Two Games: Kingmaking vs. Durability in the AI Rebuild

the macro-themes driving investment dollars

Good morning!

Today’s newsletter:

The primary challenge for every single technology company now is simultaneously disrupting some core area of an industry while navigating the constant disruption risk they too face from AI accelerating competition.

Everyone has a different interpretation of the game theory here which is why every day you can read a new article on “why vertical AI is dead on arrival” or “why vertical AI is better positioned than foundation models” or “why vertical SaaS is the biggest beneficiary of AI.”

My take? The truth is incredibly vertical and business model dependent.

But I do want to briefly sketch the capital frameworks that more investors are beginning to group their bets with.

Kingmaking

Harvey at $8B, OpenEvidence at $6B, EvenUp at $2B.

Financially speaking, crowning a vertical winner prior to mass market saturation is designed to give companies sufficient capital to guarantee their dominance in the vertical.

To customers, this signals “this company is here to stay and is safe to partner with for the long run”

For competitors, it’s meant to signal “don’t even bother trying to compete.”

These are very valuable messages to communicate when the cost of code has precipitously fallen. Communicating stability matters to companies when there’s 20 different companies in the vertical competing for their attention. Credibility is simply at a premium.

And by no means should we discount the user growth and revenue underpinning these businesses. These are rocketships in their own right, simply trading at multiples that are unfamiliar in vertical tech.

Put succintly: The kingmaking strategy is not reducible to “put in cash at high multiples.” There is a strategic bet that buying companies at higher multiples is a way to protect the investment as a whole.

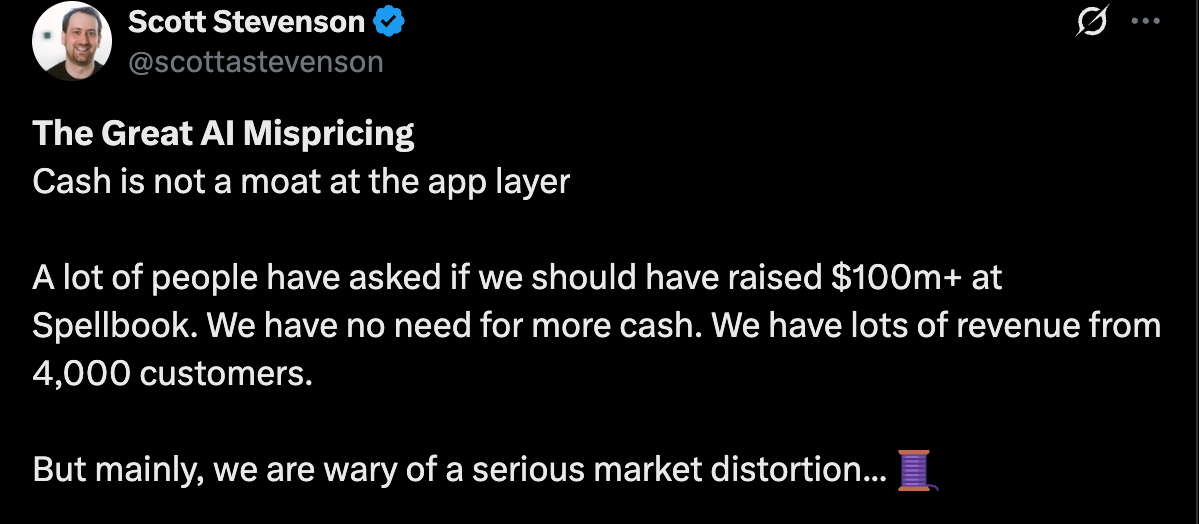

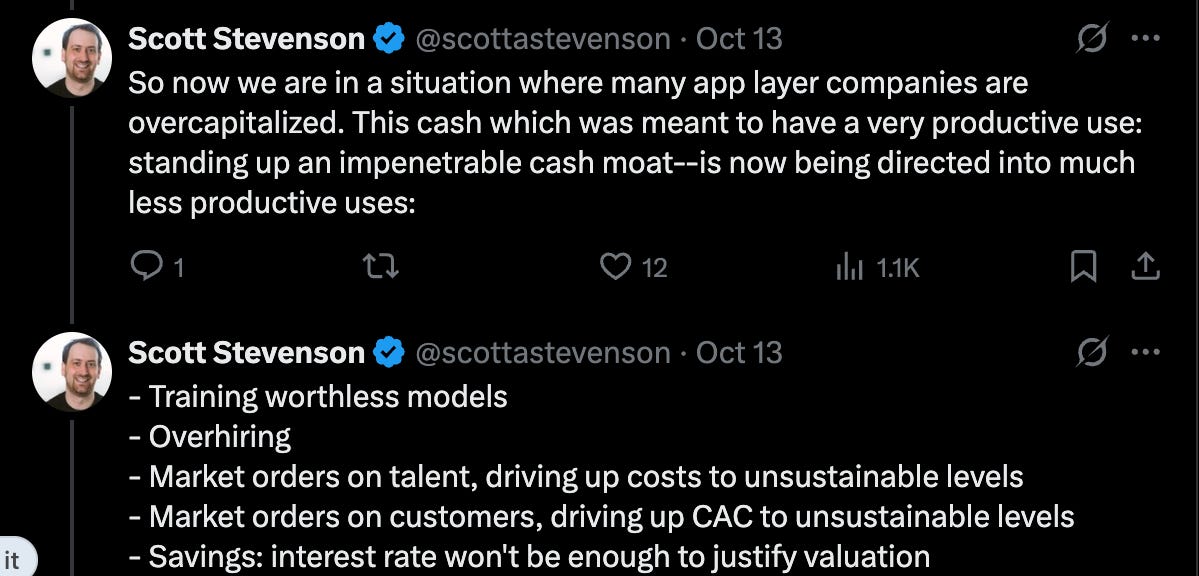

Of course, competing with crowned kings is still a viable strategy. In the words of Scott Stevenson, founder of Spellbook Legal. The whole thread is worth a read, but some excerpts below:

Is cash a moat? It’s unclear. But there’s a case to be made that the cash itself is not the most relevant reason why companies are taking kingmaking rounds.

If kingmaking dynamics are going to incentivize somebody to take the money, it might as well be you. It’s much better to be the one driving up CAC to unsustainable levels than be the business that can’t sustain it.

Despite a lot of attention on the mega-rounds inside of vertical AI, it’s somewhat surprising that most verticals have not seen a kingmaking moment.

Insurance, logistics, construction, and plenty of others have no obvious winner yet or are not nearly as winner-take-all in their construction as VCs seem to expect medical and legal to be.

Will we see a venture firm look to solidify this strategy in every vertical? Or are other verticals less susceptible to kingmaking dynamics?

When disruption is priced in, durability is mispriced:

Marc Andreessen has said that a16z is “investing on the thesis that everything will be rebuilt because of AI.”

Rebuilding everything implies massive opportunity in disruption. When this becomes the market expectation, disruption starts to get priced at a higher multiple than assets who are favored for durability.

This of course was the original Constellation thesis. But a new crop of firms are starting to bet heavily on the durability of assets and their reinvention in the AI age.

Two have been the talk of the town this week: Bending Spoons and Beacon Software.

There’s many variants of this thesis, but I think you can distill this into one core idea: companies that survive and improve in the AI era will likely endure for 30-50 years.

In other words, it’s business kintsugi. Take pottery showing some cracks and fill in the cracks with gold.

These companies will long term be judged by their capital efficiency, the durability of their assets, and the transformation of the underlying companies.

And I think the real bet here: if your underlying companies can survive the next 10 years in the AI age, they likely are positioned to survive the next 50. What disrupts them once the very means of software production and nature of software itself has become intelligent?

This trade in software is particularly powerful because of the current perception of software today. Beacon, Bending Spoons, and I’m sure many others are stomaching the current disruption risk to ultimately take advantage of a long term durability multiple as they help these businesses navigate the next 10 year stretch.