What drives the EA return case?

AI value creation in LBOs

Good morning,

Today’s newsletter: getting more specific around underwriting AI in buyout contexts.

EA gets LBO’d

2 weeks ago, the largest LBO on record took place, resulting in EA being taken private.

$55B purchase price, with $18-20B in debt underwritten by JP Morgan.

Reportedly Silver Lake’s co-CEO, Egon Durban has been a long term admirer of EA’s management team and believed the business was undervalued by the public markets.

Durban said EA was an attractive target because of its “premier sports franchise, with accelerating revenue growth and strong and scaling free cash flow”. He added that Wilson had “doubled revenue . . . and driven a fivefold increase in market cap during his tenure” since becoming chief in 2013.1

And there are certainly intrinsic reasons to believe the business with or without AI can sustain performance

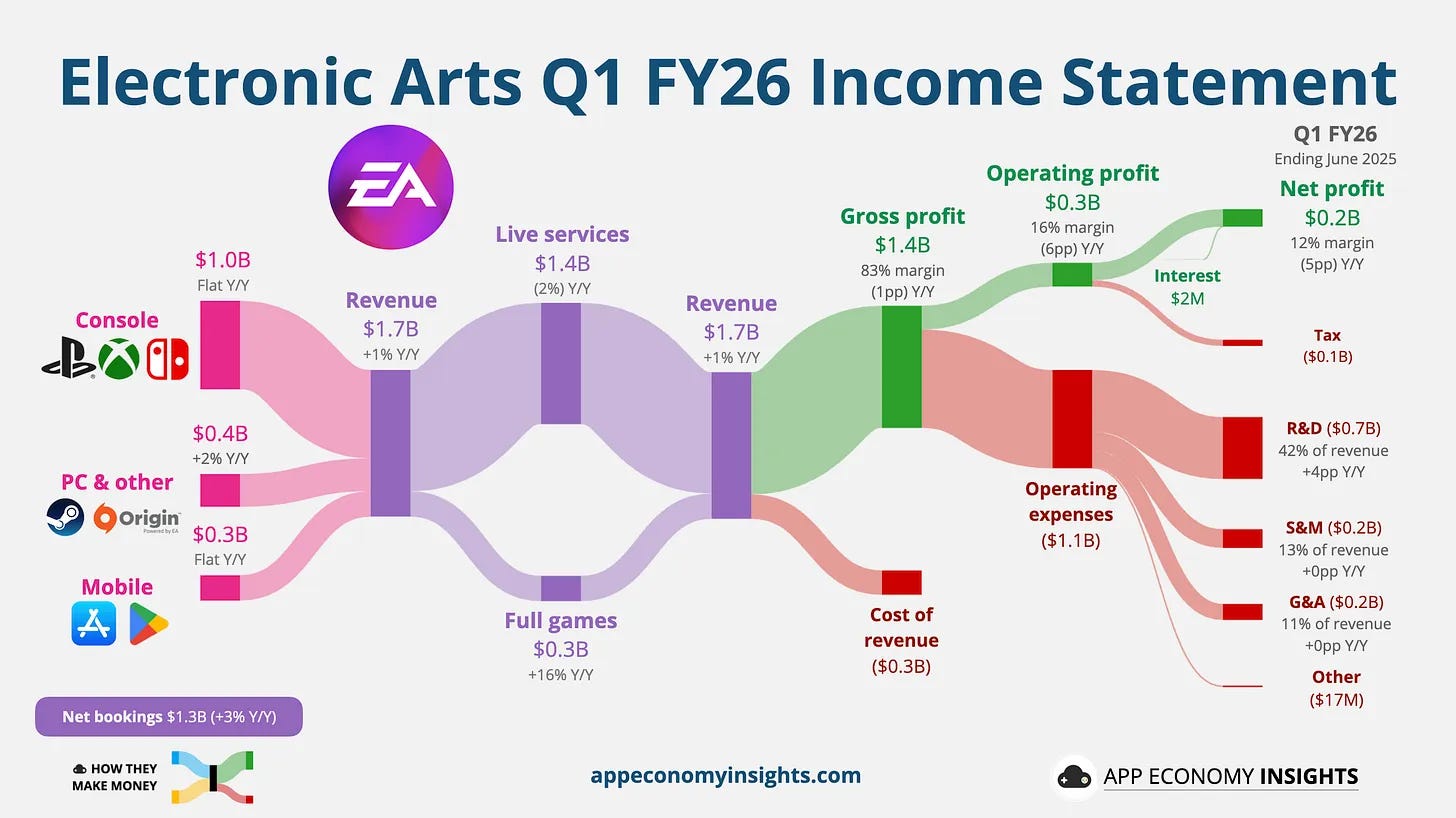

But also reportedly, with the amount of debt being taken out here, the majority of EA’s free cash flow will be going towards debt service.

And while there are certainly other factors you could believe will lead to more free cash flow inside the business, the value creation case in large part must stem from AI.

The investors are betting that AI-based cost cuts will significantly boost EA’s profits in the coming years, people involved in the transaction told the Financial Times.

And so it’s worth considering where exactly the AI boost can come from and what will be required to make it happen. After all, as founders and investors in every market become more interested in inorganic growth and value creation, it’s incredibly important to pinpoint what exactly will lead to higher multiples post-acquisition, revenue growth, and increased profits.

Because the simple truth is this: if AI value creation works, the arms race for equity and private credit financing will speed up in every segment of the economy.

First, lets briefly touch on what underlying principles of the business enable the investment group to feel confident in performing a takeout

The gaming industry is an incredibly difficult place to perform M&A.

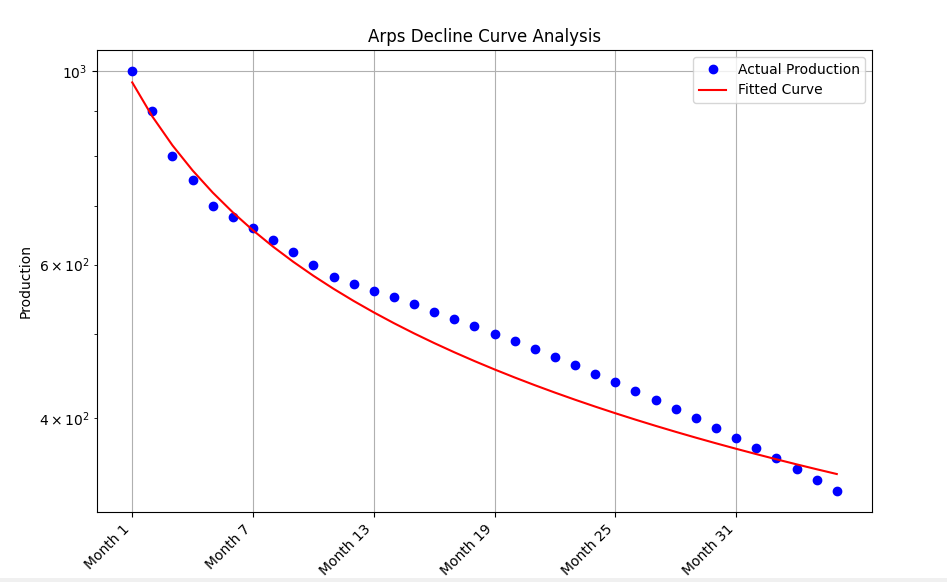

First, most gaming franchises only release new titles every 6-7 years. This in many respects mirrors revenue graphs that look a lot like depreciation curves in oil and gas. Tons of “capex” is required to bring a new “well” or game to life, and then corresponding revenue from that well (or game) dries up over time.

This is why gaming much like oil and gas has consolidated so aggressively. You want many different franchises, management efficiencies, and a ton of different production sites in order to create durable value.

Second, there was a theory that live service games which resemble annual recurring revenue (gamers log in consistently, buy annual battle passes, and show up year over year) would defy these dynamics and result in companies that look more like software revenue metrics. Good in theory, extremely difficult to implement practically.

Sony in particular bet the company on this with a string of acquisitions and new title bets. The majority of these have been failures.

The glut of potential live service models has resulted in the majority of these never recovering their development costs and not being the boon to revenue that investors expected.

So what does work consistently from a shareholder perspective?

Mobile Games:

Mobile games are immensely profitable due to lower development costs, potential install bases in the billions, and because of micro-transaction models.

Take Two, one of the last independent gaming studios trading publicly, reports 52% ($2.94B) of their revenue from mobile with 79% of their total revenue coming from in-game transactions.

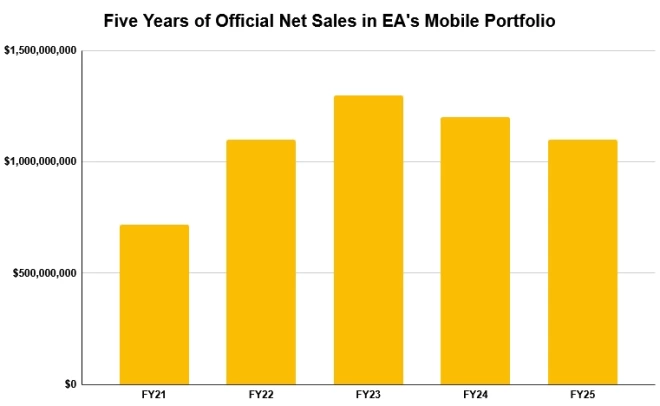

EA’s mobile presence is in comparison far more limited comprising 15% of revenue:2

But what EA does have is arguably the most durable revenue in gaming via sports licenses to almost every major sport globally.

Licensed Properties

The outsized successes in gaming that have proved durable are live-service or pseudo-subscription business models from licensed IP.3

Year after year, gamers show up to buy the latest FC or Madden or College Football game.

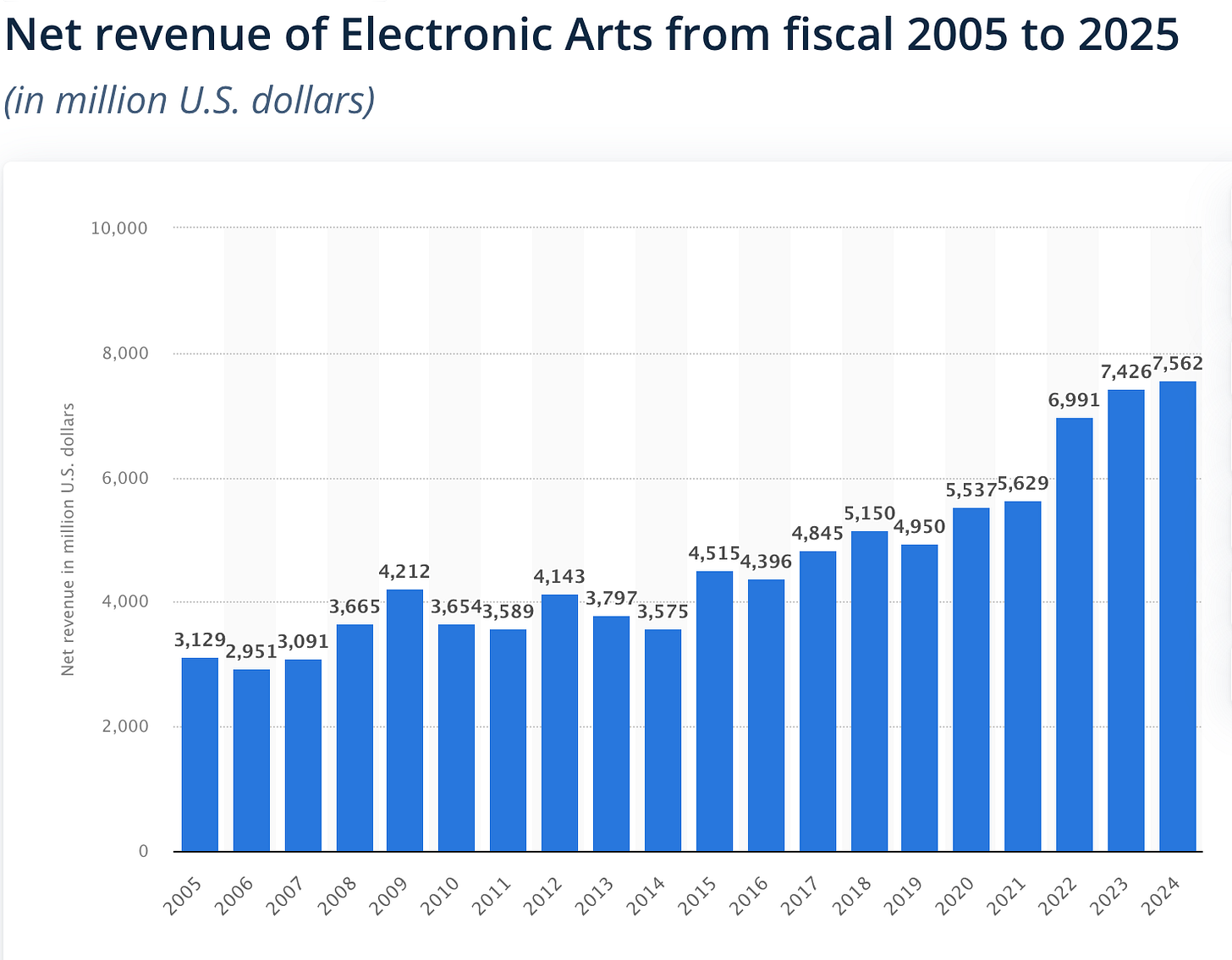

Revenue continues to grow, but more importantly, net income is steady - EA isn’t susceptible to massive swings in R&D costs for their business.

In short, the business model is durable, resistant to gaming’s ills, and through its licensing agreements with every major sport is not as susceptible to revenue and cash flow swings. Add in a stellar management team who has renegotiated these licenses (or walked away in the case of FIFA) as they manage the business, and you have a truly great business that can theoretically get even better via AI.

You’ll also note one other thing: revenue is stable, but not necessarily growing. The sports audience is likely close to tapped out. Growth is going to need to come from other segments whether mobile, new IP, new licensed opportunities, or more.

But with the pending debt servicing, it’s going to be quite tough to develop new IP unless there’s some breakthroughs. So the win condition for EA broadly is going to be contingent on doing more with less. But unlike nearly every other business in gaming, they have the flexibility to innovate here without

So how does that happen?

The AI Case

The simple case:

AI is arguably really great at one thing: coding.

Games are bundles of code.

EA spends roughly ~$2.8B a year on R&D.4

If AI can deliver reduced R&D costs or increased speed in the development cycle, the result should be incredibly lucrative for shareholders.

But there’s one expected problem:

Gaming engines are incredibly complex environments. Off-the-shelf coding agents thus far do not excel in complex codebase environments.

They in particular don’t excel when the gaming engine comprises C++, proprietary scripting languages, and myriad other factors.

There is one advantage that EA has in this regard: they own their engine, Frostbite.

Originally, built for Battlefield, the majority of EA releases are now built on top of Frostbite. If EA can enable faster development around all aspects of Frostbite, they will not only save costs on their current gaming portfolio, but be able to bring new properties to life in reduced dev cycles.

And so all AI initiatives at EA in my view are going to be concentrated on turning Frostbite into an RL environment that enables custom coding agents across asset creation, game development, engine development, and more.

Let’s suppose the cost here per year to train is on the order of $20m-$100m with an expected 30%-40% efficiency gains in their games development pipelines.

Well two things then hold true:

An extra 700 million or so in cash flow gets shaken loose from current R&D budgets. There’s your increased budget for debt service and more.

New IP gets developed in less time or with less budget. Battlefield 6 reportedly has cost over $400m over the last 4 years to develop. It’s been 7 years since the last title release. If new titles can be accelerated, there’s your return to growth.

In short, the success of the EA acquisition is going to primarily come from turning the entire company into an RL feedback loop concentrated around the Frostbite engine.

There are various checkpoints in this endeavor I’d imagine. For instance, microtransactions through selling weapon or player skins is an incredibly lucrative strategy.

Can you create a faster design to implementation cycle using AI throughout the entire process?

And One last thing: Is it any surprise that Kushner is involved fresh off announcing a round for his AI implementation company, Brain Co?

Things to monitor

So the list of questions, AI companies should be monitoring:

How much does it cost to actually convert Frostbite into an RL environment and bring coding agents to market?

Does this work or are there other factors that create bottlenecks that are not reducible to AI?

If this works (and for the record, my bet is that it will), does AI here solely impact profits or does it allow EA to reaccelerate growth in a much more capital efficient manner?

I’m eager to watch this play out as to a large degree, the initial wave of these transactions will underwrite the entire AI inorganic playbooks that are beginning to develop over the next 20 years.

Graph and numbers via PocketGamer

It’s not worth diving in fully here, but cross reference NetEase and Epic Games w/ Fortnite for more here.

Obviously it’s naive to think this is all coding. It’s not and that’s beside the point.

Great piece, Eli!

One more value creation lever: durability of that R&D.

The other interesting opportunity is using agents to make titles more dynamic and keep the content fresh for Players… this increases the longevity/durability of the title as an asset!

When DeepMind pulled out of Edmonton, many of the great RL engineers that were working with Sutton started a new company based on this. Really wonderful people working on a cool vision:

https://www.artificial.agency/