Freight Payments and 340B Programs

capital on paper

Good morning,

Today’s newsletter:

Freight Payment rollups and 340B programs in healthcare. Let’s dive in.

Loop Payments

Friend of Verticalized, Matt McKinney dropped some big news a few weeks ago, Loop Payments is merging with Data2Logistics to continue automating the freight cost management supply chain. You can read more here.

The result was DUX, the first large language model designed specifically for the supply chain, capable of mapping and reconciling data across all formats with remarkable accuracy.

“An invoice is capital on paper,” McKinney explains in an interview with FreightWaves. “If you take the friction out of the transaction, you’re unlocking that capital. That means faster payment cycles, fewer drivers forced to factor invoices, and a real reduction in both the time cost of capital and the human cost of processing.”

M&A with AI founders is quickly becoming a highly lucrative strategy. In Loop’s case, they now get 200+ freight professionals, hundreds of customers spanning the enterprise and mid-market, and a great dataset to continue to finetune and train models with.

As these technology + service M&A plays become more popular, they’re not going to be directly measured on one dimension. In short, here you’re acquiring deep operational expertise, 30+ years of freight data, and customers.

What I love is the team’s continued focus on the invoice itself as a capital facilitating instrument. That’s valuable pitch and plays nicely into our next topic.

340B Programs are likely an area for healthcare software/AI innovation

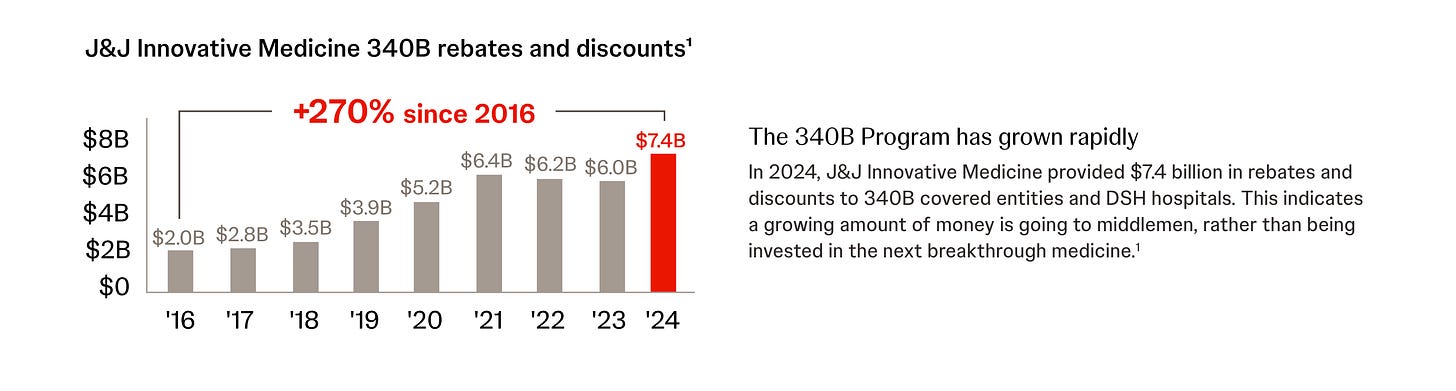

Speaking of healthcare, the Congressional Budget Office recently released an in depth report outlining the 340B program. Those numbers likely mean nothing to you, here’s the short of it:

340B is effectively a rebate program where hospitals and patients that meet certain conditions are eligible for lower priced drugs from manufacturers that are then rebated at near market rate by insurance companies.

This is now a large and growing source of revenue for hospital systems who are a market maker of sorts between patients who may be eligible for 340B drugs, the federal government (whom steps in to ensure all parties are made whole during this exchange), insurers, and manufacturers.

I’ll quote the report here:

Because 340B facilities generate net revenue when they dispense drugs purchased through the program, those facilities have an incentive to prescribe more drugs and to shift prescriptions to drugs for which the difference between the insurance rate and the 340B discounted price is large.

And as the report lays out, while there’s only been 4% growth YoY in the overall prescriptions market, the 340B program has grown about 19% YoY. Meaning, we have somewhat clear evidence that prescriptions and patients are being shifted into these programs.

Or we can simply graph it and see how big these programs have become:

One other thing: there is no legal prescription in the program determining how hospitals use this revenue.1 What does this mean? Well from the perspective of drug manufacturers, 340B directly takes money out of R&D funds for next-gen drug programs. From the perspective of hospitals? This is a high-margin pool of revenue with no strings attached. From the perspective of patients? It’s unclear to me if patient outcomes and costs are improved.

Managing a 340B program is best left for another day. But Loop’s notion that invoices are capital on paper ring true here. The regulatory management, reporting, and money movement here are all complex enough that certainly a new crop of TPAs and audit firms could be born to help various parts of the value chain make sense of these programs. And even with the US government trying to make sense of possible reforms that ease the frustration amongst stakeholders, these programs continue to grow, leading to plenty of opportunities for AI enabled solutions in all parts of this market to help facilitate the billions of dollars moving between parties.

It is… let’s say tenuous at best… if this is leading to lower patient drug costs.

Really interesting take on invoices as “capital on paper.” The way frictionless payments can unlock working capital - whether in freight or complex programs like 340B, highlights the value of tracking and optimizing cash flow. Platforms like TCLM provide insights and analysis that can help businesses make sense of these kinds of capital movements and identify opportunities to accelerate cycles.

(It’s free)- https://tradecredit.substack.com/subscribe