Vertical Acquisition Strategies

various approaches to vSaaS platform building

Vertical SaaS companies operate in one of the most fascinating market environments possible.

The name of the game is capital efficient growth to transform entire industries with the best technology possible. That means getting really savvy about product strategy, additional product lines, and platform building.

And so, vSaaS companies often look for strategic acquisitions which allow quicker paths to industry platforms where they can accrue far more value.

Today is a bit of a shorter piece, highlighting some of the different strategic dimensions of vertical acquisitions.

Roll-ups as a way to build initial platforms

Most new vertical companies build out their initial solution from scratch and only pursue strategic acquisitions later on in the company’s lifecycle.

But maybe you as a founder are convinced that the industry has decent point solutions (albeit without much R&D investment) and the real problem is around knitting together a platform vision.

As such, acquiring and rolling up these companies into a single platform might look highly attractive.

If the playbook for most vertical disruptors is to start in a core workflow and expand into a platform, a vertical roll-up looks at leverage points within the existing point solutions where they can quickly add value, and then uses traditional private equity tactics and metrics to fuel the acquisition engine.

For this to work, the platform’s value as a whole must exceed simply summing together the value of independent point solutions.

So teams have to blend a mix of capital discipline around debt implications of potential acquisitions and traditional metrics with great product chops in order to create excess platform value.

Broadlume

Perhaps the best example of this strategy is Broadlume, a purveyor of flooring SaaS.

Starting with an acquisition of Floorforce, a digital marketing tool for flooring companies, the team was able to parlay success at marketing and lead generation for their clients into a suite of acquisitions spanning CRM, ERP, and additional marketing toolkits.

Now armed with the whole gamut of industry workflows, they have consolidated all these solutions are under one roof and brand.

There are of course other things they have done extremely well. For instance, they kept many of the original founders on board, thus acquiring their industry expertise, connections, and credibility - all things that would instead be hard-earned over many years.

The remaining questions are around R&D and how to build a true platform.

Part and parcel of this is product integration where efforts must be made to knit together acquisitions in order to form the second-order insights key to vertical disruption.

The danger is that the product lines are just disjunctive enough that a true platform, where systems are accretive to each other, seamlessly map data, and can provide relevant insights from different workflows isn’t fully possible.

Broadlume’s still in the early days of building out the platform, but you can get a sense of the challenge here, with wholly different auth systems still being required for different solutions.

Right away, you can grok the complexities, Broadlume will have to solve. Wholly different acquisitions means wholly different database structures, different permissioning, and different UIs to sort through.

If we take Rippling to be the ideal for developing architecture (a unification layer) and primitives (the employee graph) that carries across the whole platform, we can get a sense of how challenging this retrofitting in roll-ups can become. More on Rippling and vertical disruption here.

And so Broadlume’s challenges will stem less from establishing brand recognition and product-market fit, and more from modifying the overall platform architecture and integrating the product experience.

How much this matters probably differs by industry, and in Broadlume’s case, is it really important if the website builder is integrated into the ERP? Probably not!

What will be trickier is developing additional product lines while simultaneously building out the sort of platform layer that enables new products to be built cohesively.

Broadlume is incredibly savvy and I’d be super interested to learn more about how they think about this and their platform integration effort post-rollup.

Acquisitions as a way to enter new sub-verticals

Say you are tackling a fairly broad category, like home services and have initially tackled HVAC software. How should you think about growing the company? Can you extend your existing product for other home service providers? Or are you better off developing separate brands for sub-verticals?

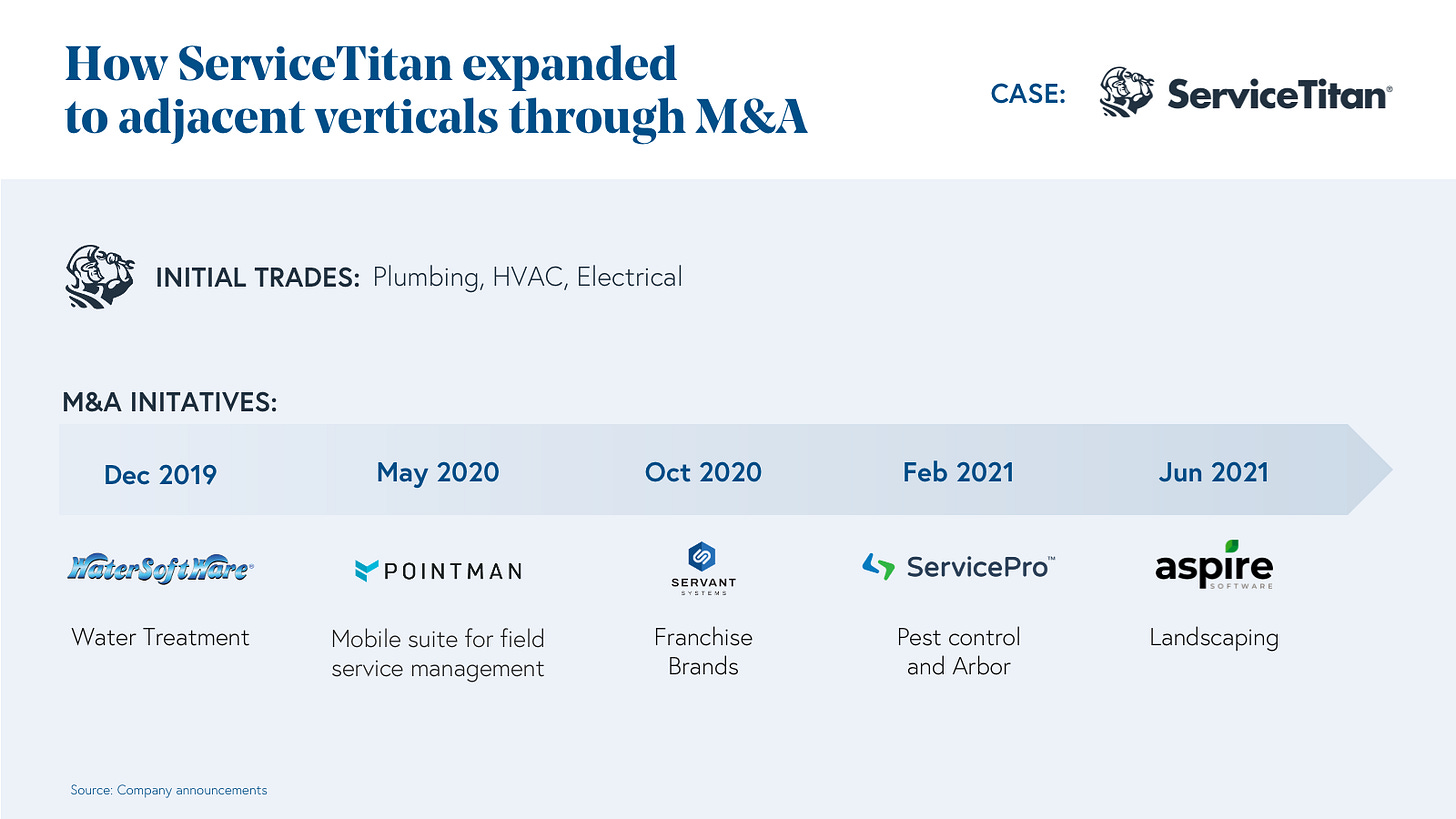

ServiceTitan decided upon the latter and (to use Bessemer’s terminology) “leapfrogged” into other verticals via acquisitions like FieldRoutes (done in Jan. 2022), Aspire, and ServicePro spanning pest control, landscaping, and other home and field services.1

Upon acquisition, ServiceTitan has managed their portfolio as discrete companies with independent branding and marketing. The upshot is that each company gets greater resources to tackle their subvertical, while ServiceTitan gets a known brand quantity and the potential to bundle their Pro Suite of tools into new verticals.

It does require really adept management, especially in turbulent times. Many of the traditional integration issues that acquirers face are magnified as you acquire a whole gamut of products within a short time period.

And if multiples contract during a series of rate hikes, what looked genius 2 years ago can quickly open up the business to value deterioration.

The numbers can start to break down across a portfolio of sub-verticals and a battle for resource allocation can ensue. Teams that have been allowed to run semi-independently suddenly face far more stringent budgets and asks from the parent company.

And so companies that choose to pursue a leap-frogging strategy and rev up the acquisition engine will have a bit more difficult path than in the good times of the past 3 years.

One of the things that really interests me about the opportunity around these sort of vertical “leapfrogs” is the opportunity to centralize certain core workflows while still leveraging the independent brands. ServiceTitan is doing this with their Pro Suite of tools. Others may choose to unite sub-verticals with a common payments gateway.

Acquisitions as a way to fine-tune GTM + Technology

Mature vSaaS business utilize acquisitions as a way to enter produce lines which would require heavy investment without many synergies with previous platform development.

This is why Toast acquired XtraChef about 18 months ago, which has allowed Toast to solve problems at one end of the restaurant business: supplier and ingredient management.

XtraChef has built a lot of technology and data that enables them to surface ingredient pricing and procurement trends. Rather than build that themselves with little existing synergies with the rest of the platform, Toast acquired one of the best in the game.

This in turn has allowed them to fine-tune their technology and GTM with a product highly useful for larger restaurants with complex procurement and in turn have another wedge in.

Likewise, Procore’s acquisition of Construction BI allowed them to fine-tune, their existing technology and bring business analytics onto the Procore platform.

Acquisitions as way to attack different aspects of ecosystems

Lastly, there’s an interesting opportunity for vertical startups to utilize acquisitions as a way to address a wholly different part of their ecosystem.

The core insight here is that the total vertical market (TVM) is far greater than the current TAM of your platform which is limited to a subset of players within the ecosystem. By acquiring a product which directly addresses another aspect of the ecosystem, you can bring your TAM closer to the TVM value.

Mindbody and ClassPass

Mindbody is focused on software for fitness, wellness, and beauty studios. And while gyms and wellness studios would prefer if their customer base only frequented their business, their customers are fickle beings whom prefer optionality in their experience. One month it might be Barry’s, the next it might be spas. And thus ClassPass was born, a subscription pass to all sorts of boutiques and gyms.

ClassPass had tapped into a different aspect of the fitness ecosystem than Mindbody: the demand function. So when MindBody looked to expand their TAM to match the TVM, they acquired ClassPass.

ClassPass has endured its fair share of criticism since its founding - especially from the gyms and studios who felt somewhat commoditized and preferred some guarantees around the stickiness of their customers.

Thus, Mindbody had to stomach industry skepticism that they were still in the operating in the best interest of their main customers: studios and gyms.

You can get a sense of this from perusing the objections that Mindbody feels the need to handle from their core client base here.

But the opportunity to service the demand function of the ecosystem and the opportunity to use ClassPass as a channel for fitness studios to onboard onto Mindbody’s software were too compelling to ignore.

And a year later, ClassPass has onboarded the largest holdout onto the platform: Soul Cycle.

So now Mindbody looks to have cured much of the industry skepticism and has a clear path to serving the whole ecosystem while leveraging the synergies in the businesses to accelerate growth for both.

Filevine

I’ve written about Filevine in the past here. As a refresher, Filevine is perhaps the best case management software for law firms on the market and has parlayed this into addressing more of the total ecosystem.

To do so, they acquired Outlaw, a CLM, which not only gave them an additional product to sell into their existing base but a wedge product into another part of the legal ecosystem: in-house lawyers.

This is a bit of a different acquisition and strategy than Mindbody with ClassPass. CLMs function both as a collaboration layer for in-house and law firms and as a source of truth for legal work product. So by acquiring Outlaw, Filevine entered the collaboration space within the legal ecosystem and could use it as a wedge to tackle the in-house side.

Wrapping It Up

So while acquisitions are not new to the vertical SaaS space, what is new is how ambitious vertical SaaS startups have become. Point solutions are insufficient and every company is grappling with how to successfully build an industry platform.

Acquisitions will continue to be a primary way even as the exact rationales for each company differ.

https://www.bvp.com/atlas/six-product-strategies-to-catalyze-your-second-act#5-Leapfrogging-to-adjacent-verticals