Industry Clouds and hSaaS Verticalization

or how the horizontal players are maneuvering the changing landscape

The vertical SaaS thesis has never been stronger. Every horizontal player is in the process of reorienting their strategy for a world where they have to prove out specific industry value.

About 10 years ago, vertical SaaS was a really contested idea. Now the paradigm is going to be taken for granted.

Verticalization has won mindshare because it wins industry dollars; now the question over the next 15 years is simply: who wins the vertical turf wars?

So today, I thought it would be fun to take a look at the strides the horizontal players have made into verticalization efforts.

Veeva and Salesforce

The biggest news story in the turf wars has flown a bit under the radar: Veeva and Salesforce are breaking up in 2025.

Veeva will be migrating all of the customers on the CRM product over to their Vault platform while one can assume (as we will see), Salesforce wants to dive into life sciences.

It’s somewhat surprising that we ended up here. Veeva now has to deal with a direct competitor in the sale while Salesforce now has to go develop a product and sell against a team with 15 years of customer insights and product development.

But both sides have plenty to gain as well.

On the Veeva side, migrating the commercial product (CRM) to the same platform as the R&D product (Vault) will allow them to connect the application experience and enable further innovation.

The connectivity between the applications, between R&D and commercial, specifically, between clinical, medical, and commercial, that's something we do see opportunity [in].

[You] really haven't had great solutions for that connectivity, and I think we'll bring innovation there and connectivity that will create the market there.1

And second, by dropping the Salesforce partnership which has historically limited them to selling CRMs in the life sciences, they can begin to sell into other sub-verticals (like MedTech) that they previously have been unable to do.

But the Salesforce side is the more interesting one and I think signals a definite shift in how Salesforce’s approach to verticals. It also gives an idea around the strategic transformation happening at other horizontal companies like Oracle, Snowflake, and even Microsoft.

The era of the Industry Cloud

Salesforce has three key strategies (ignore the Trailblazer stuff).2

Customer 360 is all about actionable customer data. Geographic expansion speaks for itself. Industries is where the meat is.

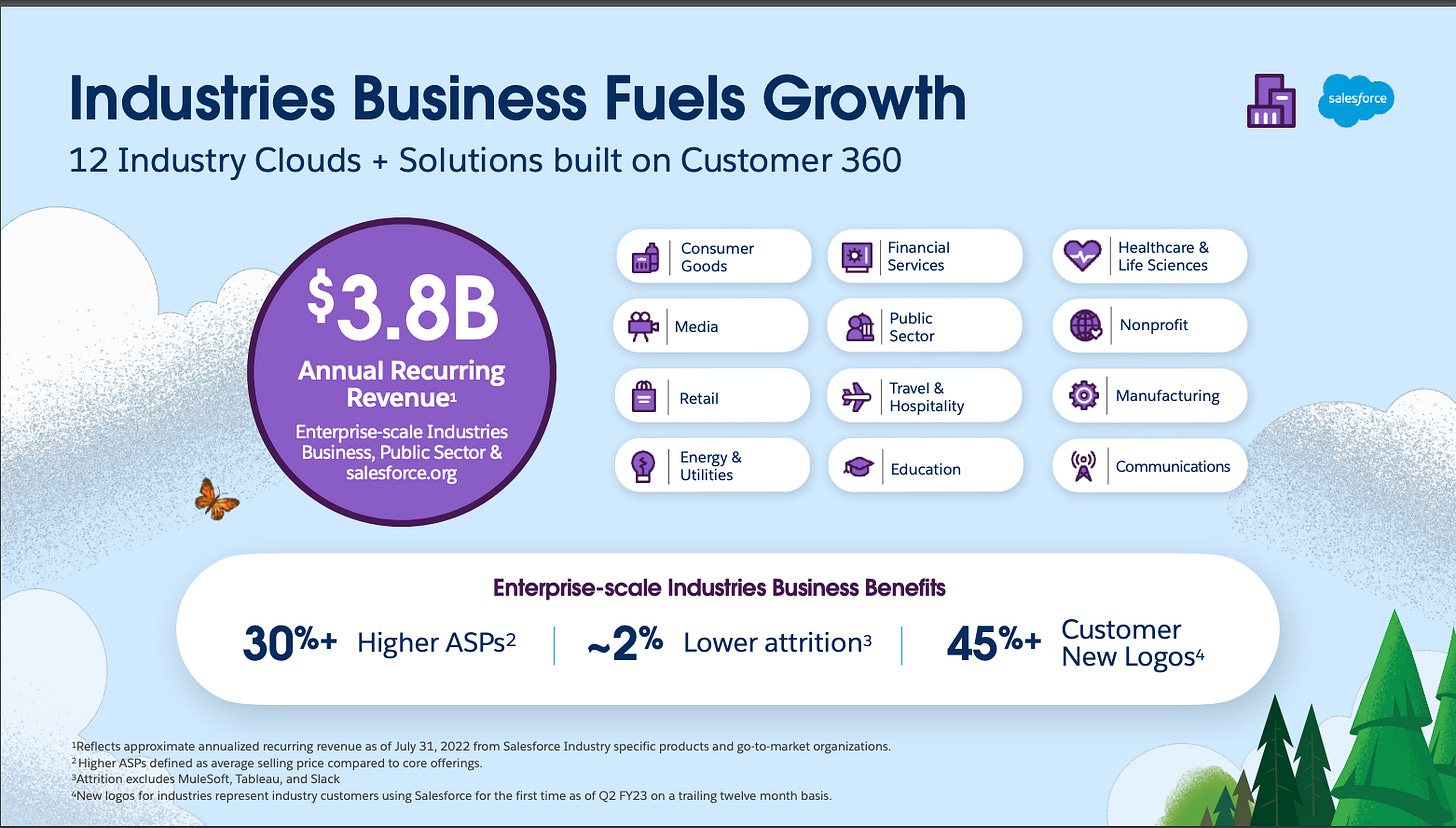

Salesforce is on the attack and bringing to market industry-specific instances of the SalesForce platform with the aim of dominating what they previously outsourced to partnerships like Veeva.

The strategic importance of industries for Salesforce somewhat began with the acquisition of Vlocity back in 2020. Vlocity was very much like Veeva and focused on building out vertically-tailored CRMs on top of Salesforce infrastructure.

1.3B dollars later, Vlocity is now Salesforce Industries, and VLocity’s CEO, David Schmaier is now Chief Product Officer and President of Salesforce. With Bret Taylor departing and Salesforce dialed in on verticalization, you can place a pretty compelling bet on who becomes co-CEO.

So Salesforce, now with shored up vertical design from Vlocity feels that they can gain ground in core verticals and there isn’t as big a need for Veeva as a partner.

Combine that with the higher ASPs and lower attrition with vertical specific instances and it starts to make sense why Salesforce is all in.

In Schmaier’s words:

Digital transformation is an "industry-specific sport. It's faster time-to-value. It's already pre-tailored to the way a bank works or pre-tailored to the way a hospital works or pre-tailored to the way government works, so why wouldn't you want the industry specific version?3

But Salesforce and the rest of the pack aren’t terming this vertical software. It’s pitched far more grandiose.

They’re building industry clouds.

So what’s an industry cloud you ask?

The short answer is that it’s a term that means absolutely nothing and everything, depending upon who is pitching their version.

At minimum, it tends to mean something like “database infrastructure tailor made for industries” and at best, it’s more inclusive of all that we tend to mean by vertical SaaS - workflow automation and aggregation for specific industries.

So for Snowflake, this means vertical data platforms replete with industry standards for formatting and exchange.. While for Salesforce this tends to mean industry specific forms of engagement or configuration settings for CRMs.

That’s all dandy but this is a vSaaS maximalist newsletter and I like when industry clouds mean far more than narrow workflows.

And it’s why I’m a fan of Steve Miranda over at Oracle and his take on industry clouds.

Oracle and Cerner

When asked if mere database infrastructure transformative, here’s what he said:

[No,] I don't think that's transformative value. I think that's providing infrastructure. Maybe there [is some value in] securing things in infrastructure and HIPAA compliance, but that is very table stakes. It's a stretch to call that an industry cloud. Our view is: we want to have end-to-end industry processes; those become our industry clouds. If we have that, then that's an industry cloud. If you say that is transformative and driving value, I 100% agree.4

So Oracle has a far more maximalist position on industry clouds. The tradeoff is that it’s really hard to go deep into 10 verticals at once.

So Oracle is landing on one of the real big ones, healthcare, and has put their money where their mouth is with the acquisition of Cerner for 28.3B dollars.

Cerner is primarily an EHR (electronic health record) system.

You’ll note here that this looks like a mere database. And to some extent, that’s historically what Cerner has focused on. Under Oracle though, Cerner is a beachhead into modernizing hospitals as a whole and building out end to end processes.

Digital transformation in healthcare starts with EHR systems and emerges from there. Oracle now has a critical piece of infrastructure and can build additional products and workflows on top to enable large visibility and operational consolidation across hospitals writ large.

At the same time, they can start to look at transforming other aspects of hospital management, namely billing. They’re set to launch RevElate to help hospitals with revenue lifecycle management and serve more and more workflows throughout the interplay between hospitals, patients, providers, and payers.

Oracle is highly focused on building out robust industry clouds that really do operate across all sorts of processes. That also means that they can only bite off a couple at a time in order to do effectively.

Healthcare is so huge that this Oracle has plenty to do and this will probably consume the better part of a decade.

Square and SMBs

On the SMB side, it appears we are in the really early days of divining what vertical strategies look like for hSaaS players.

I’ll take Square here as the stand-in for what all sorts of companies are thinking through.

Square’s thesis has always been that SMBs want great tools for accepting payments. That was/is true, but SMBs want more than just payments facilitation.

And so akin to any other horizontal player, Square has faced a war on a thousand fronts as vSaaS players have emerged to serve both the payments needs and far more workflows.

And so Square has started to explore more vertical specific offerings including Square for Restaurants, Services, and Retail.

At the same time, Square is approaching further efforts in a cautious manner. They’re still convinced that the depth of their ecosystem with Afterpay, financing, and hardware will win over time.

You can see this caution even from their chosen verticals. Outside of restaurants, these are more “meta-verticals” mostly defined by shared workflows like booking and basic inventory management.

But don’t just take my word for this, here it is from Dorsey, himself:

I would say that generally, there are certain areas across our verticals or across some of our products where we're behind competition and somewhere we're ahead. But on the net… we're much further ahead over the long term because of that ecosystem mindset and because of the breadth of the tools that we offer and, most importantly, how easily they integrate together. It's literally a button push to turn things on or off, and that includes a wide array of services from lending to customer relationship management to vertical points of sale to hardware.

So this is where I think things really matter is a business no longer has to go vendor to vendor to vendor, but they can come to one place. They can come to Square, and they see pretty much everything they need. It does mean that we are going to be slightly slower in rolling out all the features for each one particular vertical, but it also balances that with a much higher quality of integration, which ultimately ends up taking a whole ton of -- it gives a whole ton of time back to the seller so that we see much, much better retention than a lot of our peers.

So will Square beat out Toast, GlossGenius, and more?

They sure are going to try. And even as they go about it cautiously, they aren’t at a stand-still.

So far that has meant acquiring GoParrot, a restaurant SaaS, to shore up the front-office ordering, and it surely means that they are on a hunt for additional ways to shore up the software offering, move more into the back office, and further verticalize.

Core to our strategy is building integrated solutions that give larger sellers a cohesive view of their operations so that they can easily manage every aspect of running a business.

- Jack Dorsey

Building these sort of operationally intensive solutions is going to be key and that will mean getting more and more in the weeds.

This means that SMB front office and back office systems are going to get really sophisticated and the landscape is going to continually evolve. And it also means that Square is going to have to pick strategic fights and probably adhere more to an Oracle approach. It’s really hard to build great software in 10 verticals at once and so it will be very interesting to see which ones they choose.

So whether it’s the industry cloud or SMBs, it’s becoming evident that the entire software and fintech landscape is in agreement that verticalization is the path ahead.

That means a couple things:

While each horizontal player differs in approach to industry clouds, they are doing vSaaS companies a massive favor by spending massive dollars on the need for vertical software.

Product excellence will shine as buyers have to figure out what the heck industry clouds mean for their industry or why they should prefer GlossGenius over Square.

And lastly, it means that it’s pedal to the metal time for vSaaS companies. The warlords are coming, they agree with you on the path ahead, they just don’t agree that it means handing over the claim on industries.

Veeva Q3 Earnings Call

Slides from Investor Day Presentation

https://www.businessinsider.com/salesforce-david-schmaier-chief-product-officer-cdp-industries-digital-2021-5

https://diginomica.com/time-get-real-about-industry-clouds-oracles-steve-miranda-calls-out-industry-cloudwashing

Great post! Thanks eli