Veeva and Industry Clouds

Peter Gassner's theory and practice

As with all posts, but especially around companies and sectors that I feel far more amateur in, all errors are mine. If there is something wrong, incomplete, or inadequate, would love to learn and issue a correction.

The market of this stuff comes out of the woodwork. Most of the market is not even categorized because it’s on custom stuff somewhere that nobody is counting. I think people are still far underestimating [it].

- Peter Gassner

Nobody has been more influential on the development of industry clouds than Peter Gassner. He didn’t simply build an industry cloud, he invented the very category. Gassner, of course, is the CEO and founder of Veeva, an industry cloud for the life sciences.

Veeva started with a CRM that could handle the regulatory complexities of the industry. Nobody really thought that was especially valuable or necessary at first. Most were focused on the massive scale horizontal CRMs like Salesforce could obtain.

Peter understood that. After all, he had been studying and working in enterprise software for nearly 30 years and had been at Salesforce. But he was focused on something different and contrarian: the potential for vertically-tailored solutions to transform industries.

And so even though investors thought the market was too small and early industry interviewees were skeptical, Peter was convinced that they were wrong about the value of the product, not him. And so Veeva was born with a tailor-made CRM that was so good it couldn’t be ignored.

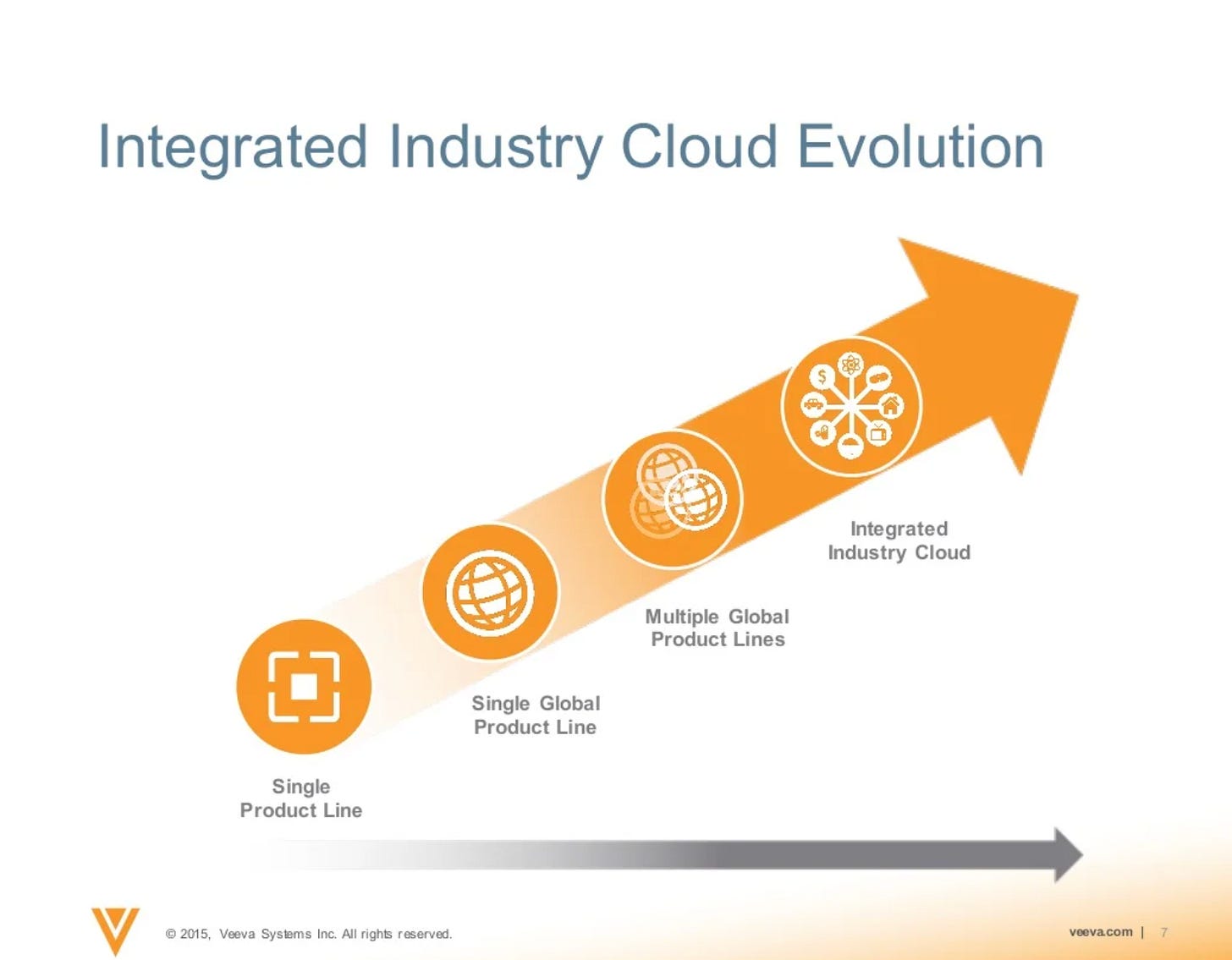

From the beginning, Veeva had a vision to go beyond one software product. In the quest to truly transform the industry, they wanted to build an industry cloud.

15 years later, Veeva has built exactly that with products spanning every aspect of the life sciences industry from aspects of R&D to commercialization.

So what follows is a sometimes sporadic account of Veeva’s path to becoming the industry cloud and the strategies they have sketched for the next generation of industry cloud leaders.

Commercial Products as a Launching Point

First, why did Veeva start with a CRM? Well clearly, there were some familiarity factors. Gassner knew the CRM space and Salesforce was happy to provide infrastructure in exchange for royalties. Luck or not, this worked and gave Veeva a launching point over time into deeper and often messier industry processes. Given that starting with commercialization workflows is common amongst modern industry clouds, it is apparent that this is a feature and not a bug. But why?

Here’s a hunch: somewhat related to last week’s sketch on software and productivity, productivity can show up in two ways. It can accelerate revenue or decrease costs.

The problem with products that decrease costs is that these costs are intangible and hard to tie to one specific process. Take clinical trials, which Veeva now has a full product line for, how do you successfully prove as a startup that your software is responsible for a cost reduction in clinical trials before you've ever proved out that your software can work in other areas?1 It can sound overcooked and slow down industry adoption, if you get in at all.

On the other hand, commercialization software has a direct and provable effect: if your product Is good, it will accelerate revenue and at minimum increase efficiency.

That means it’s usually a more provable outcome and if you prove it, your customers will love talking about it. This was key to Veeva’s capital efficiency: existing customers were often referring Veeva into other companies. And so the flywheel began for the initial product, but that wasn’t the end for Veeva.

Veeva and Industry Cloud Strategy

Building an industry cloud wasn’t a post-hoc realization that Gassner had. It was always the plan.

And Gassner’s outline for industry clouds has not only come true within Veeva’s context, it’s a pattern many self-defined industry clouds aspire to. To build an industry cloud, a company must build a seamless suite of products that span both software and data. And a consequential aspect of industry cloud development is that often you must build a services arm on top.

Software

Great software in the life sciences, especially software that works globally, is dependent upon a) alleviating compliance concerns in all markets and b) proving out the specific value of each product for different departments within these companies.

That last part is important and why building industry clouds is so hard.

Far before you reach having product lines for each business unit and interconnected insights become useful, each product must stand on its own. That often means the synergies aren’t what create the sale. The software must really be that good for each individual unit.

In Veeva’s case, Peter sketched this out from very early on in the company. And with their launch of Vault in 2012, Veeva not only began to enact the full industry cloud vision, but was orienting the products towards it.

Vault is a content repository for all sorts of important documents across all sorts of business units. It’s in some ways better to view it as an infrastructure layer for document management that can be bought either as individual modules for different departments or as a cohesive package. Given it’s infrastructural value, Vault has become the most important product for Veeva in fulfilling the industry cloud vision with the CRM being replatformed within Vault at the end of the Salesforce-Veeva contract in 2025.

With multi-product built into the DNA and basic infrastructure developed for the vision, Veeva has been able to continuously build new products even as core products experienced massive scale.2

Data

As Veeva’s multi-product strategy and industry cloud vision began to gain ground, Veeva has been able to build net-new data products that make industry specific data easier to access (Veeva OpenData) as well as data tooling for users to gain higher-order insights across Veeva’s products.

This is perhaps the biggest area for Veeva to continually innovate in as the data era is relatively new and Veeva’s software products and standalone data products have reached enough cross-functional users to make aggregated insights more valuable.

To that end, 15 years later, Veeva’s data products are currently powerful yet still an important growth lever for the company that they are investing heavily into.

Services

Lastly, since the early days of Veeva, Gassner has prioritized services as one of the key parts of building an industry cloud.

The reason is two-fold. First, it’s incredibly important to ensure software in complex industries is adaptable and useful. Second, industry transformation doesn’t just happen. Veeva isn’t only building out software, they’re building out foundational practices for the life sciences as they enter the cloud.

And while many treat services as a cost of business, at Veeva services are a revenue driver. Gassner has been content to let deals fall through rather than subsidize this portion. Most of this seems to be a result of a belief that people’s time is worth paying for (or else they wouldn’t be employed by Veeva), but there is also an inherent calculus. If an industry cloud is worth paying for (to the tune of tens of millions), then setting it up (and enabling new use cases) properly is valuable as well.

And so services have always been an important bedrock of Veeva’s growth and revenue.

Building an industry cloud in motion

As previously stated, to build an industry cloud, an organization must continually scale their existing products while mounting the feat of continually building new lines.

Thus, the complexity of an organization as it grows is non-linear. As you accelerate, you also have to accelerate the number of products you are simultaneously developing each with 4 year targets and each built for an enterprise context.

Second, given the complexity of organizations you are serving, these products may have very little to do with each other, involve entirely different parts of the organization, yet must be developed with future synergies in mind for future higher-order use cases (often involving aggregated data).

So to build an industry cloud both requires the product vision necessary to make additive bets and the execution arm to manage the complexity as you scale.

Vision matters but execution matters more. That’s the art Veeva has mastered. It’s fun to look back on Peter’s talks in 2015 and note how incredibly well the company has executed upon the industry cloud vision. Everything Peter said has happened.

Industry Clouds and Customers

Every industry cloud faces a dilemma. To become a true partner means your solutions must eventually be priced into the market. Your solutions must not only be the go-to, their use must become the unspoken assumption for every company in the space.

But that reliance also makes industries uncomfortable. After all, if an industry cloud has that sort of ubiquity, it also has leverage. Customers are scared of leverage.

Gassner is well aware of that. And from the early days, he has consistently made note of the potential dilemma and sought to avoid the perception by emphasizing customer relationships and branding Veeva as a partner. (Veeva’s move to becoming a public benefit corporation as a very notable action for Veeva in this regard).

There’s some additional things Veeva does to alleviate this concern. Interestingly, I think paying for services sets the right expectation of the partnership early on. Since Veeva is very clear that they expect to be fairly compensated for the entirety of their company’s time, it also sets the expectation that Veeva is pricing fairly for value provided. They aren’t subsidizing services to hit you with a massive upsell later on.

Second, Veeva sets the expectation that they are twenty year partners to their companies. I don’t know if this shows up in the contract term, but it wouldn’t surprise me given the enormity of these Ks.

And at the end of the day, when your products enable companies within the industry to move faster and more intelligently, concerns about leverage may never come up. You’ve proven you are indeed a partner.

What makes an industry need an industry cloud?3

Lastly, it seems there are certain industry aspects that lend towards a full cloud vision necessitating a similar approach to Veeva. And while what follows may not be an exhaustive account, I do think it’s a good starting point.

Complexity in the goods or services rendered that favor large organizations.

The complexity in the distribution of goods or services can be made more efficient by both software and data.

The industry either through its own eccentricities or through regulation needs specialized data or workflow support at all levels of the business.

The barriers to entry for new industry participants are high (but not insurmountable).

They tend to be global industries rather than localized.

Or alternatively, simply look at the industries doing trillions of dollars of revenue and they most likely exhibit these traits.

There’s plenty of software - even vertical software in complex industries. And most struggle to reach escape velocity into true industry partnership.

This I think points to a common reason industry clouds become singular. Complex markets with niche skills tend to retain talent within the industry. Once your software becomes the standard, not only do individual companies have switching costs, the talent using the software have switching costs that can be avoided by defining common software across the industry.

This isn’t a top-down mandate. Instead, it happens organically over time as talent moves around and it simply makes sense to have less friction in systems.

Some Open Questions:

To end, here are some of the questions I am mulling over this month. Let me know if you have thoughts. Would love to jam.

Can industry clouds be built through mergers?4

What are the new wedge points outside of the GTM function to start industry clouds?

How do industry clouds intersect with fintech? Should/can they?

Cf. Benchling but started with a fascinating model targeting freemium users in academic R&D, expanded into pre-clinical R&D, and are signaling with a recent acquisition that they will ultimately end up driving into the clinical space as well.

Nowadays, Veeva defines its “clouds” in three buckets: Commercial, Data, and Development. Its platforms upon which these clouds are built: Vault (enterprise apps), Link (data apps), and Crossix (patient data). For the sake of brevity (and sanity), I’m going to ignore the nuance here and how cloud solutions map to each platform. But suffice to say, platforms = architecture, clouds = industry segments.

Caveat: This is a work-in-progress that I am still trying to intuit and is probably incomplete.

Maybe. But I’m not convinced. Mega-mergers to form huge industry companies are impressive, but I think it’s usually a shadow industry cloud. These companies often lack the product vision to intuit a full gamut of products and execute. As a result, they aren’t fully able to capture the higher order insights that matter later on nor continually build new products for the industry that are relevant.