Putting for Par

all about golf SaaS

Hey folks!

One of the foundational principles of Verticalized has been that competition is a good thing. The true test of a vFounder is often how you are able to attack the problem in your space and go after competitors in your vertical. It’s not something to fear but instead an opportunity for the best founders to enter strategically and conquer.

And then last week, I wrote about Constellation. Constellation is well-aware of some of the negatives of competition. And for that reason, they are somewhat fearful of what increased competition could mean for vSaaS companies. Specifically, Mark Leonard and the crew are worried that vertical software will become commodified.

As more money pours into niche verticals, the concern goes that vSaaS pricing power will dissipate and the whole sector becomes low-margin. I think it’s wrong and one of the goals today is to show why Leonard’s concern is overstated.

In the past, I’ve written about judging VAHR in vSaaS: The value a vertical company provides above its horizontal replacement. But in many verticals, you will not only face horizontal competitors hoping to eat away at workflows, you will also face legacy solutions with deep moats.

So today is more about judging a new vertical solution against its predecessors. And to do so, we are chopping it up on the 18th. Today is all about golf vSaaS (club management software).

To build an incredible vSaaS company, you need a killer product strategy and a killer GTM strategy that allow you to resist commodification in the space and ensure you never let pricing against your competitors be the ultimate distinguishing factor. Whoosh is a great example of what that looks like in an early stage vSaaS company.

The Golf Boom

Golf is booming. Just in the US alone, 3.2 million new golfers hit clubs in 2021 with around 25.1 million people total playing on courses that year.1 Another 12.4 million hit clubs at driving ranges, simulators, and Top Golf.

The number of golfers is accelerating and most importantly a younger demographic is starting to try to hit par.

You can probably tie a lot of the modern golf explosion to three different factors.

First, when Covid was in full swing, golf was a great way to hang out while still practicing social distancing. In fact, it was the only way! And so that’s how my buddies and I spent time: driving to different golf courses around LA and slicing drives.

Second, golf has a lot of really interesting personalities, both professional and amateur.

Tiger winning the Masters in 2019 was really good for the sport. Content creators like Good Good Golf, Bob Does Sports, and Foreplay are getting millions of views. And then you have Bryson and Brooks raking up controversy (and media attention).

All of this is changing how people interact with golf and view the sport. It’s more social, more digital, and younger.

And lastly, there are tons of dollars going into golf as an industry. For the first time, we have a challenger to the PGA Tour in LIV Golf. For the individual golfer, you can get dripped out in fashionable golf outfits from Malbon and get all your golf balls fully customized in pink from Vice Golf.

The point is that golf has pretty rapidly changed as an industry from what some might call stodgy to a culture that feels more modern.

There’s a big problem though.

The Club Experience

As every golfer knows, the local public club experience can be quite hit or miss. Lots can go wrong on 18 holes. And not just for your own game. Even if you are a scratch golfer, your fellow golfers on the course are usually not. The result is that pace of play can slow dramatically, leading to long outings on the course and backed up holes.

It’s no surprise then that private clubs are experiencing membership growth as people try to escape the public courses. And club dues aren’t cheap. So even if pace of play is faster, members are also expecting great service to justify the fees.

Private clubs provide that level of service, but they often do it in a reactionary way. What I mean is that clubs lack the software or real time data to make decisions that allow them to be predictive around the member experience, the course, or staffing. Decisions are usually either reactionary (a marshal is sent out to improve pace of play far too late) or by chance (a cart girl brings by some drinks at random times).

The result is a wide range of inefficiencies that both cap revenue upside and take away from the member experience.

Luckily, great software is coming to fix this.

The Golf SaaS Landscape

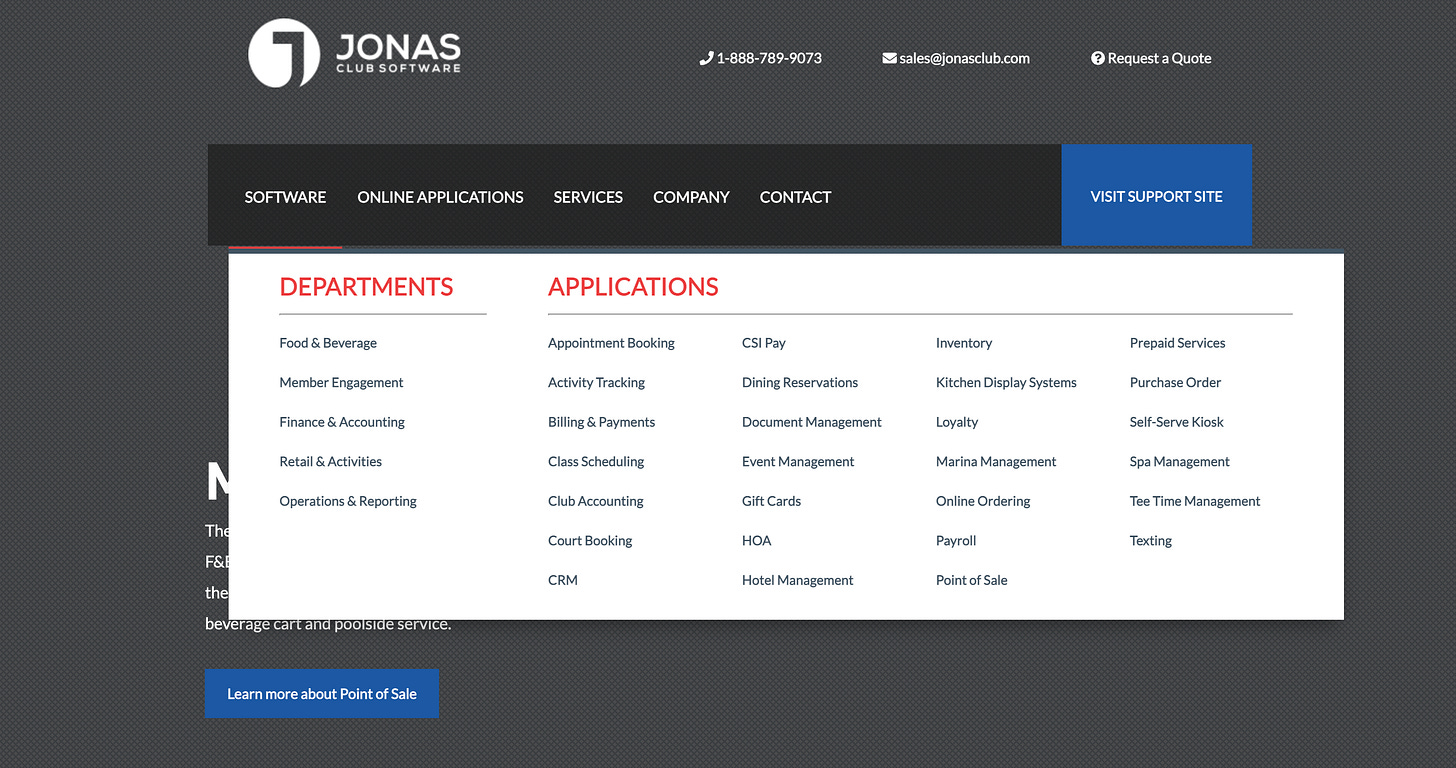

As we talked about last week, Constellation loves niche vSaaS and here it is no different. They have backed their horse for years: Jonas Club. If you see a club running computers from 2005, I guarantee this is what they are running. Jonas Club has adhered pretty closely to Mark Leonard’s vision: find vSaaS companies that are really hard to disrupt and basically don’t spend too much time innovating. Jonas Club has done just that. And even though the software is quite bad, Jonas Club touches every aspect of club management.

It’s not a great solution. The UI is truly terrible, and it feels incredibly dated.2

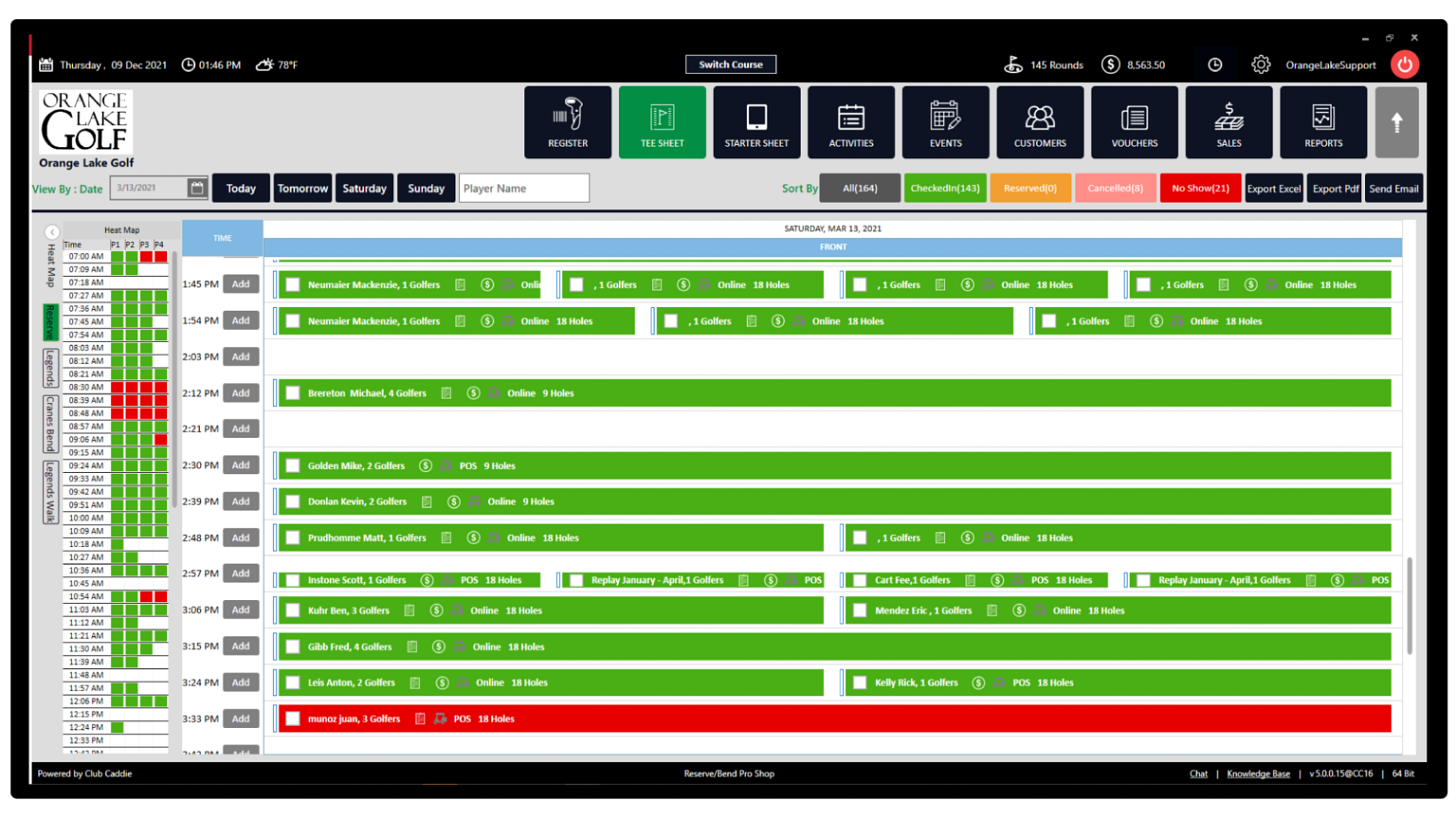

To shore up its weaknesses, Constellation also bought Club Caddie in 2020 which is specifically focused on golf course management. It’s a definite upgrade to Jonas Club. It’s cloud-based, has a mobile app, and offers a full suite of club management workflows.

There’s a smattering of other club management solutions, with probably the most notable being Clubessential. Clubessential with Silver Lake backing has their own golf specific solution in foreUp.

Right away, you can kinda grok the workflows that matter for a club. Any SaaS product that will reach scale will probably need a way to support all these workflows. It’s also where the platform itself will accrue all the second-order insights that make the solution highly valuable.

But you can also start to get a sense of where incumbents and investors sense opportunity: golf management.

Everyone views golf management as an unsolved problem and as an opportunity for product expansion. Clubessential with foreUp, Jonas with Club Caddie. Jonas and Clubessential certainly have a distributional advantage by selling into their existing clubs.

So why then bet on an outsider? Or maybe a related question: if you were an outsider, how would you start to crack club management?

Well, I think you would do what Whoosh is doing in the space.

Whoosh, there it is.

Whoosh is a Series A vSaaS focused on golf operations. Their core insight isn’t actually super unique to them. Everyone knows that golf operations are highly inefficient and software should be used to solve the problem.

The problem is that getting clubs to adopt technology to fix this is still quite tough.

And that’s what Whoosh figured out. Whoosh bet the entire company on creating the best mobile experience possible. In this respect, their product strategy is very similar to Procore. Procore realized that part of the reason contractors hadn’t adopted software was because nobody wanted to haul a laptop to the jobsite or wait to plug data in at the office afterwards.

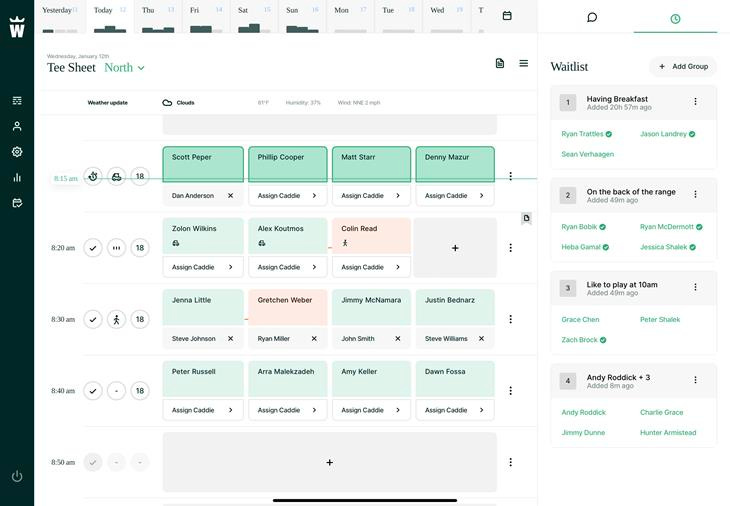

The same thing is true about golf. Caddies, marshals, and staff are out on the course. Unless they can communicate, track, and input data in real time, software has no shot at solving the inefficiencies. What has been needed is a highly usable and truly mobile-first solution. Whoosh cracked this.

Whoosh works by solving one highly critical workflow: tee sheet management. Tee sheets are highly specific to golf. It’s not a mere reservation system although of course it tracks when members are set to play. But it’s far more. It’s really the foundation of the member experience on the course.

And that’s how Whoosh views itself. It’s designed to solves all of the inefficiencies that exist today in course administration. A lot of this is simply about real time availability of data and communication.

Staff can easily monitor course progress, send real-time updates, and easily see how the tee sheet is looking for the day.

But what makes Whoosh great isn't simply the reduced operational burden. What makes Whoosh great is that by bringing all this data into the cloud, Whoosh is far more of a CRM that contains all the interactions a member has with a golf course.

Earlier I mentioned that clubs are reactionary. Whoosh allows clubs to be far more predictive. Since staff can communicate in real time, caddies can communicate a food order to the club house, pace of play issues can be corrected before they compound, and members can be delighted by their favorite beverage being delivered to them right as they run out of their previous drink.

All of this then enables the club not only to rectify inefficiencies and improve revenue by predicting things like staffing needs more accurately, it also allows them to drive top line revenue. Golfer spend goes up as their wants are more accurately predicted. Caddies will especially love this as they start to get bigger tips.

And then lastly, Whoosh has done an incredible job at developing software that looks good. It’s well designed. A lot of the current club management software is full of bad color palettes, weird UI choices, and high friction steps.

Whoosh avoids all of that. Tell me which one looks better:

So the move to predictive vs. reactionary workflows, mobile-first, and better design are all reasons why Whoosh is a great product. But I think there’s another reason why Whoosh is set up so well for success. Whoosh built their product with a really clever GTM strategy in mind.

Golf GTM

At the outset, if you are going to build club management software, you face a pretty unique challenge. A lot of startups enter their market by going after new companies in the sector and convincing them to pioneer new software over legacy solutions.

The big problem with golf is that there aren’t a lot of new courses being built. There’s about 15 new ones a year. It’s pretty insignificant. So that route doesn’t really work. And even if your software is better, it’s really hard to convince a stodgy industry that they should rip out their existing technology and bet on a startup. Not impossible, but unlikely.

This is also why strategically Whoosh went after golf operations. Since the existing solutions aren’t great at golf operations anyways, Whoosh has been able to avoid direct confrontations with club software. Instead from what I can tell, clubs have even asked Whoosh to build integrations for better data sharing between the club management systems and Whoosh. After all, currently all of the billing and payments for tee times happens in the existing systems. But more on that later.

This strategy is really powerful. It has allowed Whoosh to not only go into clubs that are not ready to rip out their CMS, but it also allows Whoosh to build in some sense a unified CRM of members regardless of what CMS system is used in the background.

All of this data is crucial to build a club management system in the future at a highly reduced implementation cost to their customers. After all, a lot of the pain involved in implementation is around data migration. Whoosh is already migrating the data into their systems. And since Whoosh is getting all of this data early, it also allows them to make really strategic bets on how to grow the product.

Product Expansion

So far, Whoosh has decided to expand into other reservation systems for clubs. On the golf side, they also have products for simulator bookings and have more recently launched racquet reservation software.

This strikes me as a pretty solid bet. After all, pickleball is exploding. Not only can you sell into more clubs that may not be ready to transform their golf operations, but you can also start to sell into pickleball specific venues.

All of this allows Whoosh to then grow what really is their most valuable product right now, their CRM, across multiple club sport domains. You can easily start to see how Whoosh plans to interact with every member of a club, build software that heightens their experience, and then use this CRM to go into other key workflows.

So where does Whoosh go from here?

Key Decisions

Whoosh has a strategic choice to make again at the intersection of product strategy and GTM strategy.

At the end of the day, the ambition has to be to become a full-stack club management software. So at some point, Whoosh will have to begin to expand into other workflows that put them in far more competition with the existing solutions. Any workflow that Whoosh expands into will of course begin to heighten the competition but others will do it far faster than others.

The most contentious and lucrative from here is around payments and billing.

Payments

Every single club management system is providing payment capabilities to its clubs. Members pay dues, receive billings for course play and dining, and clubs will even get paid for tournaments all through their club management system.

This is highly lucrative as we are talking about around 25B dollars in spend at clubs a year. And that number will probably go up.

Club management systems really don’t want to lose this business. If you come after their payments, you probably start to experience more heat. At the same time, Whoosh’s competitors are already using the fact that Whoosh doesn’t have built in payments and billing against them.

I especially like the below marketing from Club Caddie.

So regardless Whoosh has to expand into payments at some point in order to accrue the full platform value and fend off the attack from Club Caddie but it’s an open question in my mind on whether the time is now.

There are of course other workflows that could be built to leverage the CRM data to provide value to clubs through better email marketing, etc. I think Whoosh could just look at how Toast built a lot of the CRM product and begin to unlock some of that. It’s a strategic question as to what unlocks product value, second order insights, and doesn’t blow up the current GTM strategy.

My hunch however is that Whoosh is going to go after payments fairly quickly. They recently brought in some product folks with fintech backgrounds which should act as a pretty clear signal as to what’s coming.

It also makes sense simply because of how many sports Whoosh is quickly expanding into. Some of these racquet venues will be far more willing to adopt an integrated payments solution and thus it makes sense to start building it.

Once Whoosh starts interacting with payments, I think it starts a race. Whoosh can’t dilly dally. Once you come after the payments flow, you have to build quickly and start to make the case for wholly replacing large swaths of club management systems.

So what other workflows should Whoosh be looking to capture?

Future Workflows

Some of the more immediate ones probably involve other areas of hassle for golf and racquet operations. For instance, a module for tournaments would probably integrate nicely into the existing solution, leverage existing data and workflows, and become highly valuable to clubs who often face administrative headaches.

Once Whoosh starts to interact with the payments flow, they probably have to make a strategic decision around how to think about concessions and inventory management. One of the benefits of the current crop of club management systems is that their point of sale integrates across the entire club and across dining. If Whoosh builds out payments, clubs will probably expect the same.

A bifurcated flow between golf and the rest of the club won’t make much sense over time. And so Whoosh will have to figure out how to relate to these other club functions. Do you integrate into a concessions management tool and effectively white label it with your own point of sale solution? Do you build it in house? There are a lot of interesting questions presented.

There are also other more back office workflows that Whoosh may enter into first. For instance, It probably makes a ton of sense to handle golf staff payroll with an embedded solution like Check. In this direction, Whoosh can begin interacting with the back office more and more, parlay this data into a workforce management and accounting tool, and begin to interact with more key stakeholders across the rest of the club.

And finally, I think Whoosh has huge opportunities around business intelligence workflows. One of the interesting things about some of Whoosh’s competitors is that they heavily market BI solutions for clubs. But when you start to poke around what they are talking about, you quickly find out that the platforms still are pretty bad at assembling the relevant data for BI analysis. Whoosh has both the best visuals and the best shot at assembling the relevant data for predictive analysis.

It’s not a stretch to imagine Whoosh expanding into a BI type tool that gives far more visual tooling around trends at the course and integrating that into a workforce management product to really drive home cost reductions.

Lastly, there’s a decent chance Whoosh can spin out a business unit focused more upon the golfer. If Whoosh is successful, you can imagine a future where every club wants to run Whoosh and Whoosh’s CRM knows a lot about individual golfers. It’s not out of the question that Whoosh could build the best golf tracker for consumers out there. At the very least, Whoosh could also start to think about entering public course management as well and solve the bane of my existence: EZLinks.3 Fix public tee reservations by building both the consumer facing marketplace and the backend tee reservation system and you can develop a touchpoint for all of golf.

I don’t even know that it makes sense for Whoosh to do this, but I think it illustrates what’s possible by simply building the best tee sheet and reservation software out there.

All of these are reasons Whoosh wins. I think it will happen and I applaud those who have been involved in the Whoosh story.

But from here, I think it’s really important to go back to what is especially instructive about Whoosh and new vSaaS solutions in general. Importantly, I haven’t mentioned pricing. It’s because none of this analysis hinges upon Whoosh being cheaper than existing solutions.

Resist Commodification

The goal of vSaaS should never be to simply build software cheaper than the existing solutions. Sure that might be a result of moving processes to the cloud, but even then, Whoosh in its end state is worth a premium over the existing solutions.

It’s also why Leonard is wrong. Really good software resists commodification. Whoosh does it with the trifecta of design, mobile-first, and predictive workflows.

And so there’s a really important question to ask for determining the value of a new vertical product over an existing one: Would a customer be willing to displace their existing software solution for this one even if it cost more?

If the answer is yes, you have a great product that resists commodification altogether.

Because the truth is, software will never be a race to the bottom, so long as your software is really damn good. And it certainly won’t be a race to the bottom if you distinguish upon the software value instead of pricing.

And that’s the goal. Build incredible vSaaS businesses that reduce commodification due to their care for workflows and design, their strategic entry points, and their end state as a source of truth for their industry.

Whoosh is really early, but I think the company is on its way. Kudos to a great team bringing modern infrastructure to clubs.

See you on the 18th.

https://www.golfmonthly.com/news/how-many-golfers-are-there-in-the-united-states

Someone at Whoosh needs to get Arcis Golf to switch over. I can’t do EZLinks anymore for tee reservations.

"I think Whoosh could just look at how Toast built a lot of the CRM product and begin to unlock some of that."

Hi Eli! Great post... I was wondering if you could unpack the above quote a little bit more?