The State of AI-Enabled Rollups

Capital deployment via venture into AI-enabled rollups continues to accelerate. There are real gains being experienced and demonstrable proof of automation.

But let’s not bury the lede, I’m deeply skeptical that to date real advances in end-to-end automation with agents have been created.

These are important productivity advancements that have resulted in time compression. But it remains unclear if these are enough to underwrite true transformative gains vs. begin to rely on more traditional rollup tactics.

So today, let’s explore the dynamics behind the AI-enabled rollups.

Rule of 60

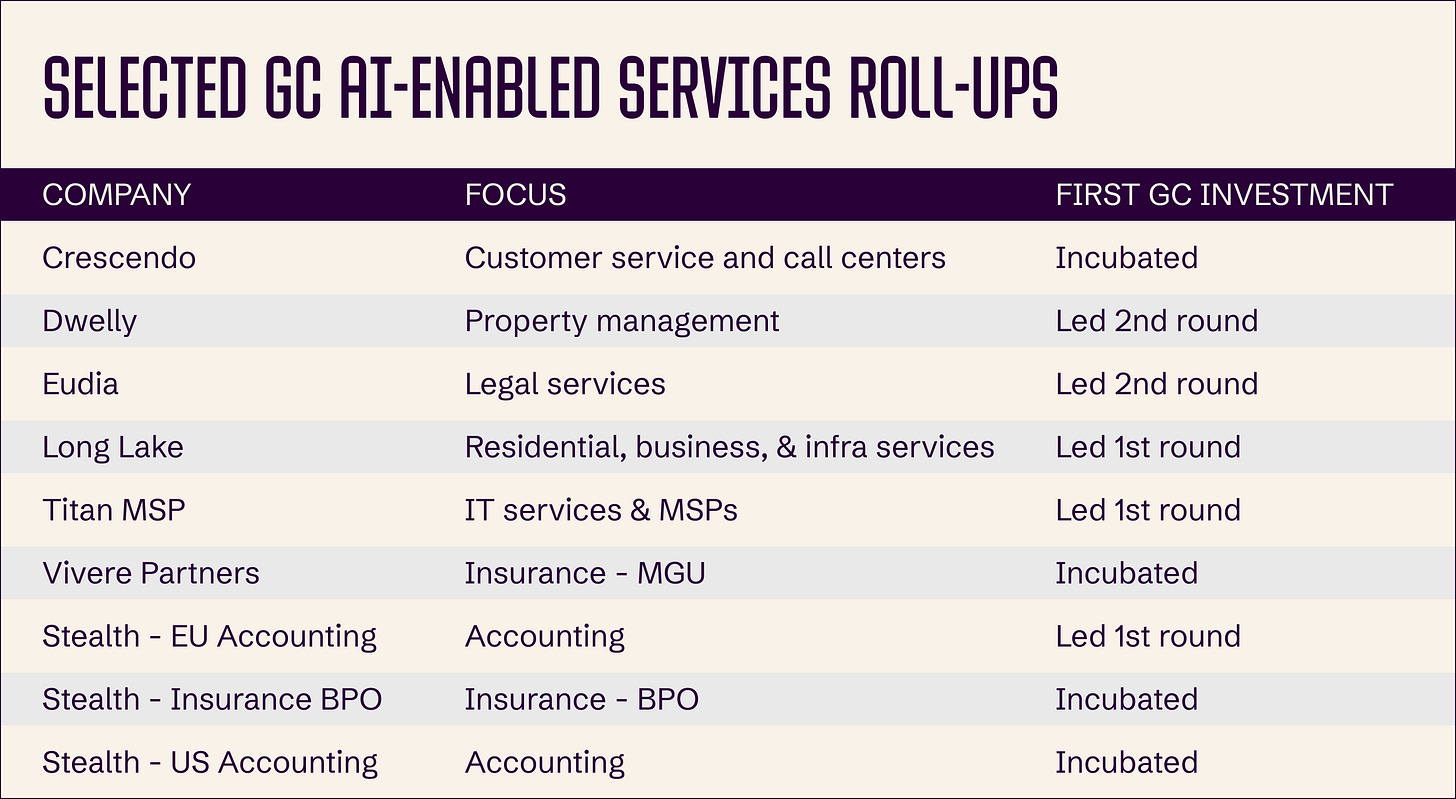

One of the primary backers of AI-enabled rollup initiatives, General Catalyst, defines a new Rule of 60 for AI-driven M&A:

The SaaS industry’s Rule of 40 reflects the inevitable tradeoff between growth and profitability. We believe AI-enabled roll-ups can eliminate this tradeoff, achieving higher combined growth and profitability through efficiency gains that yield software-level margins, immediate inorganic growth from acquisitions, and expanded outcome capabilities that create new markets. The companies we back aim to take businesses growing in single digits to 10-20% growth through a combination of organic capability-led growth and acquisitions. They simultaneously aim to double profit margins, often targeting 30-40% margins. They are setting their sights on a new Rule of 60 standard.

If the Rule of 60 underlies the expected return and therefore the multiples of these businesses, are we on the path with current AI tech to deliver Rule of 60 AI-enabled rollups?

Well to know that, we would want some further clarity on Rule of 60 dynamics:

Is it inclusive of R&D costs?

If not, is there a market expectation that AI technology will somewhat take care of the devops, maintenance, and agentic automation build going forward?

Are we primarily looking at the margins of the individual acquisitions or the parent company?

Inorganic growth and organic growth have different implications for what needs to be accomplished with automation.

The Bull Case

You can imagine the bull case through a toy example like the following:

I buy an asset at 3m in revenue with 15% EBITDA. I buy $450,000 in profits

I subsequently double EBITDA to 30% and grow each business by 20% YoY, obtaining $1.08m in profits in the next year.

I’ve added $630,000 in profits, and will continue to grow bottom line every year.

In this example, I’m not even overly reliant on end-to-end automation.

If my operational costs are fixed, and I increase the throughput of the underlying business via AI and technology, I can keep the same headcount and support that extra 20% growth and achieve 30% EBITDA.1

The bull case on the Rule of 60 is essentially the following: these businesses can grow at 20% and keep the same labor force in place but with enhanced throughput to achieve higher EBITDA.

Theoretically, I could achieve this via inorganic growth as well. Once I have a core labor force, I could imagine utilizing that labor force on new acquisitions and part ways with personnel previously managing the new acquisition.

We will circle back to this, because this is where I think it gets a bit more fraught; especially because of the sensitivity here to acquisition multiples and cost of capital

In short, the Rule of 60 stems from either:

Organic growth with higher throughput of existing workforces

Inorganic growth with the replacement of workforces with a higher efficiency one

So then we have our assumptions and frankly our target sectors for AI-enabled rollups:

Higher throughput must be achievable

Once high throughput is achieved, organic growth or inorganic growth are vastly more important than further labor automation.

Inorganic growth must be based around the core ability to use my higher throughput operations.

Organic growth solves everything

If AI doesn’t substantially impact the throughput or the organic growth profile, I think we are essentially doing private equity.

One more question

I take it as given that gifted engineers and M&A types have been making real throughput gains. AI-assisted code has increased their own velocity. Internal tooling, data, retrieval has reduced the time spent on parsing deals.

But let’s be honest: these people cost a lot. Is Rule of 60 including the added costs of engineering and M&A talent?

Will you be able to keep these organizations lean if you have to serially acquire assets across a vertical? It’s too early to tell, but is an important part of the achievability of the Rule of 60.

Tells here are going to be:

The amortization of the same engineering work across many entities

Compounding savings

Organic growth once again cures a lot. In fact, it’s really the essential quality in making the inorganic growth and engineering components work.

What’s working, what isn’t

If there are tells that an AI-enabled rollup is going well according to Rule of 60, there’s corresponding tells when it isn’t.

If a business is struggling to achieve Rule of 60, we would expect to see:

Labor substitution: If I can’t achieve enhanced throughput via AI, I have to likely obtain cheaper labor to achieve Rule of 60.

Engineering and R&D rising as a percentage of revenue.

Stalling organic growth and increased M&A activity2

If these are the primary levers at work, then the story looks more like a classic private equity rollup, not a Rule of 60 AI platform.

In many cases, they will be able to. But vertical selection is everything.

Long Lake in HOA management (and other verticals) is crushing. They have been able to substantially increase throughput and grow organically via improved HOA operations with AI being a large driver.

Buena in Germany is a clear winner in this model and have been able to centrally manage property management functions via AI.

But other verticals are trickier. For instance, accounting looks far more difficult.

Accounting work is bespoke. It’s difficult to get throughput advances across a number of localized assets. That combination makes it much harder to achieve the “same headcount, more throughput” version of the bull case.

Organic growth is tough.

And so it looks like some form of labor substitution is happening.

But there may still be reasons to do rollups in these verticals.

For one, the inability to automate is at least some form of a moat. If AI timelines elongate, you will still be able to automate on longer timelines without risking the value of the work itself being commoditized to zero.

But then ultimately the question is simply: will AI-enabled rollups look more like really good private equity rollups? Or more like Rule of 60 companies that change a vertical forever?

Of course, game changing AI agents may change the math altogether. But is there evidence that this is happening? I think not.

The real numbers are something like: $2.55m in opex in year 0 pre-acquisition, $2.52m in opex in Y1 post acquisition.

I welcome debate on this one. You can slice this one both ways: fast M&A may be due to underlying technology advantages. It also may be due to stalling technology advantages and organic growth advantages and the need for a growth story.

The distinction between throughput gains versus true end to end automation is critical. HOA management and property managment seem like natural fits because they have repetitve workflows and clearer metrics. Accounting being trickier makes sense given the bespoke nature of each client. I'm curious if the Rule of 60 will hold once we see more data on R&D costs scaling across multiple acquisitions, that feels like it could be the real test of whether these are truely transformative or just well executed PE plays.

Another way to think about this is the "buy then build" vs "build then buy" framework as well. In my opinion, the latter if done correctly should be able to deploy software more effectively across the acquired assets to drive both top-line AND bottom-line, rather than buying first and being tasked with full ownership right away.

One piece that has been stuck to me with some of these roll-ups is the ones going into verticals with large TAMs but structurally slower growth. How do some of these Co's expect to drive HSD growth to Low to Medium DD growth organically? What does higher through-put look like in industries that already have some tech involved but gating factor is human deployment (HVAC, plumbing, etc)?