The New Value Above Horizontal Replacement

or which vertical AI businesses get better as model capabilities grow?

Hey folks,

Today’s newsletter: Durability in vertical AI.

As the onslaught of vertical AI continues, I think it’s worth exploring where true moats can be found. As revenue figures skyrocket and everyone celebrates hefty ARR milestones in short time periods, I wonder if the durability of some of these businesses is present.

“We care deeply about organic revenue growth, but only if it’s profitable and sustainable. We will not trade profitability for topline.”

— Mark Leonard

I’m not suggesting we have to go full Mark Leonard, but I do want a deeper reason for why certain vertical AI businesses are sustainable beyond “the revenue numbers are high.”

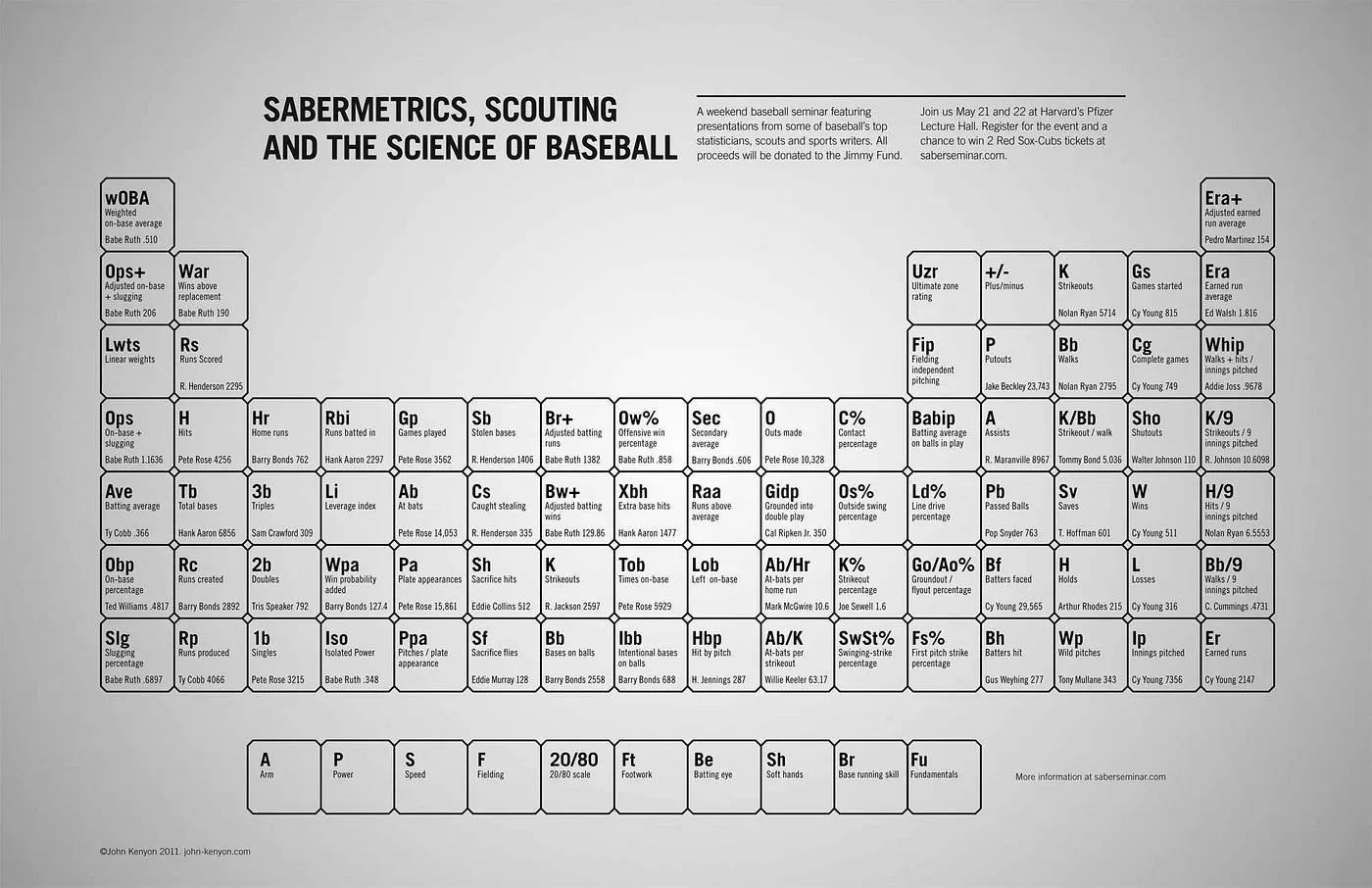

One of the earliest pieces that I wrote used Moneyball as a way to explore the defensibility of vertical software over and against horizontal software.

At the time I wrote that vertical SaaS’s value above horizontal replacement stems from:

The ability to generate second-order insights

The ability to render a [particular] business legible.

I want to revisit that now because these reasons are still true, but the focus here for how vertical AI will succeed are quite different. I take it as a given that vertical AI wins if there is clear value above:

Horizontal agents

Foundation model product offerings

So far, that should be an obvious insight, no?

Identifying where the true value above replacement lies is potentially harder:

What’s defensible?

Many will point to the distribution angle in vertical AI. This is a valid point; you could certainly argue that focused teams that crush on distribution will win even if horizontal products are at feature parity.But the durability here is an open question.

For instance, if you provide a RAG layer across a document set is this durable as models improve and myriad players continue to focus on this horizontally?

If you are solely a voice agent platform, does this endure?

Part of the problem in AI generally now is the widespread gap between what you have to do to coerce a model for work in a particular business setting and then expected capability of a model at some future date. This dichotomy pinpoints the complexity in articulating the long term durability of solutions that are codifying AI workflows and prompts inside of an industry.

The fact that I can argue it both ways maybe underlies the central point:

Defensibility ideally should not be questionable vis a vis horizontal companies. If there is a defensibility question, the long term value above replacement is in question. This does not mean that you can still be outcompeted by a fellow vertical company, but that is an altogether different question.

So, that would seem to mean we should be seeking durability beyond pure model capabilities.

Why did the last wave of vertical market software succeed? It was impossible to rip out of company operations due to system of record dynamics. If we assume that system of record dynamics might be harder to capture for pure vertical AI companies, where then does the moat come from?

Vertical value then must lie in a couple different things where horizontal software can simply not go.

That list in my view looks like the following:

Network effects

Compounding expertise that is not evenly distributed

Services

Industry business model reconfigurations

Let’s pull out some case studies to see what I mean:

Network Effects:

By network effects, we simply mean: the more customers, the more each individual customer benefits. Here AI is being leveraged as a way to unmask discoveries and analysis across an entire industry in order to provide insights that were previously illegible.

Perhaps there’s no greater company to talk about than Loop:

The true value of Loop is not in its financial LLM, albeit this is obviously a core and necessary driver of their success.

The true value lies in the compounding value of financial analysis for every invoice and cost metric in the industry. Every one wants access to this network. Every financial officer wants to know if their costs are out of whack vs. the industry norm.

In essence, signing up for Loop is signing up for a network for analyzing all financial information across the industry.

Compounding expertise that is not evenly distributed

If you’ve got a better way to say this, let me know! Here’s what I mean: because AI can automate drudgery, it unlocks true experts to focus in on the few things that are not commodity. Businesses that help experts focus here and alleviate the drudgery can distribute that expertise and talents in ways that were previously bottlenecked by the unit economics of running these sorts of businesses.

My favorite example here is OffDeal:

How do you enable SMBs to experience Goldman Sachs level investment banking when their business goes up for sale?

Well, you need to compress the unit economics of a transaction - bankers can’t be spending time on the minutia of decks, CIMs, and other things, and then you need to enable the best talent to share in the economics of the deal in order to give them a reason to join your firm.

In other words, the value that OffDeal accrues is in relation to their success at using AI internally to unlock better deal economics, give SMBs better access to expertise in selling their business, and in incentivizing said talent to spend their time with a market that they previously wouldn’t.1

Services:

This one is basic: offer a service to customers that don’t just want to use a platform to manage themselves. EvenUp offers a service and intelligence platform that enables their clients to generate more revenue at lower time expenditures. Demand letters, medical chronologies, and more.

If I’m a busy personal injury lawyer, and I’m confident that EvenUp is continuously incentivized to improve every aspect of their offering by utilizing the latest AI capabilities to make their service better to retain me as a customer, why would I bother managing this myself?

Industry Business Model Reconfigurations:

Lastly, I’ll group this as one category, but there’s an argument that this is nebulous. What I’m really getting at here: have a service so good and so cohesive across the core operations of a business, that companies are willing to contractually make you part of their continued life as a business.

Right now, you could loosely group all the MSO structures in healthcare into this category.

The moats here are contractual. Once you’re part of the MSO, it’s nigh impossible to leave.

And because the moat is the contract, this is the area where I have the most questions. If the vast majority of businesses on your platform are 20-30 year businesses, then this concern goes away. But is this a crucial reason we haven’t seen these businesses scaled outside of health?

Tentatively, Reinforcement Learning:

I want to add one more here that certainly could be a source of compounding value above horizontals: Reinforcement Learning and RL Environments

RL is currently the best method for coercing models into new performance thresholds necessary for certain aspects of industry work.

If RL does not generalize, then compounding value can be found in the companies that own the RL environments and model finetunes for entire industries.

with comp packages reaching millions!

Excellent analysis. Spot on alignment to our GTM ground truth. Thanks