Engines and Tech Trees

powering industry R&D going forward

In early-stage SaaS, everyone is at least modestly concerned about a world where SaaS can no longer create the lifecycle dependence that previous waves of SaaS have accomplished.

This isn’t solely an investor/founder fear, it’s evident in the buyer sentiment too. In the face of large technological uncertainty generated by LLMs, buyers are taking a barbell approach: Either give me the most enterprise-grade SaaS workflow system that’s publicly traded and not going away, or give me the experimental AI product that isn’t displacing existing systems of record.

Nonetheless, the ecosystem must plot a path forward. And the only durable investment strategy in this climate is to seek companies that can actually create lifecycle dependence.1

As for bits-based companies, even though AI has partly created these issues, it also poses the way out. We are still pre-paradigmatic in every industry in figuring out how exactly AI is going to factor in.

And if you believe that AI is indeed meaningful, will continue to get better, and also is capable today of changing business processes to be significantly better, opportunities abound.

As a result of foundational LLM and hard tech development, R&D in essentially every industry is going to enter an expansionary phase and this will be captured in large part by the next generation of startups. All it takes is a bit of business model innovation and a bit of reformulation around what technology itself will accomplish.

You could sum up the the goal in a sentence:

Vertical tech should focus on building R&D engines to climb industry tech trees.

And by engines, I have a very discrete definition in mind:

The best engines in my view all create a) product lifecycle dependence2, b) initially higher R&D investment strategies, and c) upside-driven revenue strategies with heavy partnership dynamics.3

Engines

Modern mechanical engines are incredible works of optimization and sheer engineering talent. Hundreds of millions of dollars are spent a year to forge carbon alloys, cutting-edge cooling systems to tame the thermodynamics, turbochargers, and precision-crafted pistons and cylinders. All of these optimizations unleash the Formula 1 car, perhaps the pinnacle of R&D.

So why the tangent? Engines as sources of controlled power are not simply a hardtech concept. They are the foundational concepts for the next era of vertical technologies that harness R&D, paradigm shifts, and new possibilities to catalyze it into useful and more productive industry growth.

We already have proof in the form of two industries: gaming and biotech.

Gaming Engines

Engine development and maintenance is fundamental to great games. Everything a player does in a game is a result of the engine underneath. The engine dictates everything from:

the processing of decision logic, rules, and physics (e.g. the X button was pressed, so a bullet was fired, which traveled from point A to point B, hit player 2, etc.), to real-time visuals, sound production, artificial intelligence, memory and network management, and so forth.4

What can be missed is the complexity to develop these engines today. Forget individual game production, the underlying engines themselves can cost tens of millions in engineering time.

Simply managing the existing complexity and tech debt often means engines are woefully outdated to take advantage of GPU/CPU advances. And the tech debt that development teams incur can lead to extraordinary performance problems leading to launches like Cyperpunk 2077.

So the story of gaming has been mostly a move away from proprietary engines to engine companies.5 And in fact, that’s what CD Projekt RED, the developer of Cyberpunk, decided to do after the disaster, migrating all their new development to Unreal Engine, Epic’s engine and often though of as the best one on the market.6

Unreal Engine

Epic is best known for Fortnite, but its real magic and its long term enterprise value is most likely to be derived from its underlying engine, Unreal.

You should really read this Matt Ball piece if you want a more extended breakdown, but simply put, the value of an outsourced engine compounds over time as the complexity of fundamental technology advances compound. Already we can see an analogy with the state of AI foundational model advances. It only gets more complex from here.

Rather than internalizing continued maintenance and ongoing R&D improvements by owning their own engine, companies are now selecting to cede royalty revenue in exchange for the an engine like Unreal.

This is the fundamental reason outsourced engines are capable of sustaining their approach. Their engine’s value is essentially a call option on the industry’s success. If R&D advances prove worthy, Epic reaps far more upside which then money they can funnel into the next engine.7

If Unreal’s engine continues to be groundbreaking, game developers expect to realize more revenue as consumers are willing (if not begrudgingly) willing to pay a premium for more immersive gaming.

I don’t want to belabor this point too much but right away we can see how Unreal meets the engine definition:

Product lifecycle dependence: each game developed on Unreal cannot be rebuilt on a different engine without becoming a different game or remake altogether.

R&D investment: This should be obvious.

Upside-driven GTM: for game developers, Epic takes a royalty stake of 5% in the game itself.

Biotech:

In biotech, the past few years have seen plenty of enthusiasm for “biotech platforms.” Biotech platforms are better viewed as biotech engines and will be referred to as such in the rest of this piece.8

The blogpost that catalyzed the biotech engine movement was this piece by Steve Holtzman, a highly regarded biotech exec. It’s a fantastic piece that delves deep into the strategic and financial reasons to choose an engine strategy.

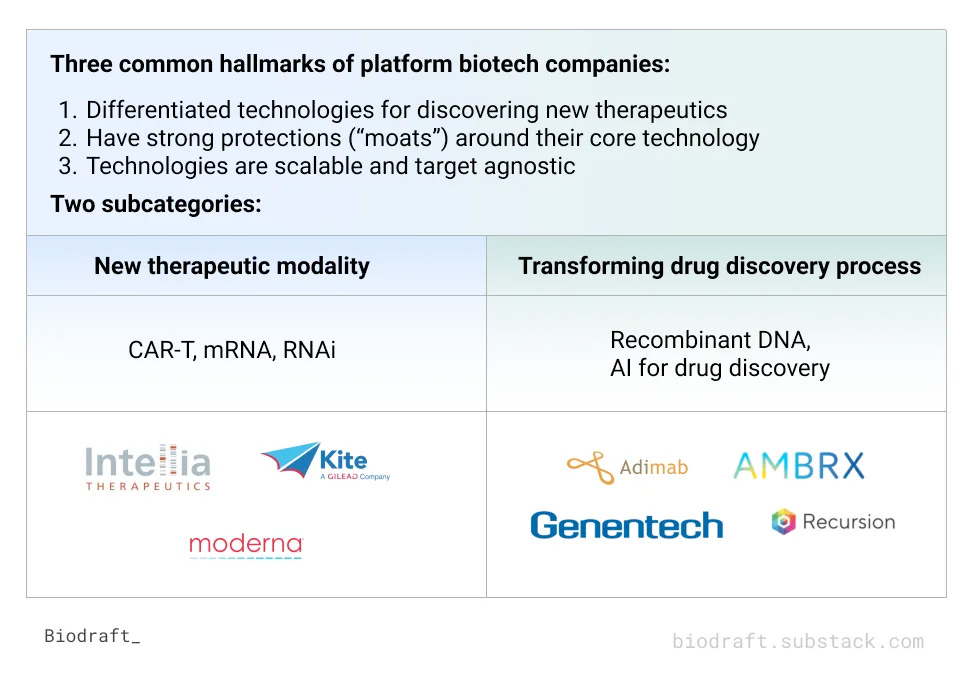

Biotech engines fall broadly into two subcategories:

I don’t think it’s worth opining on which is a true “platform/engine” vs. the other. Eliot Hershberg and Patrick Malone wrote a piece on this topic if you really want to delve into the fine details:

The important part is that many biotech engines are catalyzing a combination of new modalities (ie new drug types), new approaches to drug discovery via AI and R&D hubs, and partnerships to invest fully into R&D processes that are costly to develop for a single drug.

In return, these engines gain lifecycle dependence from their partners, whom often pay a royalty or grant equity.

Again, a lot of nuance here but you can sketch out at least three similarities: a) product lifecycle dependence, b) higher R&D investment strategies, and c) upside-driven GTM strategies.

Other industry providers start to look similar to this thesis: Anduril with their engine for defense R&D catalyzation, Varda with space manufacturing, Hadrian with factories9.

So prima facie, it looks like we have evidence for independent industry specific companies that act like R&D engines. What hasn’t been proven is the need for this across many more industries. Is this a model that only applies to limited surface areas? Or does it have broad applicability?

The answer here depends on your industry tech tree.

Tech Trees

Tech trees are a long tenured gaming concept (it’s a nerdy piece, I know). Anyone nominally familiar with Sid Meier’s Civilization has encountered these. The concept is pretty simple: you’re given a civilization with natural resources, you use existing resources to gain dominion and skill points, and you subsequently spend these skill points on nodes of the tech tree that result in societal advances through resource utilization.

I’ll let this piece and Balaji defend the concept of tech trees themselves. I think they’re useful. Technology companies should have a telos. We are swimming in techne, yet have no derivable telos that we are aiming for. Tech trees aren’t a telos in the traditional sense of course, but they are one aspect of it. All industries have a telos by which they define their end goal. Advancement upon the tech tree speeds up these goals, unlocks TFP, and ultimately advance human flourishing.

Except, it’s pretty much impossible to find industry-specific tech trees. In some industries it’s more clear. Thiel once quipped that there is no dying from death, you die from a discrete disease. Thus, it’s much easier to conceptualize a tech tree in biotech that is made up of branches that target discrete illnesses.

Gaming has a tech tree dictated by graphics, immersion, and player choice. Ultimately its telos can only ever be the metaverse.

Defense has a tech tree aimed at the lowest possible human lives lost at the maximal success of objectives. Its telos can only ever be the removal of the human operator altogether.

But plenty of other major industries have a telos. You can imagine a telos for construction and architecture, insurance, transportation, energy, and more.

Even something seemingly as simple as landscaping has one - as evidenced by Jason Carman’s video on Sheep Robotics.

Maybe you eventually get genetically modified grass that cuts itself, but absent that, landscaping is ultimately the realm of robotics.

But most tech tree development looks like looking back at the technologies that must be developed to get there from the maximalist goal.

Engines then occupy a semi-prophetic role that is still yet rooted in realism. It attacks a tech tree node, often doing fundamental development and then rolling out its engine to the industry. As the tech tree progression stacks, so too does the engine’s compounding advantage. Effectively, technology is a game of catalyzing asset-intense and fragmented problems into consolidated, more capitally-efficient, and asset-light(er) business models.

There’s a pretty common criticism of tech trees, namely that they are overly deterministic. And this is probably true if you are trying to adhere to a model too narrowly. But the goal of tech trees within engine creation is to sketch a plausible series of R&D investments at the start that will enable you to pick your own path to the top of the tree.

Tech tree is top-down theory, engines are bottoms-up praxis. Both Tim Sweeney and Palmer Luckey are crystal clear on their telos, how to tie it to shareholder value, their industry’s specific tech tree, and then have developed an engine to accomplish it.

So is this universally applicable?

I think mostly, but some are more actionable than others. Most industries broadly have a telos consisting of higher consumer value at the lowest possible cost.10 That necessarily involves automation.

The key thing that has changed in the past couple of years is that foundational technology advances mean that there’s more effective industry tech trees to innovate upon. Hence there is now more conviction that engine businesses are worth spending more time on.

Just to be crystal clear: What I am saying is that the future across robotics, AI, and software looks more like the development of engine technologies alongside novel business models and playbooks to create lifecycle dependence in the industry.

Creating an engine for an SMB industry? Perhaps, a franchise or novel MSO model is the right path. There you go, you just achieved lifecycle dependence with huge value flowing to your engine.

Mid-market and/or new business formation is hard with distribution captured? Buyouts may be the novel way to drive true lifecycle dependence.

A highly intense R&D industry or heavy enterprise concentration with lots of specialization inside of firms? Royalty driven partnerships may be the right answer.

One last thing:

AI in certain industries the ultimate last mover advantage. Others have come before and improved things on the margin. But there are certain industries that are so knowledge work intensive that AI will effectively be the last margin enhancement possible from a technology perspective. Last movers win and they win indefinitely. Specifically with AI, the businesses that build the industry engine will win indefinitely.

And even in a case where this means AI is deflationary for that industry, being the only industry engine in town, the only sufficient R&D investment paradigm, and the creator of the last business model will yield an insurmountable and indefinite monopoly. How’s that for building lasting consumer and enterprise value?

Part of the reason we’ve seen an explosion in hard tech companies is because each one of them has an answer to the question around lifecycle dependence.

Product lifecycle dependence: the end user’s goods or services are not able to be sold in their current form without entirely redeveloping the good or service itself.

You could almost call this “R&D-led growth” where partners don’t have significant cash outlays until the engine helps commercialize something novel successfully at a lower initial cost.

https://www.matthewball.vc/all/epicprimer1 By the way, Matthew Ball is the smartest man alive on media, entertainment, and gaming.

Tangent: Gaming companies by and large fall into two categories: artisans whom happen to generate revenue or companies that happen to publish games. Occasionally the artisans make money and the companies happen to make great games. Artisans and companies may both choose to use their proprietary engine, but from a pure financial standpoint, it’s clear that all else equal, R&D spend on engines has no correlation with the success of the game itself, especially as Unreal continues to become the best par none.

I’m going to ignore Unity for brevity, but it’s actually a really good case study in creating engines for SMB customers.

It would be shocking to me if AI doesn’t eventually do the same in B2B given the R&D costs, but more on that later.

For a more extended breakdown on biotech engines, start here:

For upside-driven GTM: Hadrian is reportedly exploring joint ventures and Varda will obviously take a royalty stake in any novel drugs that they are able to develop as a result of their space factory. Anduril is the less obvious one but here success looks like taking over larger and larger amounts of the DoD budget which is viewed more as a partnership in many respects.

It’s incredibly important that the telos is more narrowly defined in my view. But at this abstraction this is true.