Monite: Unlocking SMB AP/AR and Trade Networks

inter-company workflows

“I tend to think [inter-company workflows are] the DNA for the next winners in Vertical SaaS -- being multiplayer vs. singleplayer and perhaps even using financial services products not to increase LTV of the initial customer, but rather to pull other constituents into a network.”

A couple weeks back, Sumeet at a16z gave an early read on where the future of vertical SaaS is going.

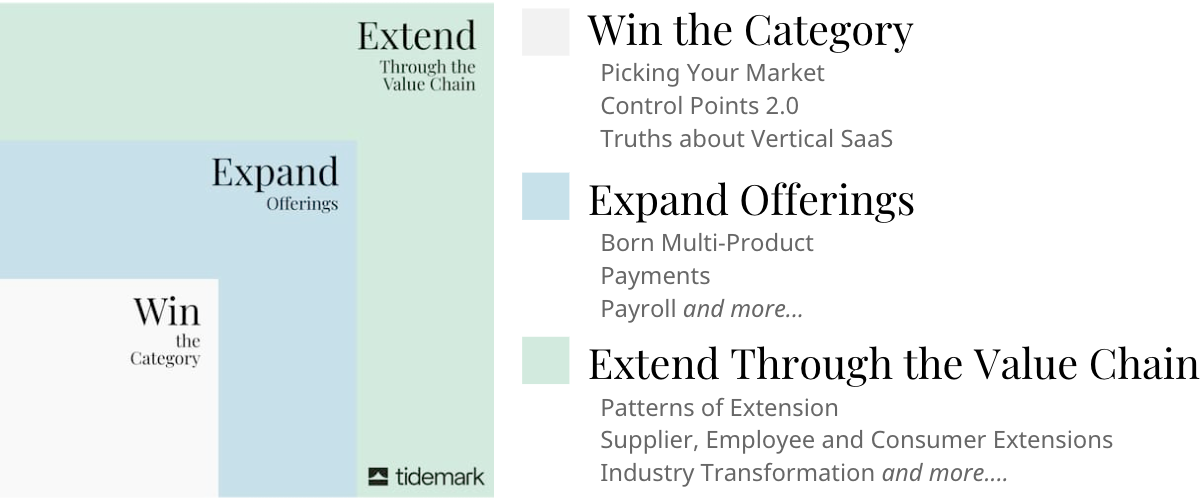

The point of emphasis? Inter-company workflows. This isn’t a wholly new thought; Dave Yuan at Tidemark has been saying something similar for years.

But I appreciate Sumeet’s emphasis on one particular vector by which companies can span the value chain: financial products.

The goal of creating a multi-player network after all, is to speed up the throughput of industry transactions. That usually includes procurement, logistics, communications, supply and demand matching, and payments.

Not only do financial products potentially allow you to pull in participants, but certain financial products actually seem to tell you which participants to pull in in the first place.

One of the primary signifiers of multiplayer activity comes when a company transfers a payment. And that activity is registered by a firm’s AP/AR processes. Invoices and bills constitute a “log” of network participants. Perhaps the future of network assembly starts with simply capturing pre-existing logs of network transactions.

This is why I’m really excited about Monite.

Because what I didn’t realize is how few SMBs have any sort of AP/AR process at all. Network data nor the AP/AR processes have really been brought online.

There is no mass adopted AP/AR solution. Even Bill.com, the industry leader, has only about 1.5% market share. But every SME uses some software to perform these tasks - the ERP-esque solutions simply just aren’t that great. There’s several reasons you could propose for this large gap: maybe distribution of solutions is hard. Or maybe the solutions themselves are not needed. Or lastly, maybe end users are simply skittish about changing their existing processes until a certain scale justifies it.

All of these seem like valid points of concern. Due to SMBs having non-complex processes for the most part, and without high frequency: most of the AP/AR attention has gone into the mid-market and up. As a result, most solutions on the market are de facto complex and meant to support mid-market companies with more robust billing functions.

The third concern is the most interesting. Your average SMB does about 450 invoices a month. That’s still quite a bit of time spent on a manual process that involves bank reconciliation, invoice reconciliation, accounting, and the payment itself.

There’s latent demand for the right sorts of AP/AR processes and most likely that demand gets realized inside of robust platforms that run the rest of their business: vertical SaaS.

The argument for embedding AP/AR is then threefold:

There’s latent demand for these products when architected properly like what Monite has built.1

Vertical SaaS company have new revenue upside without R&D costs.

This then enables vSaaS companies to build out a log of network transactions in order to build out new digitized networks.

Monite

Monite’s core offering revolves around a suite of AP/AR products that vertical SaaS companies can embed into their product offering.

Key to this: Monite is focused on thoughtful and simple design. The way to get SMBs to adopt better financial processes is through making their life a lot more seamless.

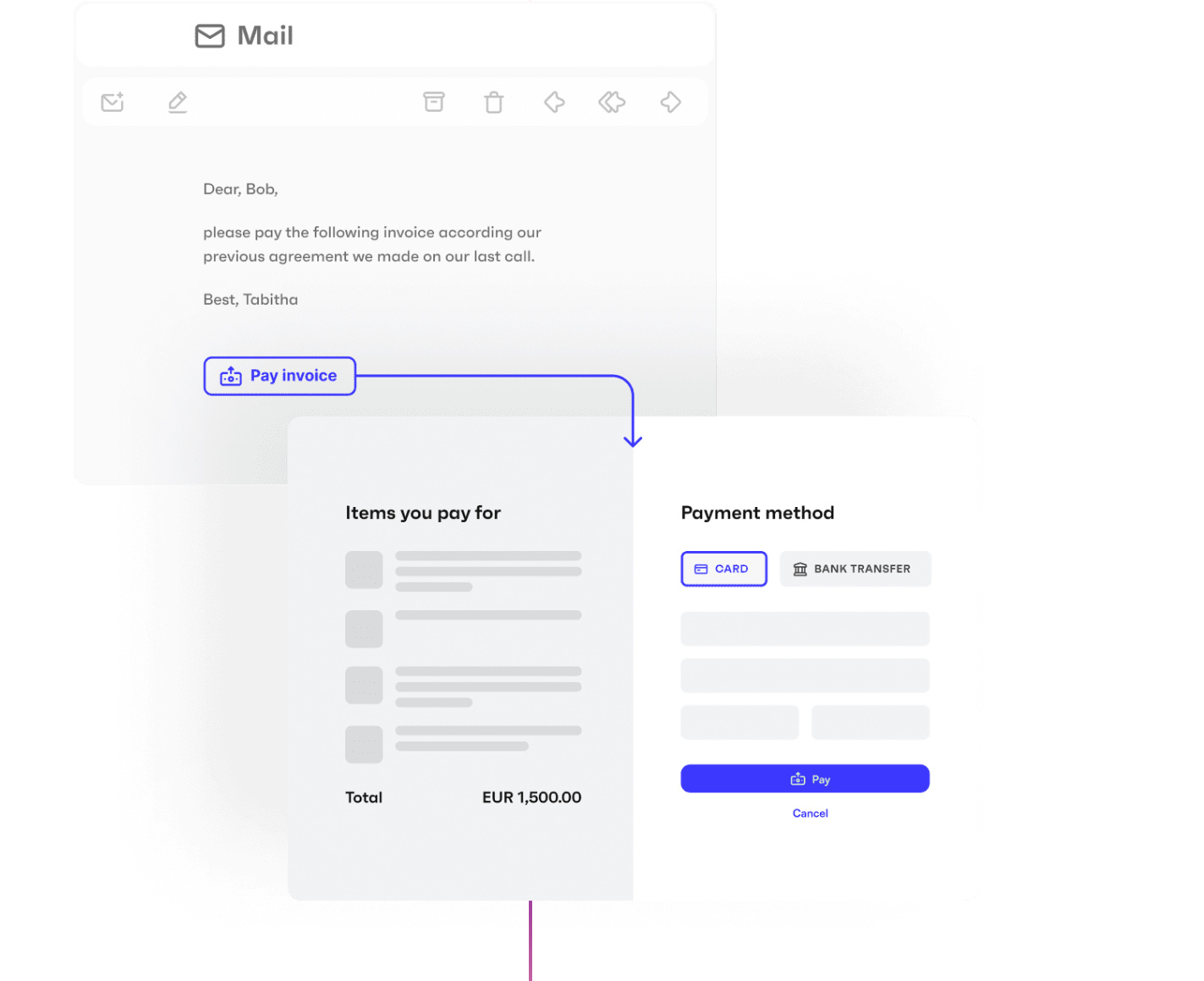

On the invoicing side, this includes things like payment links.

Since most SMBs are running operations highly manually, payment links are the sort of feature that is revolutionary. Monite has data that suggests that payment links can increase the speed of payments by 40%. Given cash flow is always the most pressing concern in these businesses, that’s an immense value add.

Likewise on the billing side, Monite has built the infrastructure to enable bills to a) be paid on platform but b) more importantly, put in all the financial automation on top that drains hours of the week.

That includes rules for bill approval, invoice capture, and higher order insights on cash flow. SMBs save large amounts of time, have better insight into the back office of their business, and can create meaningful time savings with the product.

And as I mentioned in my piece on embedded technologies, that sort of embedded tech enables LTV to grow and R&D costs to drop for vertical SaaS companies.

The Future of Digital Networks

Value chains/networks look far different from industry to industry. So too, does the approach that vertical SaaS companies will take.

Some may favor owning the entire supply chain function like Odeko. Others might create trade networks with advantaged wholesale pricing for their users like Bloomnet (1-800-Flowers). But my guess is that the future of networks and inter-collaborative software will start with the financial billing cycle, unlock data insights on the right network participants, and then slowly capture more of the workflows involved in the transaction.

And my guess is that Monite will be at the heart of a lot of these plays.

A key piece here is that seamless embedded AP/AR integrations are only possible with flexible APIs. It's a huge part of the Monite’s value proposition.