The Capital Structure Idea Maze

what drives the next crop of industry transformations?

Good afternoon,

Today: a tour through capital structures.

The Capital Supercycle

Some anecdata:

There’s an expected $2T entering the private credit markets over the next 5 years. This would double the current private credit market’s AUM. The raises are staggering.1

There’s interest and growing demand for novel capital structures from founders, investors, and more. Interest and businesses performing rollups, buyouts, neo-franchise models, and more have only grown.

Hard-tech too is fueling a capital renaissance. To reach industry transformation, novel hard-tech strategies are necessitating novel financing structures much earlier in company lifecycles. (Base Power is the example that most readily comes to mind).

Great power dynamics are increasingly creating new wedge points for innovators. The interplay between global infrastructure, China’s Belt and Road Initiative, construction and manufacturing sectors, and the Trump administration’s “dealmaking as policy” are creating a new crop of winners and new opportunities across the equity and debt stack2

Will Manidis’ takes on merchant banking seem prudent and exemplified at the upper echelon by Thrive Holdings and at the lower end that are rethinking company incubation altogether.

In short, the smartest founders I know are starting their businesses not simply with a product idea, but they are increasingly spending their time plotting the capital constructs that will enable them to do wholesale industry transformation.

We can maybe riff on an existing term and call this the capital structure idea maze.

I don’t want to be misunderstood: this isn’t operators asking “can I be more capital efficient via venture debt?” It’s founders increasingly asking “what mix of capital is critical for the success of industry transformation?”

Or in Will’s words:

Throw in “company” instead of “professional life” and I think we have a good sense for what is required.

Let’s take a brief tour through the new capital structures and realities in each part of the market.

Product-market-capital-fit.

It’s worth considering a potential emerging trend that likely will refactor some of the capital stack in years to come. One of the direct impacts for all sorts of companies is the new ways in which their businesses are becoming more “underwritable” for debt. My favorite example is General Catalyst’s Customer Value Fund. Scaling businesses can often determine their CAC/LTV mix. Why fund growth with equity? That’s the question that GC asked too and the result is a fund specifically for companies like Ladder to scale their businesses with less dilution.

Once a business has components that are “structured”, like S&M and CAC, those components deserve a solution that is precisely matched to their output – just like a company with inventory gets financing tied to that inventory, or a company in need of a machine takes out a financing tied to the value of that machine. Using equity to fund S&M is a poor use of that capital, which is even more pronounced now given the capital constrained environment.

Which leads to a new hypothesis one could have:

AI Services are a hypothetical new asset class

Here, let me paint a brief picture of asset-based finance.

Asset-based finance lends against an asset. In fintech, this has mostly looked like receivables purchases.

Pipe was one of the first to collateralize SaaS contracts, take a haircut on your monthly ARR to convert that into a lump sum annual pay out.

We have also seen the collateralization of sales via far better payments data from companies like Stripe, Square, and Toast.

These companies could underwrite the purchase of future sales and solve cash flow and lending challenges with certainty of execution for SMBs who previously had slow or no options to do this.

How does this apply to AI services you ask?

AI services are neatly tied with new arrangements that often move services from time-based billing models towards outcome-based project models.3

Crosby just announced their latest funding rounds. By no means, am I suggesting they should do this, but it’s a simple enough example to show how radical of a shift certain AI-based services are and how that enables different asset-based finance compositions.

Law firms historically bill hours with tons of variability in the number of hours required, the future variability of how many hours will be billed for a project, and the length of the project. Underwriting is slow. Lending facilities are imprecise. There’s no asset to really collateralize here. And so instead, it’s necessary to extend lines of credit.

Crosby? Crosby just says, “here is your price for an outcome on an MSA.”

And that simplification and corresponding ability to forecast the asset (the outcome) enables a service that was once too complex, costly, and onerous to underwrite to become a series of assets that can be collaterized individually.

In short, AI services simply by nature of their existence reduce the cost footprint to underwrite. Depending on the industry and context, these can now be modeled as future receivables to be purchased, measured around their outcome-linked components (if you want a General Catalyst-inspired flavor) and because AI services are de facto digitally native, they’re suddenly rendering transparent hundreds of different services that previously were invisible as an asset class.

That in turn reduces the cost to service, the cost of debt, the velocity of lending, the velocity of payback, and more.

You can imagine the net result:

A whole slew of receivables just became ripe for asset-backed lending.

How much does this matter? It might matter greatly in the future for AI services companies also performing buyouts, rollups, or other structures with longer cash cycles. It certainly may matter for future platforms that potentially are built in a Shopify-esque manner to allow SMBs to create AI-based services. The certainty of pricing and outcome with AI services could enable these companies to acquire an asset, convert customer agreements to outcome-based AI service models, collateralize these new receivable assets for quicker cash conversion, and grow faster. In turn, this could give rise to a new source of capital efficiency for services companies scaling.4

Does this happen and does it pencil out how I outlined? Jury is out, but it’s now theoretically possible and I find it extremely interesting.

Time to Innovate vs. Time to Scale - Rollups and Buyouts

If AI services represent capital efficiency at the micro level, rollups and buyouts represent that same logic at the corporate level. I won’t belabor this point too much right now:

Many of the well known rollups right now are on record as not spending much time thinking about debt. These are primarily equity-infused deals designed to give teams time to fully understand the P&L impact that AI can have on a firm prior to scaling. It is quite hard to imagine that at a certain point, many of these companies won’t also use acquisition financing to scale.

But equity is going to continue to be a part of the stack and my guess is a meaningful part of accelerating business acquistions. And I’m very curious to see how startups utilize equity-incentives in their acquisition structure. After all, this is a massive component of what led to Acrisure becoming one of the largest insurance brokerage in the US.

Industry Disruption through Capital Structures

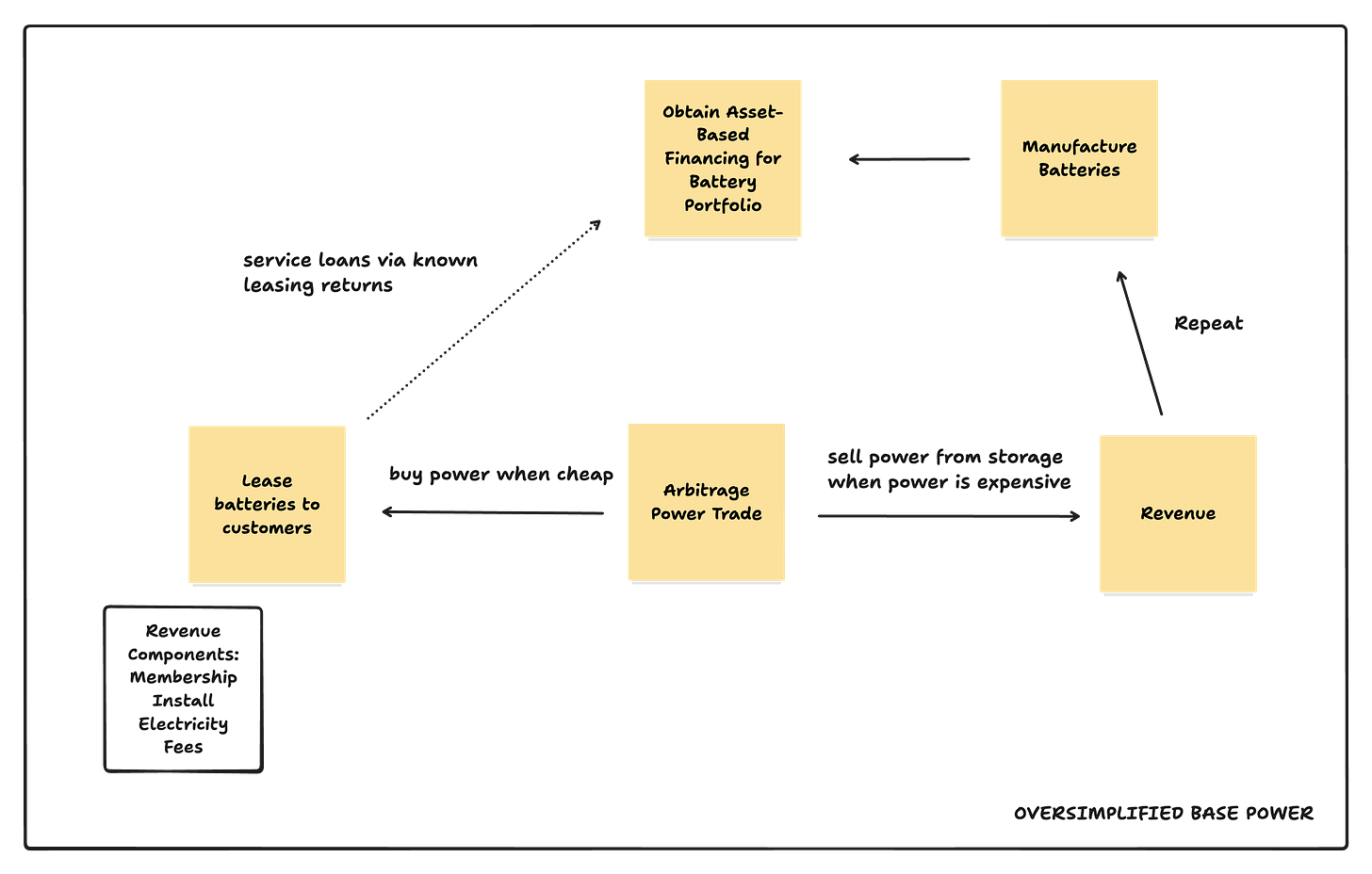

Base Power is 50% battery company and 50% “we found an incredible structure to unlock a crazy revenue pool.”

The short of it: manufacturing is capex intensive but worth doing for all sorts of reasons. If you want to manufacture batteries5, what if you initially operated as both a battery leasing company6 and a Retail Electric Provider to enable another revenue pool through buying and selling power into customer storage?

Private credit markets love leasing arrangements because they generate consistent yield over time. Base’s unlock was partly realizing that you could sell batteries, not to end customers, but instead sorta to private credit funds.7

Shinkei Systems can be somewhat modeled the same way.

Great Powers and Capital Structures

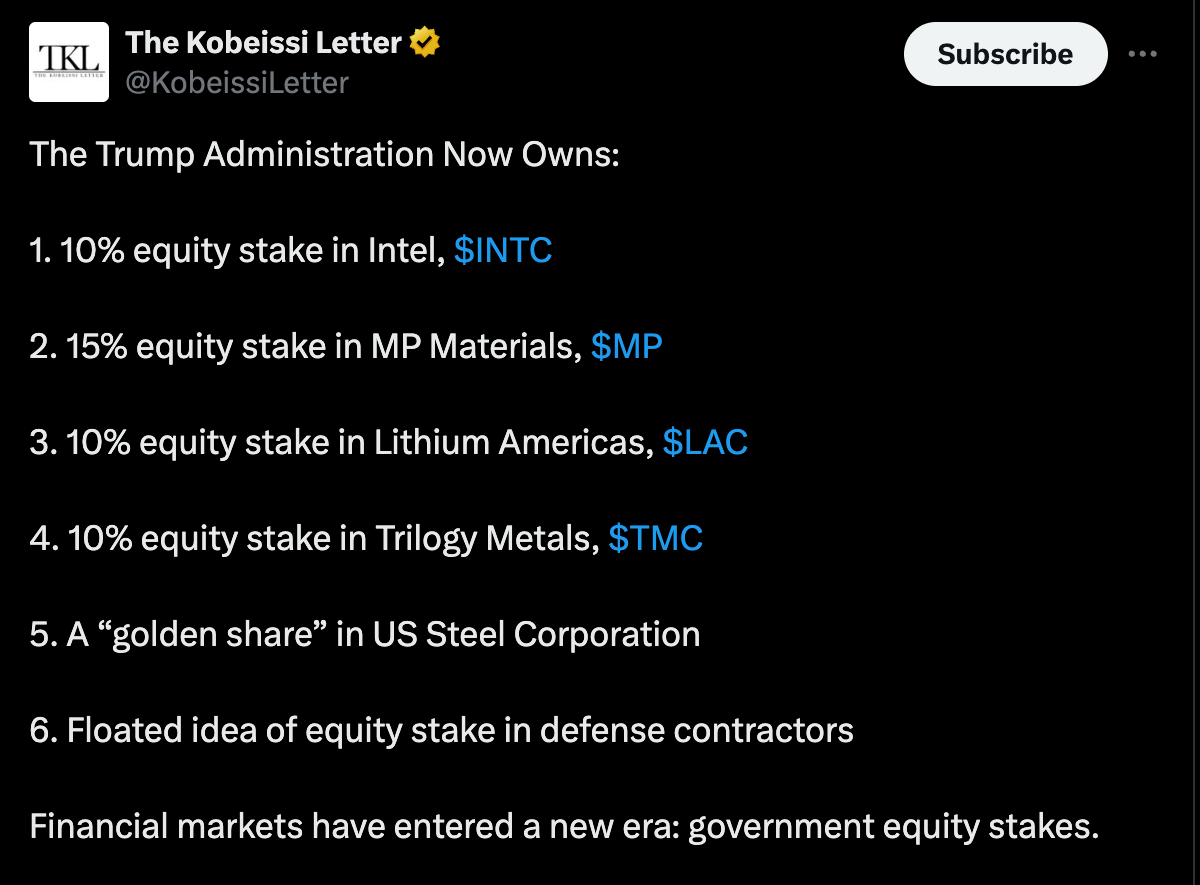

Lastly, new horizons are opening. I have no take on whether companies should do this nor wish to speculate on whether its a good development or not, but it is now a viable(?) avenue.

Government equity stakes in exchange for industry approval is happening.

In fact, maybe we leave a more extended analysis here for a different time. Because after all, new capital realities are where the alpha lies both for investors and founders.

Trilogy Metals, Ukraine critical minerals, the Panama Canal (which fell through), the Finnish icebreaker purchases, etc.

And to be clear, they are not fully AI-serviced. There are meaningful human components and will likely continue to be.

You can develop an entire fund thesis around what this enables.

And intrinsically you should because the opportunities in batteries extend far beyond retail.

These leasing companies are incredibly valuable on their own, cf. airplane leasing.

This is of course far too simplistic, but this piece is already too long.