Everybody kept getting bad tattoos

and now companies are making a lot of money removing them

You’ll probably notice some changes around here soon.Testing out a new content schedule:

Going forward expect a tentative Monday, Wednesday, Friday rhythm.

I don’t want to belabor this too much (yet), but expect more emphasis on weird industries on Mondays and vertical tech on Wednesdays. Fridays are dealer’s choice.

Today we are doing a quick tour through the removal economy.

Quick hits:

There’s a noticeable shift across consumer markets towards “classic” aesthetics.

32% of Americans have at least one tattoo with the average tattoos per person at 3.3.

The margins of removal are extremely good stemming from locations in dilapidated strip malls and subscription based packages to incentivize consistent removal.

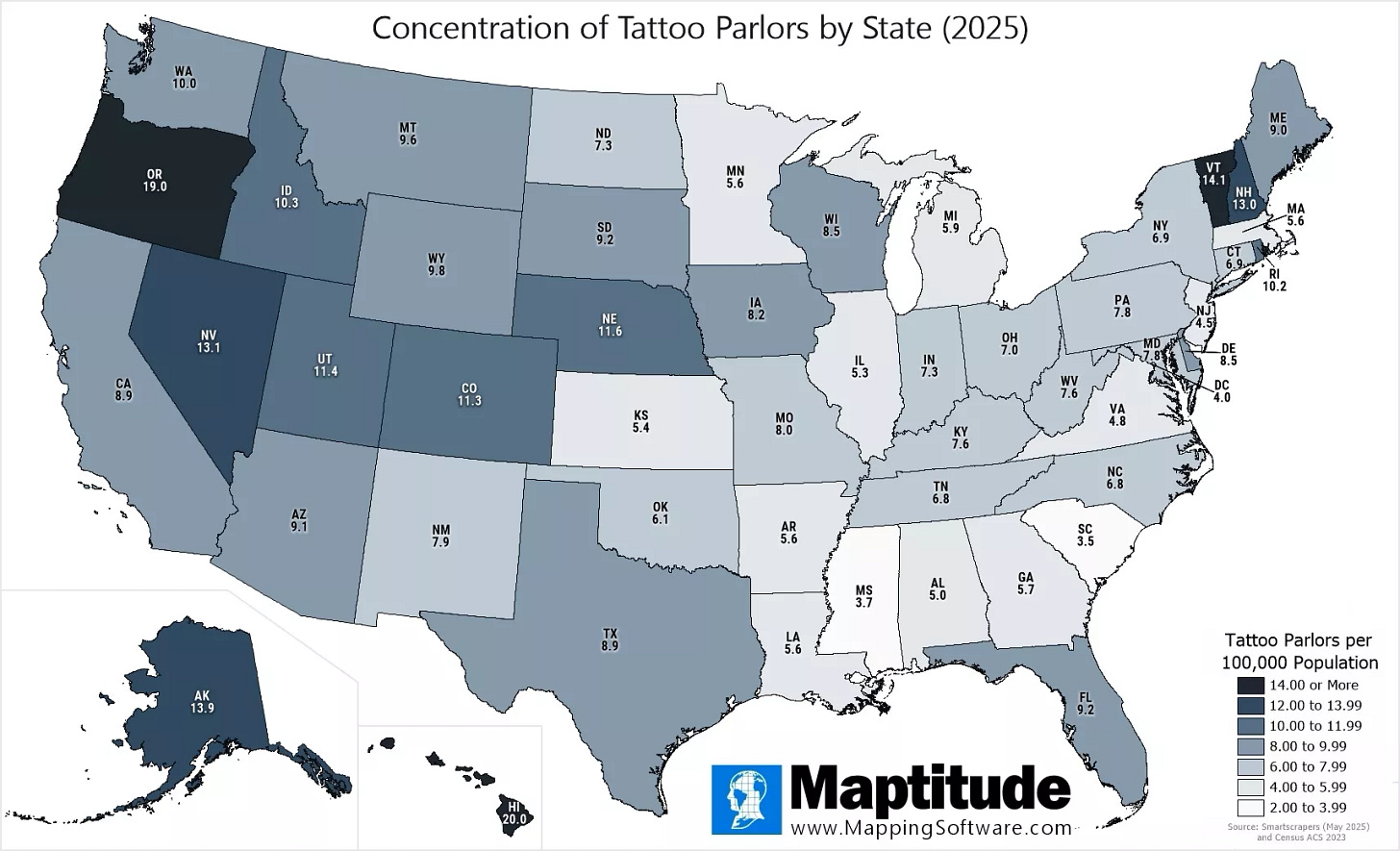

There are roughly 21,000-23,000 tattoo parlors in the US. And they stay busy.

Over the past 20 years, tattoos have become a fairly large business as tattoos became socially acceptable, hipsters got cool ones, and they lost negative connotations. Millenials and Gen Z have especially latched on with approximately 46% of millenials and 41% of Gen Z tatted up.

Of course, permanent body ink always has some potential for ragrets.

And there’s some evidence that culturally tattoo removal is growing quite rapidly.

We can look at data on current state of tattoo removal:

Or just look at the sentiment in culture:

Pete Davidson has spent over $200k removing his tattoos and there’s plenty of other celebrities following suit. Removing tattoos has become trendy. It turns out a lot of people do have ragrets.

Generally, there’s a sizable cohort of people staring down the barrel of being inked for 50-60 years and choosing to get rid of the ink altogether.

And since culture is heavily memetic, this is leading to more and more people undergoing laser treatment to part with their ink. We would expect this to continue partly because tattoos are likely at the height of their cultural power.

When nearly 1 in 2 people of your generation have a tattoo, there’s nothing distinctive about the ink anymore and its signaling power is lost. And that seems to be what’s happening.

This is opening up a fairly fantastic industry around removing all this ink and as we will see, it’s really focused around two trends:

There’s a ton of shitty strip mall space

The lasers got really good for performing these types of treatments.

Laser Tech

Let’s start with the second point, picosecond lasers hit the market. A picosecond is one-trillionth of a second. Essentially, when a laser treatment is done on a tattoo, the laser is making contact with skin for one to three-trillionths of a second. Further, these lasers are calibrated to only activate when they sense ink. This means less scarring, pain, shorter recovery, etc. The ink gets lasered, nothing else really does.

That makes a massive difference for the pain of treatment, the recovery, and generally the consumer willingness to endure what can amount to months of removal treatments.

In 2012, the FDA formally approved these lasers for skin treatments and the removal market became plausible. Suddenly, laser treatments look like a viable method for removing tattoos without long term damage, disfigurement, and pain.

The price point of these lasers also isn’t incredibly expensive. We aren’t talking millions per laser, more on the order of a couple hundred thousand.

Company to Watch:

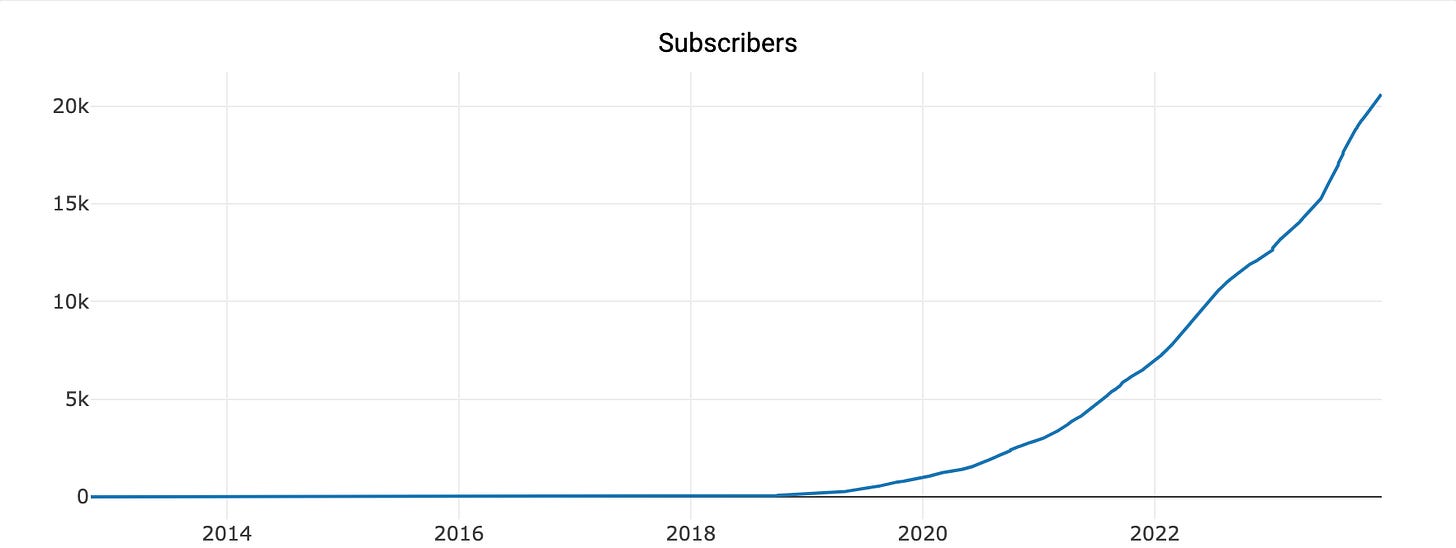

Removery has perhaps predicted and capitalized on these trends better than anyone else.

Founded originally by Mark Evans and Chris Chambers through their fund Normanby Partners (precursor to Factory Capital), Removery started in the Land Down Under.

When first considering the investment, Mark Evans wanted to see if this technology was legit, proceeded to get a tattoo, and then subsequently lasered it away. He came away impressed enough to back/start Removery and the company was off to the races.

In 2021, Elliot Management invested $50m to aid Removery’s expansion into North America. 150 locations later, the concept is clearly working due not only to the laser tech, but due to a real estate arbitrage.1

You’ve got to remember the sorts of firms Removery is competing with for tattoo removals: medspas. You could certainly try to compete with medspas at their own game and choose locations in fancy parts of town. Medspa screams premium and need their space in more premium locations. Ergo, higher real estate costs. Or, you could do what Removery has mostly done and choose real estate in strip malls.

This I think gets to where Removery and other tattoo removal shops have a true advantage vis a vis the cosmetic industry:

The real estate doesn’t have to be sexy.

The capital expenditure required for a new facility is far lower than full service cosmetic practices.

Top of funnel marketing is highly performant.

Removery’s key insight is that while this is a cosmetic procedure, the clientele seeking out tattoo removal don’t need premium locations. In tattoo land, nobody has ever walked into a tattoo shop and said “wow, what an amazing space in the best area of town!”. I’m not saying the shops are gross or unsavory, I’m just saying, tattoo shops aren’t known for premium real estate. It’s usually the opposite.

As a result, consumers are desensitized to the actual location where tattoo services happens. Simply put, you don’t need premium real estate for tattoo removal, the market doesn’t expect it.

This means tattoo removal shops are competing for space with the local plasma donation center or the local Gamestop and not with clinical practices in the best part of town.

Second, the footprint for each individual location is fairly concentrated. You need a front desk, and 1-2 rooms for the actual removals. An already low real estate cost is now even lower.

What about the costs to service?

Some quick math for you:

~10 treatments to remove a medium-sized tattoo and ~40 minutes- 1 hour per session

x $55-60 per hour for a nurse practitioner2

= ~$440 in direct costs to service a tattoo.

At around $3000 per tattoo, this is an 80% margin business on the direct services.

You think SaaS businesses are good? How about tattoo removal businesses that can theoretically achieve Rule of 40?

So the fundamentals of laser treatment look really attractive, but what’s the size of the opportunity here?

I threw Verticalized’s senior data analyst, ChatGPT, some numbers around the tattoo removal business.

Assume 350m Americans, 1/3 have a tattoo, 11m new tattoos a year, and currently 1.5m-2m removals per year with an 8% growth rate YoY, what does this market look like?

Some quick hits:

Theoretically, if removals continue to grow and outpace new tattoos, you would expect at some point, the removal business dies out as there’s no further tattoos to remove. Not exactly expecting this to happen, but it’s an interesting thought experiment. If you extrapolate out, we would expect all tattoos to be removed in the US around 2072.

In the meantime, with 2m tattoos (and growing) being removed a year, you’re talking about a total revenue opportunity per year around $4B.

If we assume that all tattoos will be removed by 2072, we are now talking about an all in revenue opportunity of around $1.9T.

At a plausible annual revenue potential of $4B, there’s going to be a significant degree of players cropping up to try to tackle this opportunity.

It would not surprise me if we see Moxie-style playbooks emerge to try to capture this as a franchise-style opportunity. Many states have medical licensing restrictions around who can oversee laser tattoo removals. This is one of the primary things Moxie solved in order to enable nurse practitioners to open their own med spa. Could we see a similar business model crop up in tattoo removal to enable a large number of nurses, NPs, or cosmetologists to launch tattoo removal businesses? Do you need dedicated facilities? Or could you have tattoo removal on wheels outfitting a Grounded RV? I don’t know the answer, but it’s worth considering.

If each of your facilities achieve 500 tattoo removals a year, you’re quickly looking at a $1.5m revenue facility - well in line with the revenue numbers you are looking for in individual locations your franchise group is servicing.

There is a rollup component to this.

I’m pulling this directly from Removery’s careers page.