Should you securitize the trading card industry + Information Blocking Laws

Today’s newsletter: trading card AUM plays, Cures Act, and Mark Leonard

Trading Cards

The economy is in a transitional state where the best place to make money is either in AI, sports betting, healthcare, or in buying Labubus and Pokemon cards.

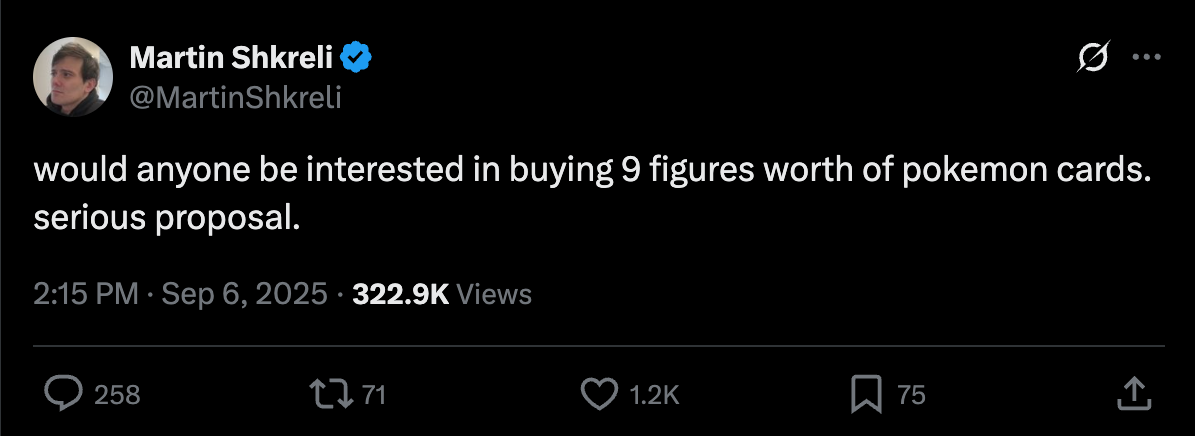

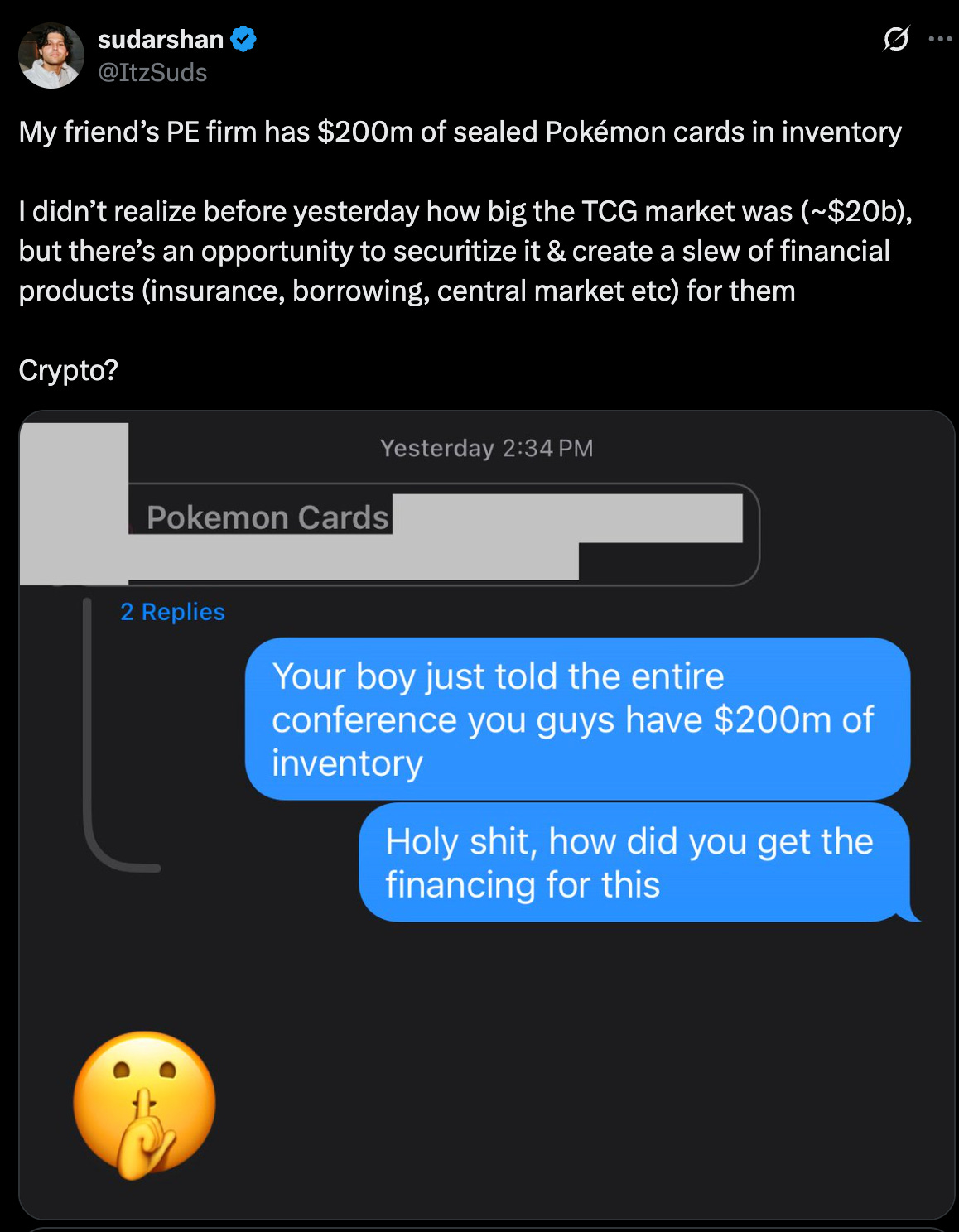

The first two seem far less fun day to day than Pokemon cards and so we are starting to get asks from Shkreli if there’s anyone that wants to buy $200m of Pokemon cards.

But this isn’t pure ironic tweeting, the hobby markets are at least theoretically becoming an investment case.

We’ve already spent some time looking into the industry, mainly the card shop side. But there’s a case being made for how to transition trading cards and hobbyist markets generally from a pure hobby into one that Wall Street could do an asset-based finance play on in order to put a portion of the trillions in private credit to work.1 After all, what teacher’s pension fund doesn’t want exposure to Gen 1 Charizards?

And if your main reaction is “this is the stupidest thing, I’ve ever heard,” that’s mostly my reaction as well. But others are starting to classify the potential in the trading card market as something halfway between sports gambling or investing.

And in that sense, this industry is starting to mirror the same consumer trends driving Polymarket, Draftkings, Robinhood, and more.

Or you can forget the trends and simply bet that it’s likely to be attempted because the market is worth $24B today and could go up to $50B by 2030.

The logic goes like this:

High level:

There’s likely about $20B in Pokemon cards in value. We can quantify this fairly well. The industry has robust and pseudo-liquid markets, professional graders like PSA (which is an incredible business) for assessing individual card quality, and lastly consumer appetite just keeps growing for hobbyist assets whether its Pokemon cards or Labubus.

My guess is the PE funds thinking about this (and likely some founders) are grouping the opportunity into a couple different categories:

The AUM play

This one is simple enough. This likely looks a lot like wine investing: capture inventory that looks likely to appreciate, charge AUM fees, and keep your operating costs incredibly low.

In fact, that same strategy has been done on the wine investing side by Vinovest.

The benefit here vis a vis wine investing is that storing Pokemon cards and hobbyist assets is not as challenging. Any secure warehouse could do. Buy cards, grade cards, store cards. And because again, the consumer markets are frothing for speculative assets, it’s not hard to imagine the opportunity in a single tech AUM play being far larger than the wine investing market.

If we just use Vinovest numbers as indicative, could you get AUM to roughly 3.5B to have a $100m annual management fee? And could you do that on less than 50 headcount internally? It doesn’t sound too far-fetched in my book from this perspective.

Trading Platforms:

This is where things start to get really wonky in my view:

If there are firms performing AUM plays and consumer appetites continue to grow, then likely appetite for financially trading hobbyist assets is going to grow. Right now, if you’re going to trade Pokemon cards, you have to take physical receipt of the card itself. And so markets like Ebay, local card shops and more act as trading platforms. But if Pokemon cards becomes more about owning the card vs. having physical ownership at all times, could you see trading platforms for hobbyist goods come about that just issue you a certification of ownership, maintain storage of the card, and settle transactions? Heck, maybe they’ll even let you loan your card out for other traders to speculate on the price…

After all, is there that much of a difference between trading NFTs and Pokemon cards from an SEC perspective?

As one of the tweets mentions, this naturally opens up opportunities for all sorts of financial products that you need in order to enhance the trader experience… did I mention private credit markets are approaching 4T?

Anyways, should this get off the ground? I’m unconvinced. Will it? If interest rates come down, all bets are off.

Information Blocking and the Cures Act

I was catching up with the brilliant Brendan Keeler of Health API Guy and he got my wheels turning on some of the coming blows between systems of record and upstarts and he mentioned some of the things in healthcare that have been done to maintain some balance.

Healthcare famously has some of the most entrenched systems of record. There’s just no path to disrupting Epic anytime soon. But regulators also know this and want to encourage healthcare innovation. An industry monopoly is great, until patient outcomes suffer and physician practices are bloated because innovation can’t get useful data out of EHRs. As a result, the Information Blocking provision of the Cures Act mandates that EHRs cannot block information. The data must be able to leave systems (with of course several caveats).

I have two thoughts on this:

Is there a world where the Cures Act is used as a blueprint for regulations on systems of record in other industries?

This is currently being litigated by Tekion against CDK Global in the automotive space.2

In industries with information blocking regulations, systems of record are still not necessarily designing their APIs to promote information leaving the system. But wait a minute: now we have computer use agents that can export the data simply via using the software in a defined way. If information blocking rules start to regulate other system of record environments, the data is getting out even if the APIs are rate limited, poorly designed, or simply not present.

Given that the majority of venture returns are going to be tied up in AI platforms that necessitate data from current systems of record, I am going to be very curious if this becomes a more public issue and policy demand over the next 4-5 years.

Mark Leonard

I did want to make a brief note here: A giant of vertical software announced his abrupt retirement this week. Given its abruptness, my thoughts and prayers are with Leonard and his family as there’s some speculation of health issues.

Constellation Software is one of the best managed and best performing capital deployment vehicles of the last 30 years. And Mark’s writing will continue to hold up over the next 30 years.

When we get to the point where we have CDOs on Pikachus, I want Michael Lewis to give me a call.