Blue Jeans Golf

tech-enabled rollups come in all forms and flavors

Good morning,

Today’s newsletter: a different sort of tech-enabled rollup.

The usual route to improving at golf is to get a bucket of balls and hit the range.

And this always a frustrating process. Golf is hard. All it takes is one hitch in your swing and suddenly you’re shanking balls all over the place, cursing under your breath,

If you make it through this stage, you may very well end up getting swing lessons and a club fitting. It’s only usually here where golfers start to get live data about their swing, launch angle, and more.

But this is crucial information for improvement. Sure, you can judge if your ball went 50 yards to the right of your target, but it’s much harder to figure out if that’s attributable to a stance problem, an open club face, or something else.

And so it’s no surprise that a number of golfers don’t ever make it to the club fitting or coaching and end up stuck in golfer purgatory. They may play the occasional round of golf, but mostly go to the range, grow frustrated, and eventually churn.

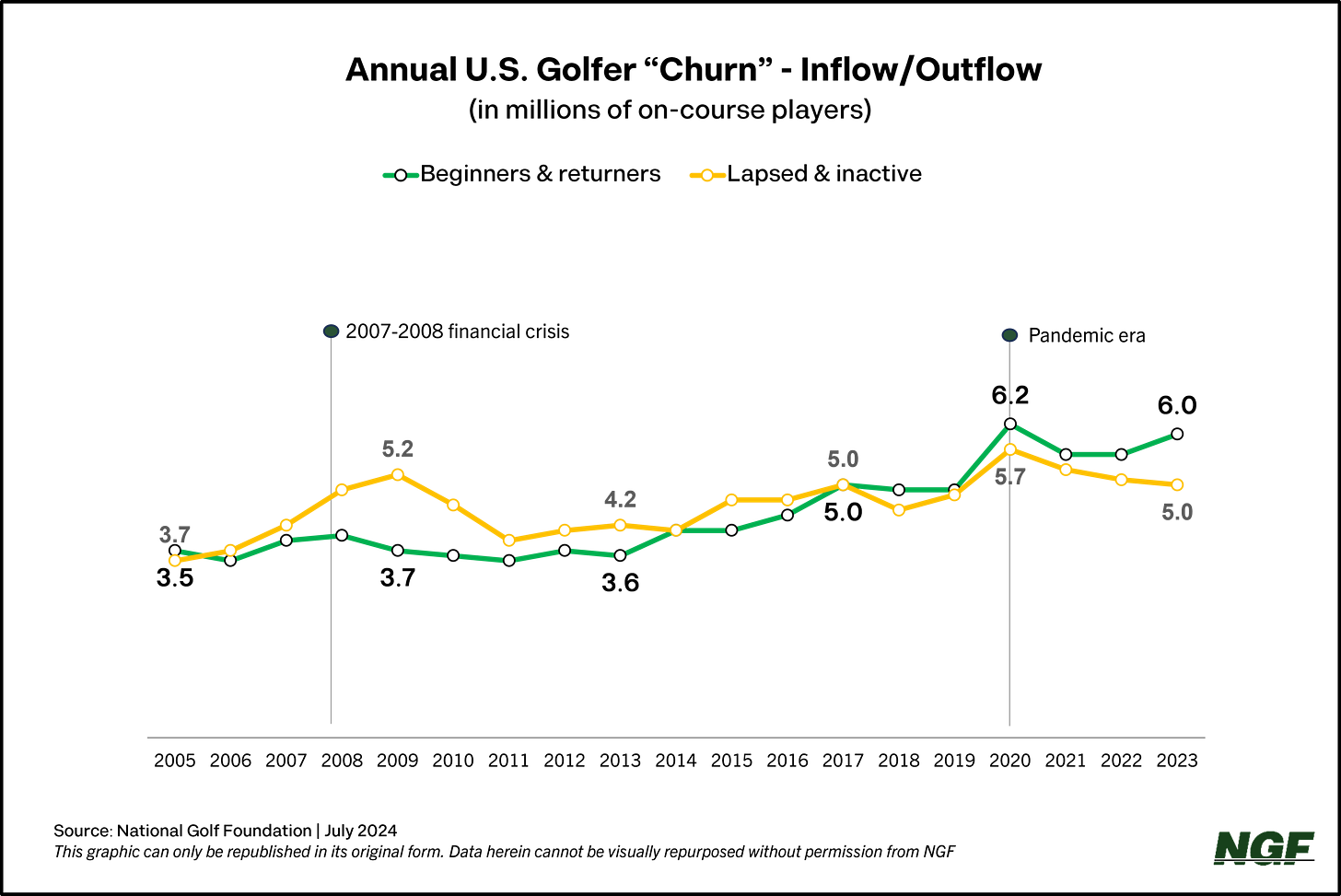

This shows up in the golfer data. The Covid pandemic saw a massive influx of golfers picking up the game. But historically, golfer outflows are pretty consistently even with golfer inflows. People get frustrated and churn out.

So growing the game of golf doesn’t look primarily like a customer acquisition game, golf’s reaching new heights of popularity in cultural discourse.

It’s more around retention: how do we get golfers to tangibly improve enough to stick with it?

Another thing:

There’s been a dearth of good options for solving this in the past.

Perhaps, the most popular attempt, Top Golf, has been a somewhat disappointing investment. After merging with Callaway Golf, repeat visitors have trended down year over year, consumers don’t perceive value in going to an expensive range, and generally the business is in a tough position, leading to Callaway planning to split Top Golf and its OEM into separate companies.

These venues were focused mainly on what Blue Jeans Golf and Old Tom Capital call “golf entertainment”. They carry hefty real estate development costs, rely on cyclical consumers, and food and beverage for success.

But what golf entertainment venues got right is that younger generations don’t want to spend 3 hours playing 18, at least when they’re fresh and starting out.

Here’s a stat: only 1 in 4 beginner golfers stick with the game. What if you could fix that and capitalize on it by outfitting casual golfers with the tools they need to improve without the initial hurdle of lessons?

With $20m in fresh funding, that’s exactly what Blue Jeans Golf is banking on.

Golf Ranch

Blue Jeans Golf is the parent company behind Golf Ranch.

Golf Ranch is probably best described as “what if you had a shot tracer while you practiced”.

Golf is a game of correction. Driving ranges are already the natural place for correction. What if you supercharged a driving range with shot tracing tech to speed up the improvement rate of golfers?

Golf Ranch is currently at 4 locations, how do you get to hundreds?

Blue Jeans Golf’s team comes from Top Golf and arguably learned some lessons.

First, Top Golf’s cost structure per location would often reach $20-30m per buildout. The underlying land itself can be incredibly expensive.

If you’re going to create a capitally efficient vehicle to generate returns, you can’t justify developing net new ranges on land that real estate owners are more than happy to sell to a strip mall developer. You have to have differentiated access to land to keep costs down as you expand.1

The Strategy

This is why the rollup aspect of Blue Jeans Golf is incredibly attractive.

There’s about 1,000 independent driving ranges in the US. Most of these are owned by golf lovers. If you own an independent driving range, it’s usually due to passion not due to min-maxxing IRR.

As a result, they want their legacy in building out a driving range to continue. And Blue Jeans is one of the only acquirers positioned to do so.

I would fully expect that as a result, every incremental location that Blue Jeans adds will have favorable multiples on both the land and business, incentives for the owners, and lower construction costs.2

Owner gets to continue their legacy, Golf Ranch takes over operations.

This strategy is already bearing out on Golf Ranch’s first four acquisitions with a reported 300-500% revenue increases per location.

When you’re driving a 400% increase per location, everything gets easy. Shorter payback periods unlock cash for more acquisitions, owners are eager to jump on board with the right incentives, and suddenly you’re looking at creating a monster business.

Golf Lite

I want to highlight the thesis from Blue Jeans and Old Tom Capital underlying this.

We’ve already talked about the entertainment golf category, which hasn’t to date created a ton of great businesses.3 Blue Jeans is not trying to compete here.

Instead, this is a rollup and brand concentrated around a new category they believe they’re pioneering: golf lite. And it’s the identification of this category that will either make or break Blue Jeans.

You can sort the golf experience into archetypal customers:

Entertainment Golf: The bachelor party, the company event. The real emphasis is on the food and beverage, not the golf.

Traditional Golf: The foursome who play every Saturday, have breakfast at the country club, and exclusively wear polos.

Golf Lite: The golf striver. The person who wants to improve but also can’t get away for four hours to lose $50 bucks worth of golf balls in the water.

3 of 4 beginner golfers churn out. If you can capture them and prevent their churn, that’s a great business.4

Importantly, the articulation of the category undergirds the founding thesis of Blue Jeans. And that’s what makes it so interesting. How many tech-enabled rollups going on are founded upon a new category thesis vs. simply operational gains from technology?

Are there other places to run Sports Lite models?

Youth Sports is now a $40B business. Youth sports have become somewhat professionalized with salaried coaches, select teams, and travel ball for everything.

Are there models that rely upon rapid improvement feedback loops, membership programs, and better tech that could create large outcomes?

Batting cages and baseball facilities feel like an obvious place where this could be explored.

But what if this worked for basketball or aspects of football?

I don’t know the answer, but we will look to explore this more in a future newsletter. Let me know if you have thoughts here.

Elsewhere in the golf industry:

LAB Putters sold for a reported $200m. JJ Spaun used a LAB Putter to shock the world (+12500 odds) and win the US Open, could it work for the weekend golfer?

Entertainment Golf is getting a Tiger Woods spin. Popstroke is an interesting company to watch here.

Happy Gilmore 2 broke streaming records

Perfect Putt is my favorite newsletter for golf industry news. You should subscribe.

The other benefit here: Golf Ranch’s buildout costs are never going to approach $30m a location. Solve the land problem and you have a great business.

I’m not sure if Blue Jeans takes over the land as well. If not, giving the owner a steady rent stream as part of the transaction likely helps incentivize the transaction as well.

Entertainment golf seemed to work fairly well in the ZIRP era. Hard to envision being able to run the same playbook now.

It’s an even better business when you’ve got membership programs, a unified consumer brand, and a quick feedback loop for golfers to know if they’re improving or not.