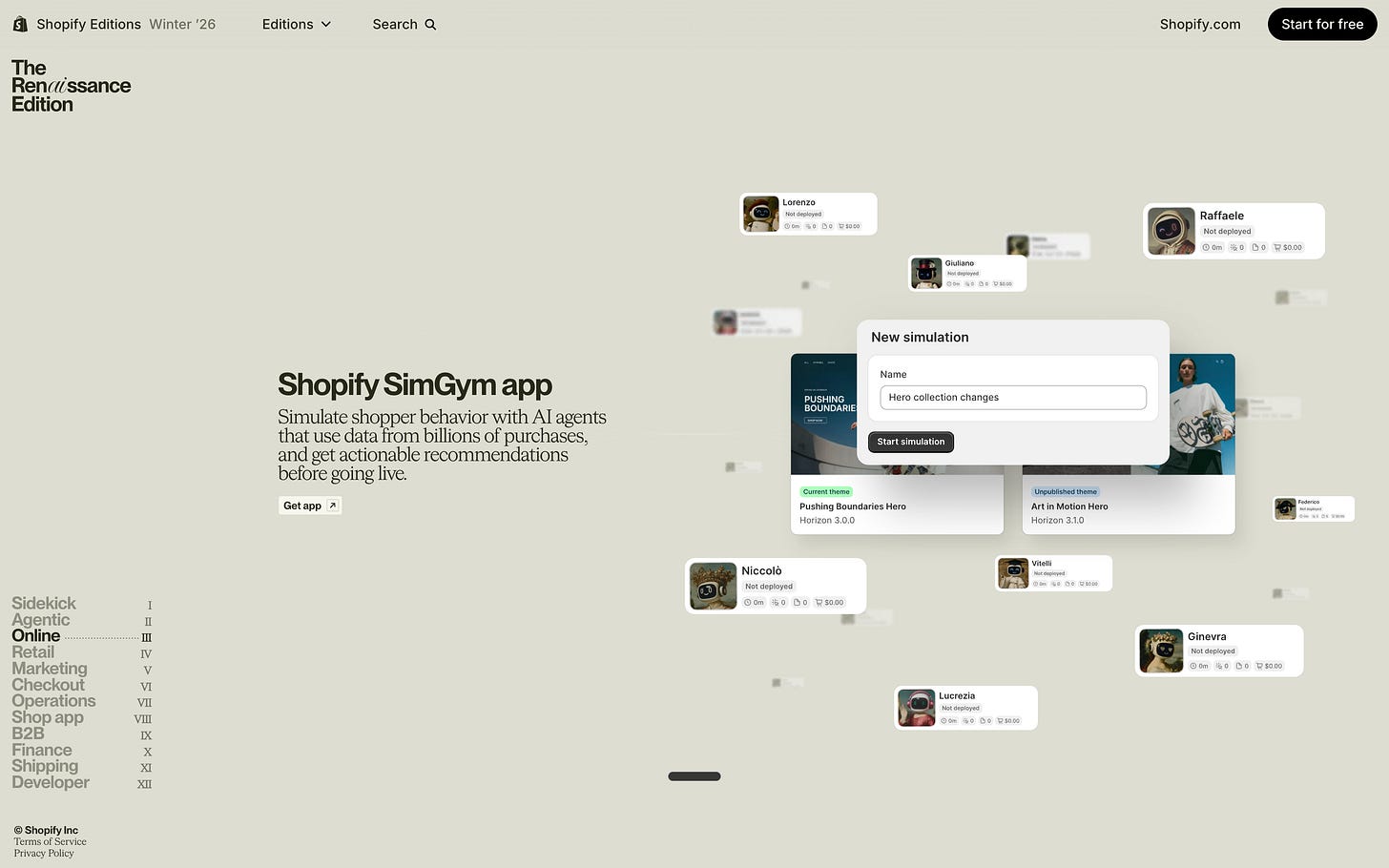

Shopify launched my favorite product of the week: SimGym.

It’s got an amazing core idea. Ecommerce companies optimize for conversion rates. That has led to an entire industry of companies providing A/B optimization tests for websites; literally going pixel by pixel to figure out what leads to a 0.2% conversion uplift.

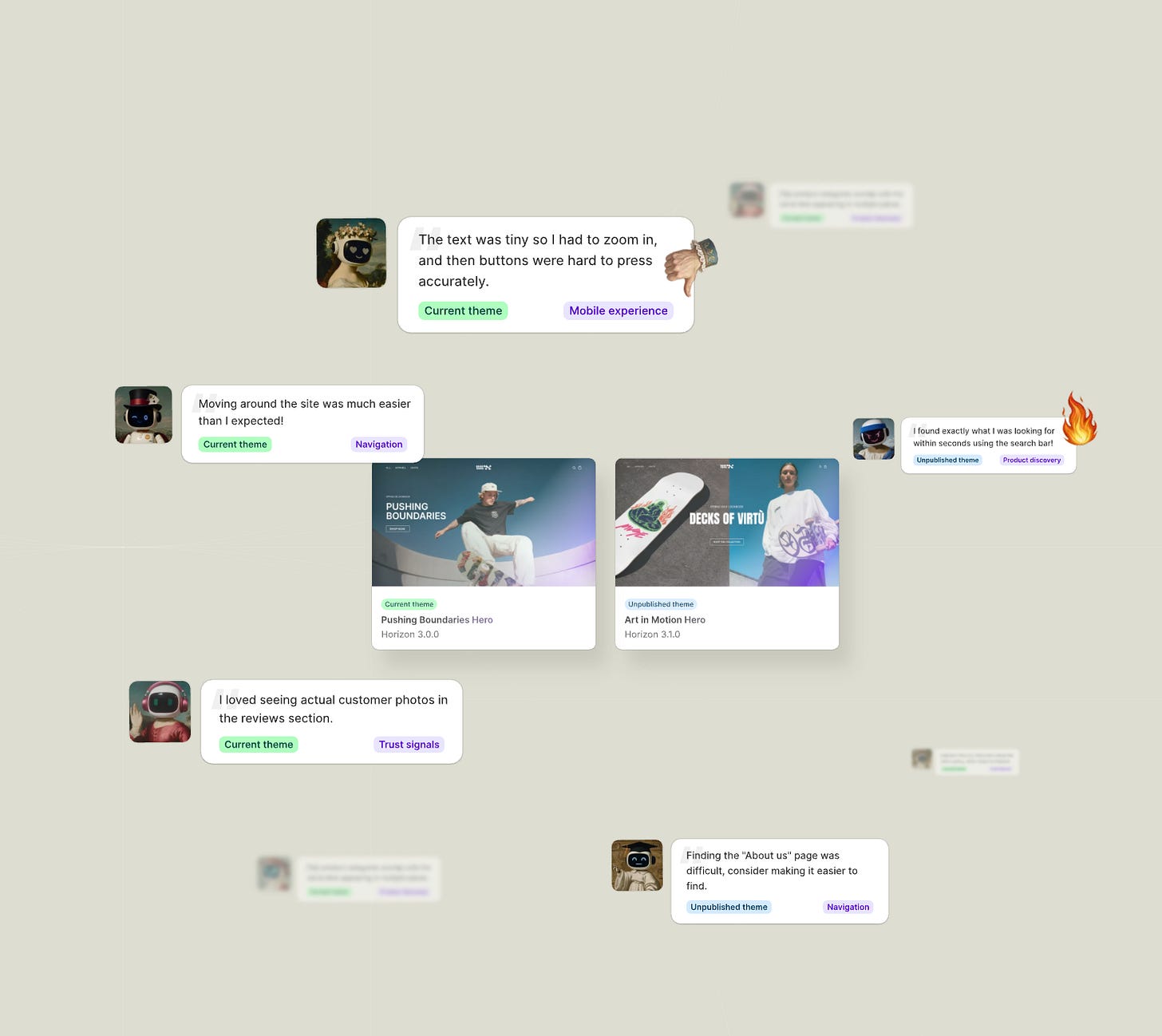

The idea behind SimGym: run those simulations via AI agents that can provide instantaneous feedback behind what leads to a conversion.

I already love this. But think through what this really implies: Shopify just created an RL environment for every single site across its merchant base to train new agents on. You can imagine further models being trained to actively optimize from real user interactions, an autopilot that automatically deploys better sites that lead to more conversions, etc.

That should translate into more consumer spend which Shopify can monetize through payments, but it also should equal more subscription revenue as firms already pay thousands for this sort of service.

Underlying all of this is the millions of user interactions and other data sets that Shopify already has as a system of record. That itself is data that any individual store can’t obtain. Unless you’re a giant enterprise doing hundreds of millions in sales, you simply don’t have the data to meaningfully optimize. And so not only is this just an insanely cool product, but it democratizes state of the art A/B testing for the entire industry.

And I think, we are getting closer to understanding why systems of record are about to have their second act. Every single vertical software company will become a training gym for agents that meaningfully expand their addressable software market. And because they can aggregate and have already aggregated necessary data across the entire industry, they are about to experience a true second act as this very data becomes necessary for creating novel agent paradigms.

The TAM remains all of Human Labor.

That’s all for this week. Have a great weekend!