Metropolis

a study in vertical SaaS buyouts

For the past year, vertical SaaS investors have been asking questions around the TAM of vertical markets. Firms like Slow Ventures and companies like Metropolis have been creating the answers.

The case goes like this:

Industries that are slow to adopt next generation software often lack a catalyst to do so.

A combination of a niche market and long sales cycles wreaks havoc on capital efficiency.

Nonetheless, these industries do have real opportunities for software to increase productivity. Thus, vertical software companies are well-positioned to buy-out industry incumbents and become large vertically-integrated businesses.

So today is about Metropolis, the innovator for this new strategy.

Metropolis

The parking industry was formerly run by two giants: ABM and SP Plus (SP+). That is until a month or so ago, Metropolis bought out SP+ for 1.5B and took its spot. It’s a fascinating acquisition.

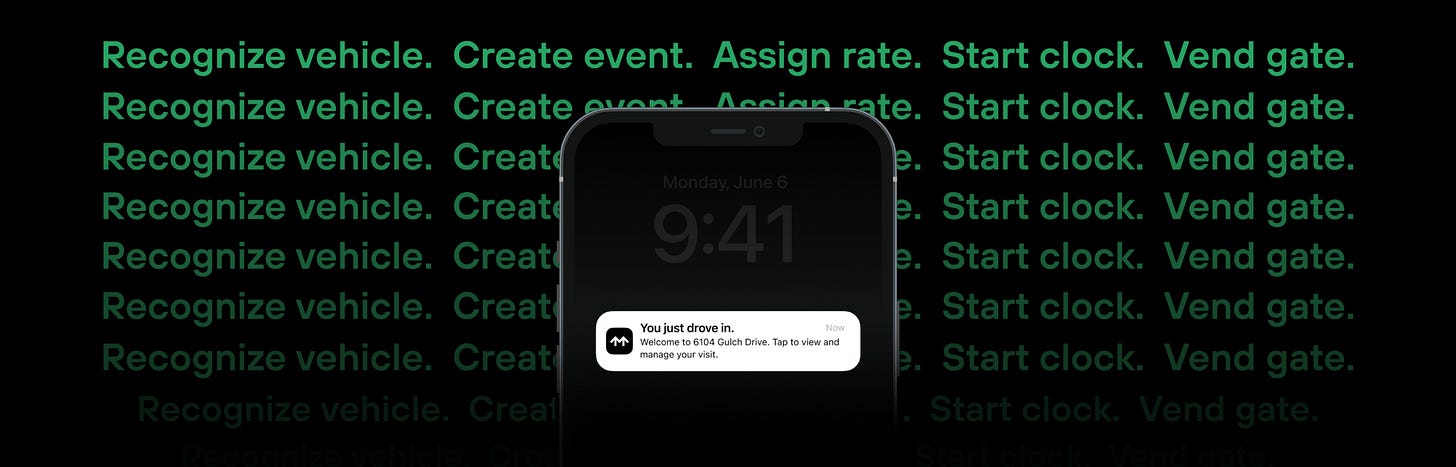

Metropolis was founded in 2017 on the premise that computer vision advancements were ripe for use in parking operations. It was already in use by Tesla to facilitate self-driving, why not use the same tech to solve parking?

Historically, parking spots are leased out to operating groups. They are then tasked with facility management, revenue enforcement (did you pay?), and more.

That’s been heavily reliant upon teams of parking attendants to track all this minutiae and handle the operations. Nobody likes the current state. It sucks. Every second spent interacting with a cashier or ticket/payment hub compounds until suddenly at rush hour, garages are backed up. And sure, this is less of a problem when a garage is focused on longer-term parking and gated with a parking pass that solves this. But if you ever try to use a garage with more space reserved for the general public, you’re in for time lost.

Metropolis proposed a far more automated path forward. What if you tracked every car that enters the garage, assess how long they’ve stayed in, and then automatically facilitate the payment when the car leaves?

That should not only decrease the labor costs associated with the operation; it should actually increase the throughput of the operation altogether.

Cut out 30-45 seconds per entry and exit and you save customers hours in traffic per week. More customers utilize your parking and suddenly you have grown utilization without increasing labor costs or increasing time costs for your customers.

So that’s the vision and Metropolis was already taking over parking operations for a large client base. Why pursue the SP Plus acquisition?

It really boils down to this: the technological value for the rest of the industry wasn’t worth delaying for another 10 years. Here’s what I mean: SP+ and ABM take on lengthy contracts to perform operations. These are often upwards of 5 years. Metropolis is a rival operator with clearly superior technology. But it just doesn’t really matter if your incumbents have locked down every mega-contract.

So here, a takeout makes tons of sense. It bought them the rights to push the innovation layer for parking to the forefront, buy an install base, and gain talent already used to managing these existing facilities and know the operations intimately.

And there’s perhaps one more element. Make no mistake, this was only going to end one of two ways. Either ABM or SP+ would buy Metropolis out and add them to a legacy tech stack. Metropolis would then be left fighting for elbow room in a large org. Or, Metropolis was going to buy one of them out.

Now we will get to answer a really interesting question in the future: What’s easier to do? Grafting a technology unit into an operationally complex org or grafting an operationally complex org into a technology company?

We know what happens when technology gets acquired. It’s usually deprecated or its priority lessened. What’s going to happen from here when the reverse occurs?

What happens next?

The scope of parking operations encompasses far more than just logging which car parked when. It involves facility management, shuttle busses, valet, and plenty more human-dependent tasks. And of course, many garages are still going to need some sort of presence on site to ensure cars aren’t broken into freely.1

It provokes a question: how much margin can you create in the operations if there are still a lot of operationally-intensive tasks to do? There may be real limitations in locations which dampen the impact of your technology. For instance, maybe a contract still prefers a cashier:

Metropolis is still going to have to “win” the contracts over with their technology even for the areas where the tech is clearly superior.

When this happens, the increased throughput should gain you more margin. The enhanced revenue enforcement with better technology should enable more revenue.

But the true bet going forward for Metropolis is that they can continue to gain leverage through software for all the other tasks involved with facility management and operations.2 And that’s going to involve some growing pains as a 2,000 person org becomes the parent entity to 20,000 employees and massive scale.

One other question: What do you do with the components of the business that are utilizing different or proprietary software stacks?

One instance: SP+ bought AeroParker, an airport pre-booking parking SaaS, last year. They’ve now rolled it out to major airports throughout the US and Europe. In-house, they’ve got around 5 different technology platforms, each of which probably have enough unique features to warrant keeping for the time being. There’s built-in operational dependence, most likely contract stipulations around using the software, and real costs in upgrading owned contracts with new hardware.

That said, I’d wager Metropolis isn’t that interested in maintaining these independent software brands ad infinitum.

But does it make sense to throw these out within a 1-2 year timeline when you’ve also now put leverage on the business to buy it out? Do you integrate your CV product into these SaaS products and keep their brands? Do you displace them altogether? Navigating these questions will yield an answer to how Metropolis will create the future of parking technology while innovating amidst a huge legacy install base.3

Market Selection in Vertical Integration

If you were to ask what sunk Convoy, it ultimately boils down to an over-dependence on the digital freight matching software they pioneered with a corresponding inattention to the operational parts of the brokerage that were really low margin. Technology isn’t a panacea for operational excellence. Every vertical software company whom chooses this path will need to gain real operating experience inside the business to pull this off. That said, the factors that led to Convoy’s demise are not entirely analogous other verticals. Market selection really does matter for enacting vertical integration strategies.

The quest for growth in a perfectly competitive market meant that Convoy needed to take on large asset-based debt facilities to fuel their growth. It worked until it didn’t. And when freight prices bottomed out this year, they got caught in a bad position where their balance of future receivables (shipper contracts) pledged for short term debt led them to bleed dry in a market where the spot prices they had to pay for freight movement exceeded the value of the long term contracts.

Combine that with the democratization of digital freight matching technology amongst other brokers and their competitive tech advantage collapsed around the same time the freight market demanded operational savvy in the face of collapsing growth to maintain solvency.

The same things will not be true for every industry pursuing the vertical integration path. Metropolis has some real advantages going into the next decade.

There’s always going to be a need for parking with limited spaces available at premier destinations (airports, events, hospitals, etc.). Demand doesn’t collapse absent a pandemic.

While complex, parking operations are nowhere near as complex as other industries with vertical integration plays.

Premium, integrated technology is a real moat here. There’s reason to believe the rest of the industry has no effective R&D branch, Metropolis has now gotten the scale they need to get the tech in the door, and they can very well win more long term contracts prior to their rivals developing computer vision.

SP+ has decades of operating experience. This is perhaps the largest advantage of the “vSaaS buyout.” If integrated properly, Metropolis gained an extensive operational arm.

The market isn’t perfectly competitive. As much as valet, shuttle busses, and other employee-dependent services enact an operating cost, they also enable Metropolis to innovate around the customer experience. A fantastic valet experience is memorable. When prioritized in conjunction with the technology, you can create a moat around the customer experience that other competitors can’t match.

As this plays out over the next decade, I can’t wait to see how Metropolis develops the playbook from here. And I can’t wait to see what other vertical SaaS companies riff upon this strategy.

Parking may be at your own risk, but nobody is using the garage that is free reign for theft.

The other reason for hesitation here: Metropolis acquired SP Plus at a 50% premium to the opening stock price on the day they closed the agreement. Market prices are clearly depressed, but nonetheless

My hunch: Metropolis’s software stack is conducive to retraining employees quickly for customer-facing services. The back office will most likely be a complex beast to navigate for the time being.