Tekion and DMS Disruption

The path to becoming the auto industry cloud

In auto, everyone grumbles about their DMS. Owners lament the cost, parts departments see it as a nuisance, and sales crews think it’s too cumbersome during a sale.

With this much grumbling, you may think that it should be a market ripe for disruption.

Low NPS with existing solutions and low NPS with customers in their experiences with a dealership should equate to a substantial market opportunity. And it does.

But at the same time, there’s a graveyard of past would-be disruptors to trot through, all of whom have either closed doors or been acquired by one of the industry mainstay. Not to mention, dealership employees will sometimes quit rather than learn a new DMS.

All of this has led to stagnation in the auto software world. But occasionally, there’s a compelling enough vision and product that can disrupt everything for the better.

After all to change complex industries, it isn’t sufficient to simply build better software, you still have to win mindshare, tear down faulty incentive structures, and convince an industry that the vision is worth the short term pain of switching.

That’s what Tekion is doing on the path to become an industry cloud.

History in the DMS

DMSs are inherently complicated. They function as the ERP systems for dealers, tracking everything from sales to financing to parts and services to accounting.

At least, they should. Instead what has happened is that often different workflows happen in different systems. To add to the mess, state by state regulations might affect how much of the process can be digitized.1 A salesperson will click through a dozen or so software systems to get a customer their car - handling everything from credit checks, trade-in appraisal value, inventory, and more.

Far before there was software to do this, there was Reynolds and Reynolds - a Dunder Mifflin-esque supplier of business forms. Founded in 1866, throughout the mid 1900s, they gained a large customer share in the auto industry - signing contracts with the Big Three of the auto world, Ford, GM, and Chrysler. Remarkably, as the computer era dawned, they predicted its effects on the auto industry and started to build out/ acquire software products in the 1980s.2

By the time, the 1990s rolled around, R&R had become a pioneer of DMS systems. And along with CDK Global and Cox Automotive, an auto software oligopoly emerged.

The 2000s began a wave of consolidation in auto software as the oligopoly began to acquire their way to more market share and expand the total workflows that they could serve. The upshot of course was that many more workflows were beginning to become digitized, but we had software proliferation as well, directly leading to the 15 odd systems in use at a dealer. They may be nominally in the same vendor ecosystem but experientially they are not.

And sure, there were some successful upstarts like DealerTrack. But oligopolies are hard to topple; it’s easier to join them. And that’s what DealerTrack did in 2015 when purchased by Cox Automotive.

There’s classic problems within these softwares - nobody is really sure how the products within a vendor ecosystem integrate, it’s not clear that they actually surface higher-order insights, and their interfaces are quite bad.

Further, these vendors operate like closed systems. Developers wishing to build better applications or integrations based on DMS data will pay prices that actively discourage data use.

In short, the existing industry clouds have been built with a piecemeal, emergent approach. And they’ve become multi-billion dollar companies. But data is siloed from the software, products aren’t highly integrated. And it doesn’t mean much for the existing vendors to promise innovation ecosystem; they’re limited by their current architecture and their own desire for innovation.

In that gap, Tekion has emerged.

Tesla, Jay, and Warp

Tesla’s impact on the auto industry extends far beyond EVs; it’s mostly incidental to the other forms of innovation Tesla has birthed. Prime among these was Tesla’s new paradigms around pushing software updates to the car and the purchase experience, both of are infusing throughout the rest of the auto industry.

Buying a Tesla has historically been far different than buying a Ford Bronco.

Tesla made the experience far more like an Amazon purchase. You go on the site, select your ideal features, and boom, you check out right there. Sure, there are incidentals to fully purchasing the car, but you’re mostly done. All within one website and one flow.

And sure, there are some core reasons this has proved difficult in the rest of auto mainly stemming from the traditional OEM/dealer model. But, if it is possible, it is worth building. After all, seamless purchasing is now the standard by which we judge industries.

Jay Vijayan was wondering if it was possible too. In fact, he was wondering it as he built out Tesla’s entire ERP system, Warp, that made Tesla’s end-to-end experience so seamless.3

After building Warp out, Jay took a bet to found Tekion and go vertically democratize an entirely new vision for how software could impact dealerships and OEMs.

Tekion and the Retail Cloud

Dealerships have two primary types of interactions with a customer: car purchasing and car servicing.

Within DMS systems, these sorts of interactions have all sorts of incidental workflows attached. Parts ordering, inventory, and of course financing and payments.

And on top of this, the OEMs will demand DMSs have certain functionality in order make their life easier as well.

Tekion had a real choice at the beginning: do you incrementally build workflows until you are a DMS? Or do you build a DMS all in one fell sweep?

There’s a big problem with the incremental approach in auto: there’s a solid chance your transformative technology won’t be all that transformative. The oligopolists are closed systems. Even though Jay was confident that data + AI/ML was going to play a big part in the next auto tech wave, if you don’t control all the data in all the systems, you will end up in the graveyard of fellow disruptors.4

So Jay wasn’t interested in incrementalism and instead Tekion chose the latter. They spent 3 years in development to do it.

The result is Tekion's auto retail cloud that seamlessly integrates all customer interactions and digitizes the customer experience from the point of purchase to the point of servicing and everything in between. And because Tekion had complete access to all data + workflows, they could seamlessly digitize the core buying experience while adding other e-commerce-esque5 functionality such as delivery tracking.

The result is two-fold. First, customer sentiment around the car purchase improves.

After years of car salesman jokes, everyone’s preconditioned to believe there’s a fair bit of manipulation going on in the car buying process. Sales guy telling you you should get the package upgrade and the 4-inch lift on the Bronco? You may want it, and you may get it, but from the jump you are wary that you’re a mark.

E-commerce experiences really do change this and redefine consumer agency over the purchase. Something as simple as letting a customer select their own upgrade packages on a tablet or website is meaningful here.

Second, dealership operations improve dramatically. Increasing the throughput of a service department leads to increased sales. Increasing the surface area of a dealership’s interactions with a customer increases lifetime value. Slap modern data infrastructure and ML models to make sense of all this information and dealerships are now analytics hubs for auto insights.

The technology is transformative, but there’s far more to do to win.

The Chicken or The Egg

Tekion ran into a problem early on. In complex industries with limited suppliers, the suppliers have the power to dictate a lot of the software stack. In auto, this means that OEMs will incentivize dealers to use certain DMS systems and heavily discourage the use of others.

For Tekion, this meant that even though dealers loved the software, they weren’t ready to purchase until Tekion got their OEM partnerships sorted out. No OEM support, no dealers.

But on the flipside, OEMs wouldn’t certify or support an integration until Tekion had a certain number of dealerships on platform. No dealer support, no OEMs.

And even for Jay, with Tesla credentials, he found it incredibly difficult to get any OEMs to bite. It’s often underrated in industry contexts how much permission you must obtain to simply build.

Tekion ultimately solved this by finding some dealerships that were willing to forgo OEM incentives to use the software. The product was simply that good.6

Nowadays, OEM support isn’t a concern. In fact, it’s quite the opposite with some of the largest OEMs like GM on Tekion’s cap table. Now OEMs are becoming a core product focus as Tekion begins to build out the Automotive Enterprise Cloud.

Crossing the Industry Chasm

The OEMs have been busy - and not just on the EV front. After a new vertically-integrated entrant disrupts some industry practice, the rest of the industry tends to adapt. They’re prioritizing Tesla’s ease of purchase.

Adaptation though is somewhat fraught. OEMs would of course prefer to capture more profits from a fully Tesla-esque purchasing experience. But dealers are mostly independent. And given state laws that prevent OEMs from circumventing these dealers through an online sale, it’s hard to fully mirror this aspect of Tesla.

Tekion though, thinks they can mostly solve this.

The magic stems from a pretty basic intuition - if you’ve consolidated the systems, workflows, and purchase experience at a dealer, why not allow the purchase experience to start on the OEM’s website and pass through most of the completed transaction to the dealer?

That is when you become an industry cloud. And it’s what really only Tekion has a shot at accomplishing. The end to end experience at a dealer is solved. The end to end experience from GM’s site to pickup at a local dealer is next.

If and when Tekion pulls this off, you can imagine the Tesla purchasing experience and the traditional OEM experience converging with Tekion handling the infrastructure that allows this to work seamlessly.

From the outside, this experience will look frictionless. But it will only be because Tekion has engineered a product that connects all industry data in a heavily fragmented space to do something previously unimaginable.

There’s other aspects here that over time Tekion will do similar things with. Parts ordering and tracking between service departments and the OEMs is still in the dark ages. The same basic rule applies: when you have all the data and integrations, you can help manage this end to end.

Open Architecture

Lastly, I think it’s important to mention a prime distinction between Tekion and the oligarchy of the past. The oligarchs operate closed loop ecosystems. You pay for API access. In stark contrast, Tekion has opened their APIs up, inviting a new partner ecosystem to form around them.

Developing a new partner ecosystem is itself disruptive. Effectively moving the cost of data transmission in and out of a DMS to zero will ensure partners prioritize development around Tekion.

Industry Clouds in Motion and Execution

It’s sometimes fun to take a cursory look at industry forums to see what they are saying about new software vendors. I take these with a grain of salt as I’m sure every software vendor has at least one anon running a counter-insurgency against upstarts. But in Tekion’s case, the parts guys still aren’t entirely thrilled with the product.7 And this is an industry where employees would rather quit than learn a new DMS to begin with.

At the end of the day, complaints are two-fold: first, they have to learn a new system. Ripping and replacing a DMS is analogous to ERP replacement and a special sort of hell no matter what. Second, the new system might not have all the functionality present for the dealership’s idiosyncrasies.

This highlights a core tension every would-be industry cloud faces upon signalling their ambition. The integrated cloud vision might not be fully realized across all workflows equally, and yet future prospects as an industry cloud will be judged by the current workflow support at the department level.

This creates inherent skepticism that industry clouds in the middle phase simply have to live with.8 It all comes down to execution. Speed trumps feature parity especially if the architecture for future feature enhancements is simply better.

There’s probably some formal calculus you could do:

When product velocity is greater than the number of weighted complaints about a feature (FUD) business accelerates.

Or more simply, Execution > FUD = Industry Cloud Adoption.9

Or in Jay’s mind, just build software that meaningfully impacts revenue and operational efficiency and you’ll be fine. The rest is just noise anyways.

Any trend doesn’t matter so long as your software is strong enough to attract and retain customers and gain operational efficiency across all departments.

- Jay Vijayan [paraphrased]

Gassner, Vijayan, and the Industry Cloud Roadmap

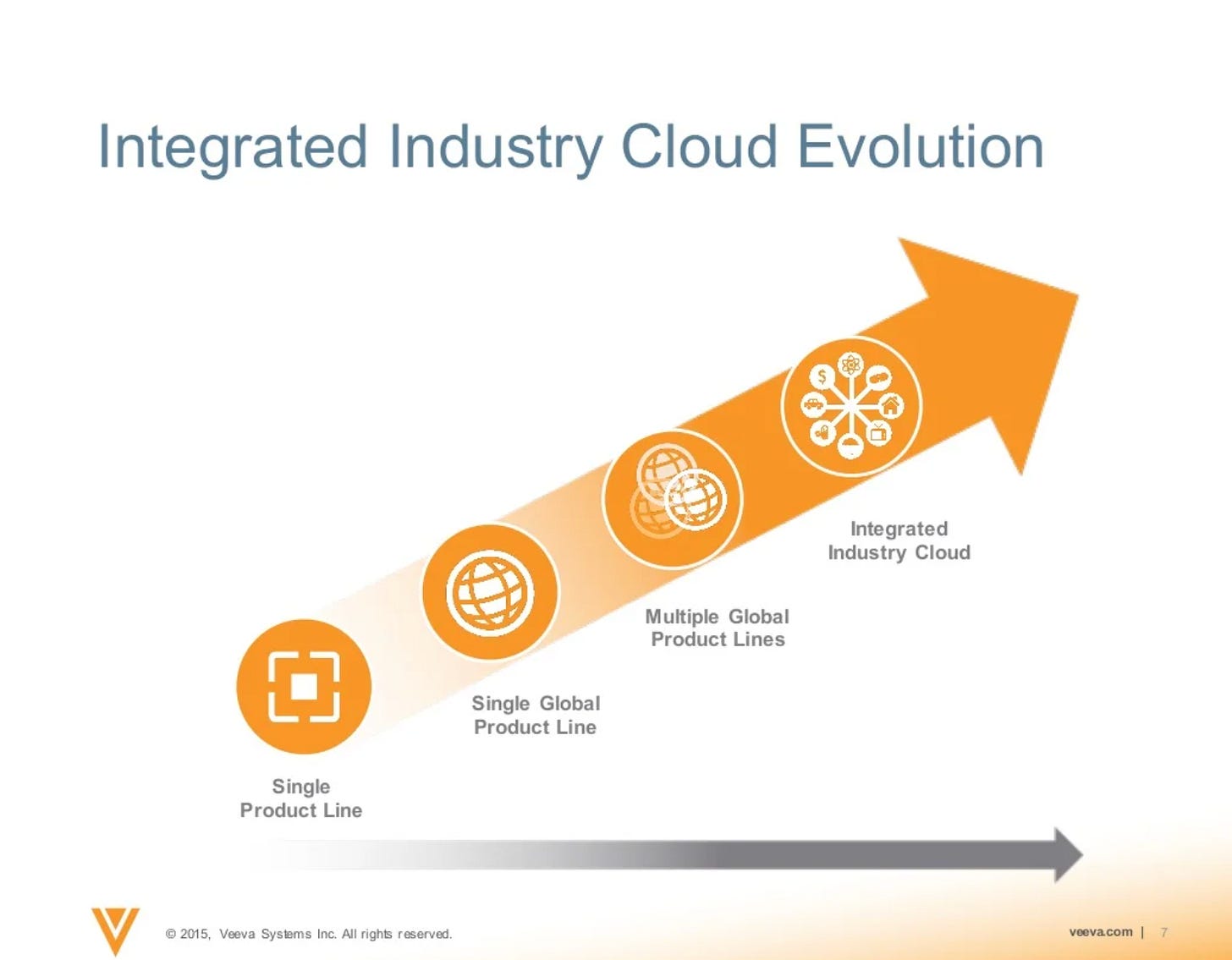

To end, it’s interesting to cross-reference Veeva’s sketch on industry cloud development and what Tekion has been up to.

Tekion’s disruption vis a vis the former DMSs has been consolidating the disparate systems into a holistic cloud. Veeva extended CRM architecture into a new regulated market, Tekion reinvented it wholesale. Thus, Tekion’s single product entrance looks more like a completely integrated retail cloud from day 1 - and yet like Veeva, they entered primarily in the revenue function.

From there, Tekion and Veeva thus far have differed. Tekion’s route to global industry cloud goes through the OEMs. In many ways, this will allow them to continue high capital efficiency in new markets. It’s very plausible that by focusing on the already global OEMs and integrating deeply with them, the OEMs will in turn help Tekion get into new markets where the OEMs can incur further benefits with Tekion’s end to end product.

Certain states still require wet signatures.

How many literal paper companies successfully solved the Innovator’s Dilemma?

Tesla had 200 engineers on this project to give you a sense of the scale involved here.

Jay had plenty of potential investors telling him to take the incremental approach.

Can you do two hyphens in the same word?

And I’d imagine Tekion’s price was also incredibly low to get some dealerships onboard to solve this.

In all fairness, who enjoys figuring out new software quirks in real-time?

Balaji in a completely different context (and one you could quibble with) makes a great point that “comparative efficacy” for transformative technologies is the wrong angle. Ubiquity and a new architectural paradigm reigns supreme.

Remarkably, Tekion has managed to do this with a high degree of capital efficiency. As recently as last July, Tekion only had 18 salespeople.

Verticalized is a standout resource for anyone interested in the future of vertical SaaS—whether you're a founder, investor, or operator. Its perspectives are well-informed and forward-thinking, making it a go‑to resource for strategic analysis in the vertical SaaS space.