The Current Tech-Enabled Rollup Gap + the Funeral Industry

April Riffs

Luke Sophinos and I had a great time collaborating on a piece recently. You can check this out over on his newsletter as well. In short, AI driven rollups feel like the most obvious opportunity but in a lot of cases have not reached the inflection point. Why is that? I will have more to come on opco/propco structures, specific case studies, and AI strategies coming soon.

AI-driven M&A feels incredibly obvious as a long term opportunity, yet while the X posts are abuzz with the opportunity, there’s a lot of uncertainty around the strategy in the financial markets.

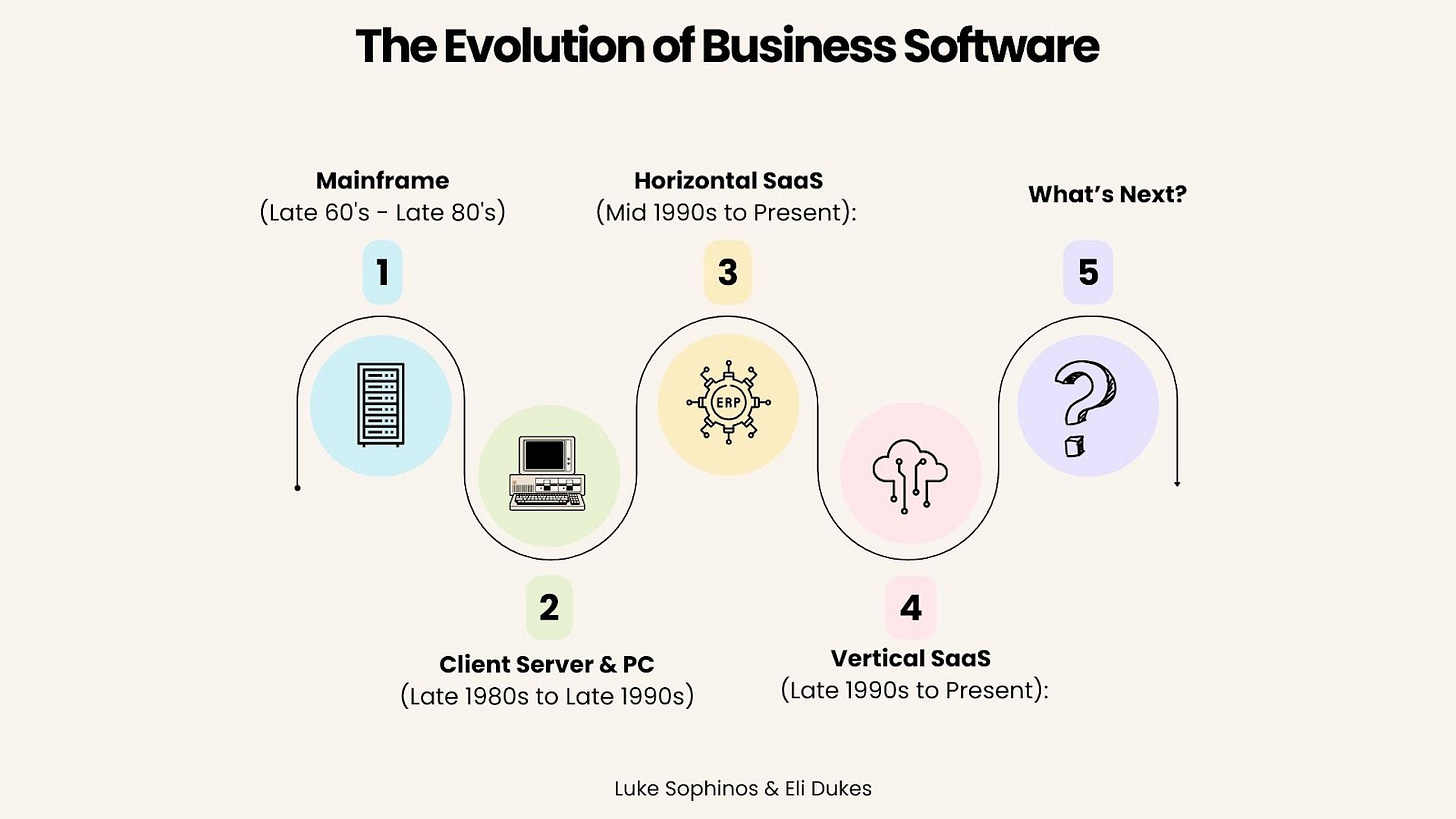

The History of B2B SaaS & How We Got Here

If you zoom out and look at the last two decades of b2b software we’ve gone through very interesting waves…

Wave #1: Mainframe (1960’s to Late 1980’s):

Large, centralized mainframe computers that ran mission-critical applications for businesses. Think batch processing, proprietary systems, high costs, and specialized technical skills being required. Notable Companies in this phase included IBM, Unisys, Burroughs, Honeywell, and Control Data Corporation.

Wave #2: Client Server & PC (Late 1980s to Late 1990s)

With the advent of personal computers (PCs) and client-server architecture, businesses began adopting decentralized computing models. Distributed computing, graphical user interfaces (GUIs), local area networks (LANs), and the rise of workplace productivity software. Notable companies include Microsoft (Windows, Office), Oracle, Novell, Lotus, and Borland were prominent in this era.

Wave #3: Horizontal SaaS (Mid 1990s to Present):

Horizontal software refers to applications that can be used across any industry and business functions, such as enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management (SCM) systems. Notable companies include SAP, Oracle, Microsoft, Salesforce, and Workday are major providers of horizontal software solutions.

Wave #4 Vertical SaaS (Late 1990s to Present):

Vertical software is designed to address the specific needs and requirements of a particular industry or sector, such as healthcare, finance, retail, or manufacturing. Software vendors deploy tailored tools and deep domain expertise. Notable companies include Toast (Restaurants), ServiceTitan (Field Services), Veeva (Life Sciences), Epic Systems (Healthcare), Procore (Construction), Instructure (Higher Ed). Embedded payments, ads, and other plays came out in early-to-mid 2010s and drastically increased TAM and revenue for vertical SaaS players.

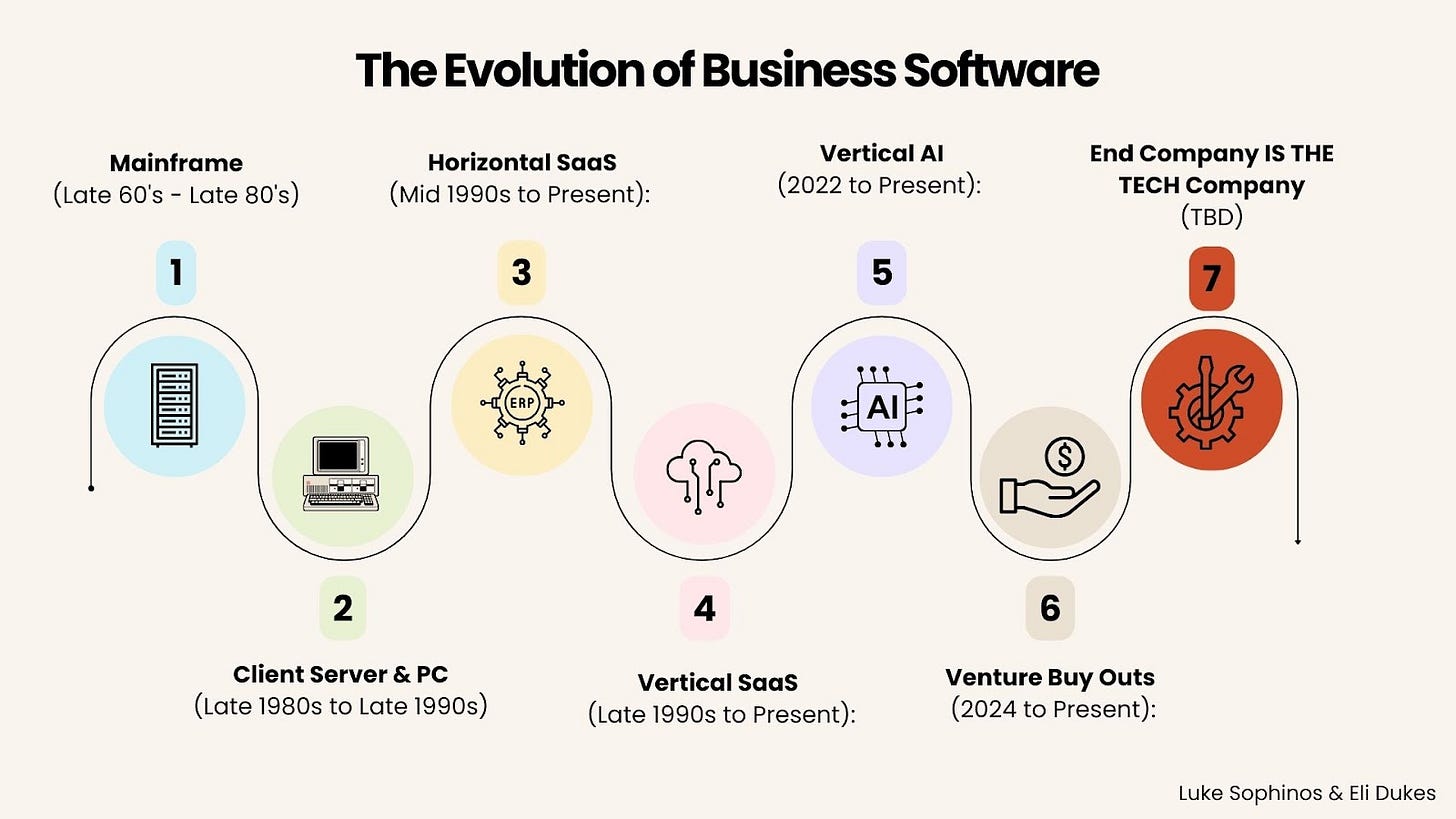

So What Comes Next?

#1. Vertical AI

Vertical AI is a relatively new term that refers to the application of artificial intelligence (AI) technologies and solutions tailored for specific industries or vertical markets. This approach contrasts with horizontal AI, which focuses on developing general-purpose AI solutions that can be applied across various domains. Example companies include Vertical AI would be Harvey for Lawyers, AxionRay for Manufacturing, Sixfold for Insurance Underwriting, MagicSchool for Education. Where-as horizontal AI would be Customer Service AI or SDR AI.

#2. Venture Buy Outs

When an early-stage company builds a game changing product for a specific industry, buys companies in that specific vertical, and implements their game changing technology that results in the end business dramatically increasing margins. From there, they run an M&A playbook at venture-scale.

VBO’s sit somewhere between Private Equity and traditional VC. Private Equity backed services businesses add in a “veneer” of tech-enablement. The reality is they are not technology businesses. They are financial engineering to realize margin improvement and proclaim that tech is making a big impact when it’s really not. Early example companies include Metropolis (Parking Lots), Cabana (Pool Cleaning), LedgerUp (Accounting), and Roofer.com (Roofing Home Service Businesses).

#3. The End Company That The SaaS Is Servicing Becomes THE Tech Company

If you’ve been paying attention to the vertical AI wave, you may have noticed that nearly every vertical AI company is doing a lot of “forward-deployed” work. This is no coincidence. AI is inherently performing more aspects of the core work for a business. Every company believes that their specific version of the work is important and differentiated enough and so naturally, they ask for their AI solutions to look more like the work their specific company performs vs. what it looks like in a Platonic state across the industry. And in most cases, the AI companies end up instantiating a mini-revolution inside the companies they work with. After all, every AI company’s revenue is predicated on meaningful transforming the operations of the companies they work with.

Today, it looks a lot like the homebuilding industry.

Companies are increasingly wanting “custom houses” - Vertical SaaS or Vertical AI solutions may be scaffolded for the industry but company A wants an open kitchen concept while company B wants a sauna installed.

Founders today are both architects and builders managing tons of different projects at once.

Both parties see the payoff! The tech today dramatically improves margins and will continue to do so. But the closer it is to a company’s core operations, the more they want to “own” the blueprints and the buildout. After all, they are the ones responsible for delivering their goods or services. They may not have the requisite expertise, but there is a latent desire to look more like a technology company. And what better way to do this in principle than to acquire companies that want to be technology companies and actually make them so?

What Has To Get Figured Out To Unlock The Next Evolution

But this has taken hold quite yet, we believe there are a few key things that MUST get figured out for this next phase to take hold.

The market must price VBO Services Companies above Traditional Services Businesses & PE Backed Services Roll Ups

The primary gap in the number of theoretically possible VBOs is financial. Here’s the big problem:

There is currently no public proof that VBO companies are capable of multiple expansion.

Without this proof, VBOs remain the single most contrarian play in the financing ecosystem today.

Here’s why:

M&A typically works by buying companies, improving their EBITDA, and getting priced at a higher multiple than what you paid for. Rollups work by pursuing the same strategy but instead taking perceived riskier (smaller) assets and combining them into one larger company with more “synergies” across the business. If you successfully run these playbooks, there is a natural multiple expansion. You may acquire a services business at 2x and subsequently sell for 8x EBITDA if you are a sophisticated operator. This sets the market floor for a successful acquisition strategy.

VC firms are split on the strategy.

You may expect VC firms to be taking advantage of the underlying contrarian bets here. And there is certainly a class of investors doing so. However, contrarian bets usually require unlocking capital incrementally. Go prove it out with a small to midsize amount of money and then subsequently prove it out with a larger capital raise.

This is the major problem today.

In our view, to prove out at a VBO strategy requires a minimum of $20-30m dollars at the seed stage. Anything less and you are left without enough funding to prove out the scale of technology improvements on the core operations of the business. Not many founders can raise $20M for their seed-stage business. The key limitation here is actually not R&D. You can certainly prove efficiency gains with your technology. But if you are buying smaller assets, you are most likely going to be concentrated on growing revenue inside the business you buy (and the first move in an AI-enabled company will never be to automate revenue functions). It will suddenly be unclear how much of your growth is related to your technology vs. simply bringing in better operations. This suddenly looks a lot more like PE than VBO and your next capital raise will be priced as such. For this reason, you need to buy a big enough asset to prove out the full EBITDA impact of your technology in a business operating at scale. Only very limited VCs are comfortable underwriting that bet today.

A defined company structure that can support physical asset components w/o the overhang.

For a long time, real estate has had the notion of an opco/propco. Operations company handles the… operations, the propco owns the assets. This is also due to financial markets: certain investors want exposure to the asset-light parts of operations, others want exposure to the actual assets.

I’ll make a bold statement: AI companies probably don’t want asset exposure. If it’s all about multiples, assets will be a drag upon it. This means that in certain industries, company structures may need to get creative and resort to opco/propco structures to capture the full operational improvements from the technology. Or even figure out ways to divest assets at acquisition time. This can be as simple as converting an owner-occupied commercial real estate building into an operating lease, but can quickly grow far more complex.

On the other hand, many VC’s will just say they only invest in Delaware C-Corps without complex structures. That’s the box they are use to. That’s the box that they told their LP’s they were pursuing.

The key lesson? There isn’t a consensus answer on what to do yet.

You will need a strategy you believe in around this if you are doing acquisitions —Luke believes believe it’s probably starting out as a Delaware C-Corp and being open to moving to an Op-Co/Prop-Co down the road.

This will also mean that founders may need to get more creative around “tranching” capital between different investor types. We will plan on sharing more specifics around this in pieces to come.

Funds that are created that understand the above and underwrite accordingly

Lastly, a new crop of funds will need to rise. We see opportunities both in the private credit markets as well as traditional venture ones.

Private credit has exploded over recent years. Most of the private credit today chases asset-based financing or traditional corporate credit. But credit markets overtime inherently will need to specialize to gain yield (this is exactly what is playing out in the real estate market with specialized boutique operators). Once the playbook has been proven out with known multiple expansion from technology, it will make sense for private credit funds to get involved with providing more capital to founders a bit earlier in the lifecycle of the company.

And of course, we need venture firms dedicated to this concept. Ultimately, this is still a non-consensus play in the financial markets. Venture firms here will not only need to provide the capital, but sincerely advocate for their portfolio companies performing this strategy at subsequent capital raises to unlock debt and equity financings.

In Closing…

VBOs remain a significant yet contrarian play awaiting both new financial innovations and founders with the appetite to go in and do the hard work of transforming companies into tech-enabled services.

The upside is increasingly obvious with every passing model improvement and new design pattern.

But so long as the bottleneck remains purely capital related and investors wait to see how AI plays out, the opportunity today remains somewhat limited.

Cremations

Deathcare1 consisting of funeral homes and all the services associated with honoring loved ones whom have passed is now a booming sector for startups.

Today, the funeral industry is an oligopoly run buy companies like Service Corporation International. If you’ve ever had to handle the logistics of a loved one dying, it is one of the most brutal and obviously financially engineered things you can imagine.

The financial engineering is more and more centered around “preneed” (before death) vs. “atneed” (postmortem) sales. Yes, as your loved one is dying but not yet dead it is quite possible that a sales rep will be trying to sell a life insurance policy. As best as I can tell, funeral homes get commission on life insurance policies if you sell the policy prior to someone dying? I have no doubt some cracked private equity group has figured out how to use preneed float to forecast funeral home demand and lever up. The next Buffett might be levering up on preneed insurance policies.

Death isn’t going away, it’s obvious that the industry needs innovation, and there’s a crop of startups whom have noticed the a) expense of death, b) the tremendously bad sales dynamics, c) the opex footprint of traditional funeral services, and d) that nobody has innovated in this space in decades and went ahead and got cranking on solving it.

Meadow Memorials is the example par excellence of this approach. Meadow had a key insight. Cremation solves a lot of the expensive problems in death. Cremation processes can be centralized and they are far cheaper to perform. The last step? Actually help families move from funeral home memorial services and into venues that celebrate their loved ones.

This is my favorite part. Guess which beautiful venues typically have unused space during the week? Turns out not a lot of people get married at 4pm on a Wednesday.

Your wedding venue can also be a celebration of life venue.

And so the pitch is relatively easy for these event venues: join our network and you can make far more money and elevate the celebration of life for families.

And that’s how you go about transforming an overly financially engineered industry into one that is cheaper, modern, and actually honors those who have passed on.

I’ll get on my soapbox for one second: Not a big fan of oxymorons that seek to sanitize the brutal reality of funerals. This is not the fault of startups, it’s the result of the funeral home industry that long preceded them.