The Freight Ecosystem

or how vertical democratization will change the industry

An overarching note on this edition: Freight is so complex that even as long as this piece is, it’s non-exhaustive and I’m sure I have overlooked important details. If I have, feel free to let me know!

Logistics and Freight

Logistics is the art of coordination. And whether the matter is warfare or trade routes, the best logistics efforts are supposed to feel ordinary. Goods appear out of nowhere, shelves are stocked, troops have access to ammunition, etc.

The logisticians tasked with carrying out these efforts are blissfully unrecognized when things go according to plan. When things go well, their customers never think about who was responsible for moving the goods. They just appear. But when crises like the Covid supply chain mess occur and coordination issues become fraught, logisticians end up in the spotlight. And suddenly the lives of the logisticians becomes quite a bit more stressful.

“My logisticians are a humorless lot … they know if my campaign fails, they are the first ones I will slay.”

– Alexander the Great

The recent supply chain disruptions have led to historic levels of investment dollars going into the sector. Everyone wants more automated and robust supply chains and so new companies are off to the races, promising better technology and the prospect of dramatically changing the supply chain.

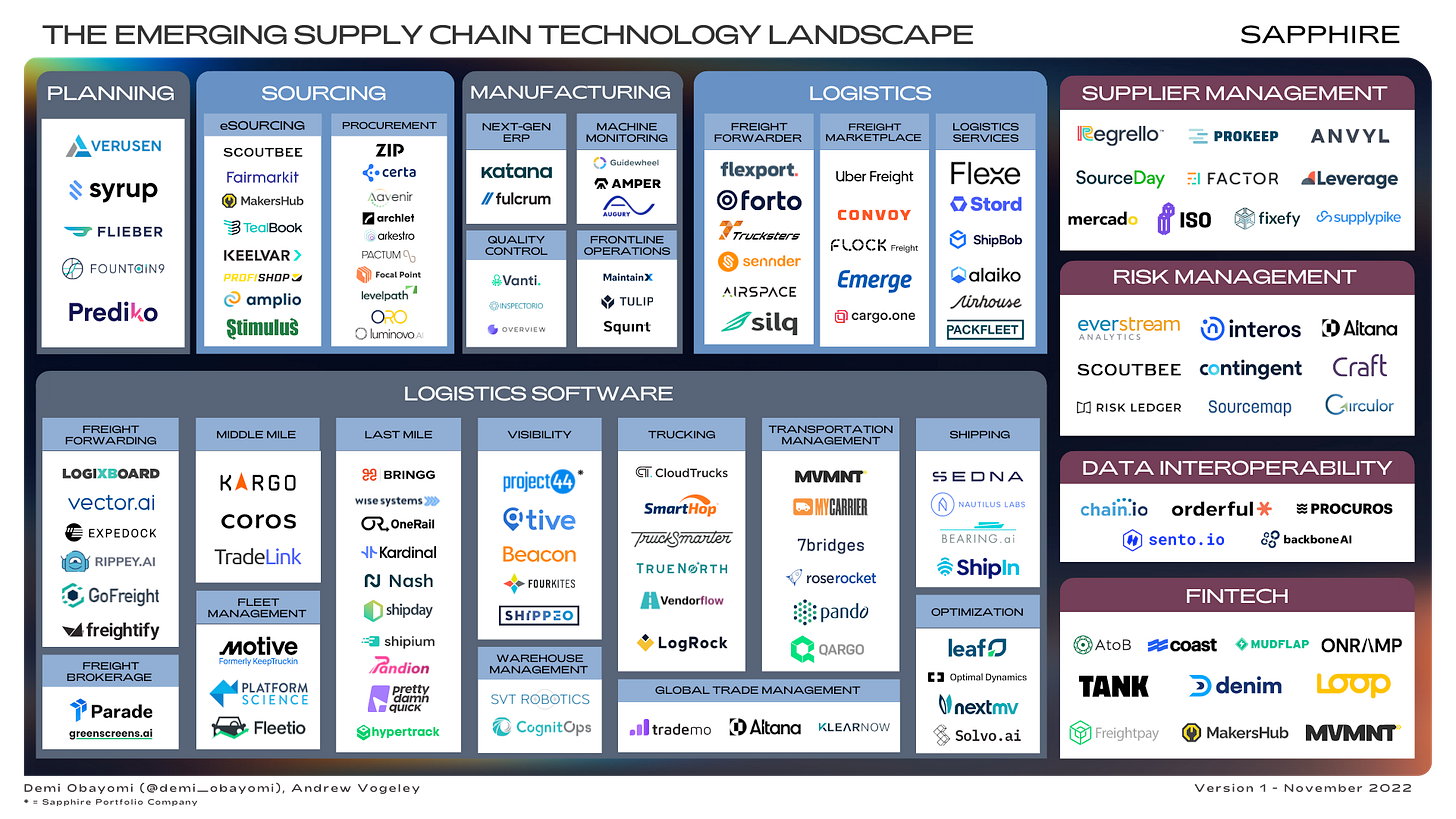

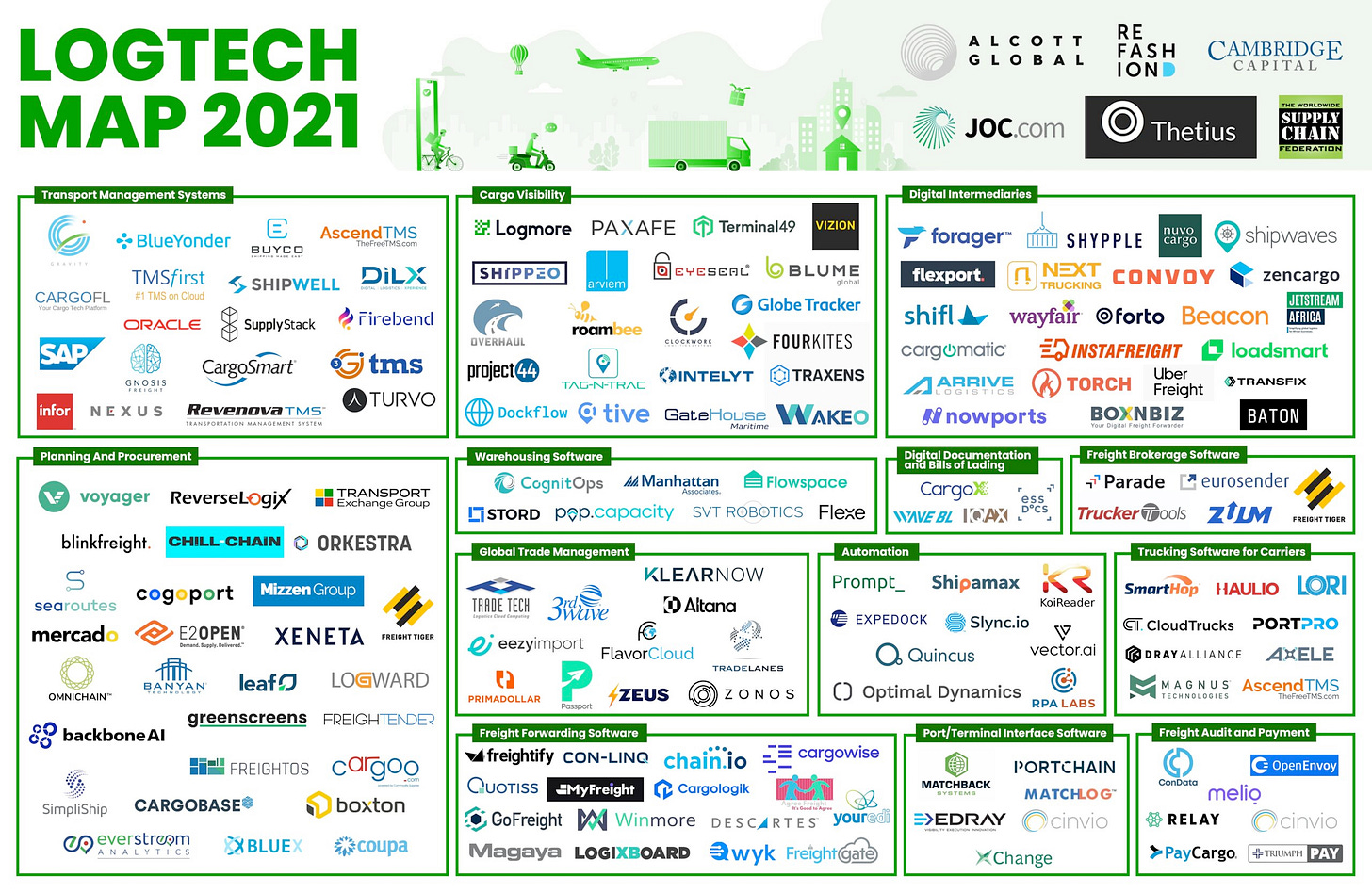

You can get a glimpse of the landscape from two maps. Sapphire’s is full of the newer players while the LogTech Map is more inclusive of existing ones.

But cut through the noise a bit and ultimately all of these companies, whether they enter as new tech-enabled service providers like Flexport or strictly as software companies, will be judged by how effectively they solve and reduce coordination issues in the industry.

And if your software or company can’t provide a clear advantage to the logistician, it too will be slain.

Okay, that might be dramatic, but it captures the dynamic within the freight industry which is often quite skeptical of Silicon Valley fervor that software can fix the supply chain.1

Coordination issues are really, really hard. And it’s a borderline miracle to solve when it gets more global. So some skepticism is healthy. The best way to grok this is probably to take a quick look at the most well known logistics tech player in the space: Flexport.

Flexport, Vertical Integration, and Vertical Democratization

Flexport is a useful starting point both because it exposes some of the problems undergirding the freight ecosystem that technology might help solve and because Flexport has been a digitization pressure for the rest of the industry.

Flexport represents the modern foray into supply chain tech in the Valley. Flexport is a digital freight forwarder, meaning that they use a mix of software and operations to coordinate the movement of goods and the movers of goods across the globe.

If you’ve ever listened to Flexport’s founder, Ryan Petersen, you know that it has not been easy to build. And since, Flexport has seen pretty much every facet of global trade, it’s helpful as a starting point to ask: “why has it been so difficult?” Or better yet, why is it so hard to build an end-to-end automated freight experience?

And what becomes immediately clear is that freight has a massive data issue.

Ryan Petersen says it this way:

The physical process [of moving freight] is manual. [But what] you’re trying to do is get it so that the data moves seamlessly without humans having to do things. Even then, there are parts that are manual where people are like, “How do I get data to and from each actor out there in the field that needs to do something? How do I eliminate layers between that operator, who really knows what’s happening, to the freight and their dispatcher or manager? Then ultimately our company and our customer?” There are all these layers to communication.2

Even today with 3.2B of revenue and large scale, Flexport is nowhere near their ideal in terms of automation. There’s tons of manual operations.

“I wish we had more [engineers]. We have less than 600 people making software out of the 3,000. Call it 20 percent or so. We have a lot of sales and account management and a huge amount of operations. These are people who are coordinating these shipments, clearing customs, and doing data entry. We still have to ingest a lot of docs. "

Even in the most tech-forward service providers, it has proven really difficult to automate all the data processes. Instead hundreds of employees handle coordination issues and they aren’t approaching anywhere near a fully automated state.

If you replicate this problem across the entire industry, you can start to grasp the problem.

Fundamentally, freight has massive data interoperability issues throughout the value chain (more below). But there’s also plenty of efficiency problems around workflows like route planning and scheduling at the individual company level that compound the mess.

And so, if the largest software-savvy freight forwarder still has a long way to go, we can imagine the state of the rest of the industry whom they interact with.

To simplify, there are two coordination issues that a company like Flexport faces that are at the root of what either their proprietary software or vertical SaaS players have to solve:

Coordination Issues

Shipper-Carrier inter-coordination: Data exchange between the freight industry and customers (shippers).

Imagine for a second you are a large ecommerce player that desperately needs new inventory in before Christmas. You need a rough idea a) when to order, b) what different costs throughout the chain look like, and would like c) real time tracking of the inventory in transit. In other words, you are a shipper and your primary problem is visibility and getting enough data to make procurement decisions.

Freight intra-coordination: Freight players coordinating data exchange amongst each other.

Alright so now imagine you are a carrier, broker, or freight forwarder that is tasked by a shipper with transit. Your task is to move the goods where they need to go, as fast as possible, and with as little back-and-forth over instructions between different parts of the value chain.

In other words, the challenge is receiving and acting upon time-sensitive data.

You need better ways to automate and inform key workflows, and better ways to integrate into key external sources of data (instructions on when goods should be delivered, etc.)

In some respects these challenges are two sides of the same coin. And initially that is what prompted the bet on Flexport.

Vertical Integration

Flexport looked at the coordination problems and decided to vertically integrate the solution.

In this sense, they mirror one of my favorite Keith Rabois quips:

And so the Flexport bet was essentially that by vertically integrating the tech stack, and treating problems #1 and #2 as solvable within one platform, they could abstract away all the operational complexity with software (ergo better margins), and win.

So Flexport’s software has all sorts of relationship management tooling and data visibility for the shippers, while they simultaneously build software and integrations to solve intra-coordination challenges amongst carriers and brokers.

But this approach has limitations for getting amazing technology inside the rest of the industry. After all, it’s dependent upon using Flexport as an intermediary.

But Flexport’s entrance has increased the number of eyes on better software and they have served as a provocateur for the rest of the industry, whom might have qualms about Flexport’s current model but agree with the need for better tech. Same too with Convoy and Uber Freight.

Industries have a way of adapting to the challenges presented by disruptors. And if the disruption factor is more to do with Flexport’s technology rather than its operational savvy, they will go hard after the technology.

So what does the equilibrium point look like for the industry?

On the one hand, logistics insiders suspect that recent Flexport moves indicate that Flexport is rethinking its approach somewhat from an asset-light, digital freight forwarder (read mostly software and emails) to an asset-based one (read actually owns a lot of… assets).3

And on the other, while the industry has historically relied upon manual processes, on-prem tech, and low visibility to their counter-parties (whether shippers or other parts of the freight value chain), they aren’t really content to let Flexport and other tech-enabled service providers eat their market share. Every logistician and every party responsible for freight is ready to implement good software.

Vertical Democratization

In other words, there’s hunger for vertical democratization of the technology that has been vertically integrated in the new service providers. And this has led to the new wave of vSaaS companies that are innovating across the whole ecosystem.

One way to pitch the vertical SaaS thesis is that you don’t need to vertically integrate in order to disrupt: you should actually spend your time building out better platforms throughout entire industries.

And so while, there’s plenty of buzz around the vertical integrators, what may be more exciting for the prospects of industry-wide digitization is the wave of vSaaS logistics tech companies focused on enabling every player to compete in the new tech paradigm and solve problems inter and intra-coordination issues.

To put it in Rabois terms:

vSaaS companies find the reasons for low NPS within a fragmented industry and solve it with better software for all players throughout the stack.

In part due to Flexport, Convoy and other’s vertical integration efforts, vertical democratization of freight tech is arriving.

So what does that look like? Well, to sum it up here is what I think is happening:

New approaches to integrations and the advent of real-time data from hardware has changed how systems interact with freight data.

Modern TMS systems are now capable of focusing on real-time and advanced workflows, assembling platforms that act as the source of truth for all data flowing through carriers.

Data gets leveraged and the ease of integration allows brokers to implement dynamic matching and new marketplace models

Freight forwarders are equipped with better CRM tools while shippers are equipped with full visibility platforms

Finally, fintech and neutral collaboration platforms begin to develop.

Macro-Trends in Interoperability, Visibility, and Coordination

EDIs and APIs

It’s important at the outset to talk about the macro-trends that are in part responsible for the massive changes in systems and possibility of digitization in the freight industry.

One of the key problems with freight coordination has stemmed from the industry’s reliance upon EDI exchange as the core data transmission layer.

I’m going to risk a drastic oversimplification and mostly talk about this at a high level.

Since the 90s, items like bills of lading, load tenders, shipment status messages, invoicing data, and more are all transmitted accordingly in accordance with the EDI protocol.

On its own this feels fairly innocuous. The problem stems less from the protocol and more from the contents transmitted.

“Each business system uses a different internal transaction format, which makes it impossible to directly import a transaction from one business system into another; even if both businesses were using the exact same version of SAP – say, SAP ERP 6.0 – the litany of configuration and customization options (each of which affects the system’s transaction format) renders the likelihood of direct interoperability extraordinarily improbable. These circumstances necessitate the conversion of data from one format to another prior to ingestion into a new system.”4

Two problems emerge: data standardization and data integration.

In fact, one way to think about Flexport is as an integration specialist. They have mastered the art of integrating into various disparate systems, throughout the world, standardizing the data, and displaying it to their customers.

Below you can sort of see what I mean.5

Since every business system is a bit unique, onboarding trade partners takes a lot of time and effort, and so most companies with dreams of changing freight end up stuck as systems integrators.

The challenge has been pretty well known but everyone just dealt with it, in part because there wasn’t a large enough ecosystem of modern tech platforms that could support an integration network. That’s all changed and a new wave of companies have emerged that are building out these sorts of iPaaS platforms to bring modern development to the space.

The knock-on effect is that seamless integration is quickly becoming an industry mandate and all participants being judged by their integration support.

Chain.io is perhaps the best example of an iPaaS platform in the space, aiming to build the Zapier for logistics by enabling any company to join the platform and integrate with any other member of the Chain Network.

These sorts of integration platforms are a massive tailwind for the vSaaS industry.

New TMS systems, logistics service providers, and more can now differentiate their offering on key features rather than upon the ease of integration into a carrier’s broker.

Historically, the thing that has killed industry innovation is the integration issue. Everyone dreaded the question often asked: How much of a pain will this be to integrate?

Not anymore. Instead of avoiding the question or worse, quietly saying “let me go back to the engineers and see if this could fit on the roadmap,” a team can immediately answer "we support all integrations possible through the Chain Network" and end up with hugely reduced deal cycles and easier implementation.

So due to these sorts of integration platforms and modern API architecture for new tech platforms, we probably end up with the integration problem mostly solved this decade. This will significantly help ease the single biggest blocker in coordination and enable new vSaaS platforms to distinguish upon the merits of their workflows rather than how fast they can integrate.

But that’s not the only data landscape that is changing.

Real-time Data

Logging driver hours has been the law of the land in the US for quite some time, but since 2019, it’s been mandated to be done through ELD, electronic logging devices. In other words, we now have a federal requirement to mount these units on trucks and now have reams of real-time data on freight.

Companies like Samsara and Motive then make this available via API, every aspect of the chain wants to display this data in their systems, and we essentially have the makings of an industry movement towards real-time visibility at all times.

So if EDI represents old forms of data that needs to be transmitted more seamlessly, real-time data represents a new form that everyone wants access to.

The chosen path has been for carriers to integrate this data into modern TMS systems, share this data with their trade partners, and ultimately this data gets transmitted to the shipper level.

In turn we now have the setup for new and existing platforms to focus less heavily upon painful EDI integrations, more on surfacing real-time data, and focusing more heavily on workflows for their specific part of the value chain.

On the Ground Software6

Throughout the freight journey, goods get moved. Logging when and where these goods get moved is largely the job of individual parties throughout the stack. As goods pass through different providers whether nodes like ports or loading docks, or carriers, they also pass in and out of a variety of systems.

Transportation management Systems

While TMS as a category is largely applicable throughout the whole stack, I’ll largely talk about it through the lens of individual carriers (mostly trucking companies) and brokers.

TMS systems are historically databases that have captured what freight a carrier is responsible for and who will transport that freight.

But overtime, and especially given the factors outlined above, they are becoming platforms key to the day to day operations of operators and the source of truth for all data streams that flow in and out through integrations.

There’s a huge amount of TMS systems in the market, upwards of a thousand even. Historically, they have segmented into support for different type of loads and complexity.

But most modern TMS platforms are seeking to support a wide variety of carriers through enhanced platform modularity and enabling seamless integration into other carrier business systems and hardware.

To echo the previous section, it’s table stakes for modern TMS systems to support all sorts of integrations, develop modern API architecture to transmit information to external parties (or join an iPaaS platform), and ensure that their platforms are built for new forms of data (temperature sensing for instance).

Apart from data transmission and workflow modernization, the newer TMS systems are starting to differentiate off of two key features: design and integrated financing.

In fact, one of the most recent Series A TMS systems, MVMNT, monetizes entirely off of an invoice factoring solution.7

Long term, I suspect you will see most of the TMS space arrive at the same key workflows, although their prioritization strategies may differ.

Key Workflows: Routing, Dispatch, Time Tracking, EDI Transmission, Invoicing, and, Scheduling.

How deep is the moat?

Here’s thing, while the ease of integration due to iPaaS platforms and more aids TMS systems in cutting down blockers to sales, it also increases the risk of churn.

If switching costs in TMS systems have mainly stemmed from the pain of EDI integration and this pain becomes somewhat irrelevant due to new iPaaS platforms, over time, what do these companies ultimately distinguish upon?

My suspicion is that TMS players with dreams of winning large portions of the market will have to build other core business systems for these companies, like CRMs, accounting features, or fintech products.8

In other words, fleet management companies like CloudTrucks and SmartHop, TMS systems like Rose Rocket, and others begin to converge upon platforms capable of helping carriers, brokers, and others fully operate their company. We aren’t there yet and so I think it will be extremely interesting to see what the strategy around this is. Roll-ups seem highly plausible.

Rail9

Rail shipping providers need software. So do rail hubs. There’s not strictly speaking a lot of it. Best I can tell, this would be your competition:

In Europe, rail has a bit more going on. I think Rail-Flow would be the interesting company to look at here for rough analogies.10

Here too, real time visibility that could plug into rail management systems and go up the value chain would probably be the path.

Port Community Systems

This is a fun one that could derail the rest of the conversation. Ports are pretty bad! And they’re the particular bane of Ryan Petersen’s existence.

It’s a complex problem that’s not just directly curable by software. Total automation would mean rebuilding the ports wholesale, but software can still play a large component. There’s really not a lot of interesting things in this space, so I am more noting it here for posterity... and in case, Ryan Petersen one day gets to be Port Czar and the ports start considering how to operate more efficiently.11

I’m not sure if there’s a startup here, despite being stuck with really bad software right now (at least in the US). The nuances of port administration might allow for a clever founding team to crack how to get the software in the door but it is an uphill battle. Internationally, since every country regards their ports as a matter of national security, expect it to be even harder.12

Loading Docks and Yard Management Systems

Freight’s journey isn’t continuous and routes are full of stops at intermediary points like yards or warehouses.

Currently, there’s software like OpenDock and C3 Solutions that helps yards manage dock scheduling and other adjacent flows, but given some of the macro-trends it strikes me that there’s a large need to equip docks and yards with software that allows access to real-time data that helps with planning. While, these two might implement some of that, I think it represents an opportunity to rethink what software with real-time data would look like.

Docks still often operate on a “first-come, first-serve” basis and digital transformation has been tough. In theory real-time data would fix a lot of this and ultimately it’s what shippers and forwarders will demand happen.

On top of this, none of the current platforms have a compelling mobile interface and since operators are often not at a laptop, there’s a compelling opportunity to take a Whoosh (piece here) or Procore approach to the mobile experience and get software in the door/yard.

Dynamic dock scheduling will happen within the decade. It’s a software problem that the ecosystem now finds valuable and a platform will emerge.

This is also an area where a clever team would be able to bundle fintech tools (payroll from a provider like Check) to consolidate systems for these SMB owners.

Key Workflows: Yard Asset Management, Real-Time Tracking of Inbound/Outbound Freight, Dynamic Scheduling

Up the Stack: Brokers

Alright now to the next level of abstraction, the marketplaces (brokers) that intermediate various journeys of freight’s journey.

With this, it’s important again to distinguish between the tech-enabled providers (the marketplaces) and the SaaS companies whom are providing workflows for traditional brokers to compete with new brokers.

Broker Vertical Integration

All brokers across trucking and air cargo13 correspond heavily to a vertical marketplace model and exist to match carrier supply with shipper demand. But mostly let's talk about trucking brokers.

One of the preferred approaches to disruption has been to develop proprietary tech packaged in new brokers and start to eat marketshare. This sort of vertical integration has featured prominently in Convoy, Uber Freight, and Flock Freight's strategies, each of which have onboarded large amounts of carriers and shippers to matchmake.

These new brokers are highly sophisticated and are a large part of the domestic demand for more real-time visibility.

Through a mix of visibility and tech, all these companies have innovated to create digital freight matching (DFM) which allows these brokers to dynamically price and manage capacity.

DFM has created large efficiency gains. Trucks often drive around empty and these brokers have been able to partly rectify this through dynamically matching loads.

And so most of the trucking industry is convinced that this sort of dynamic matching is the future, they see it in the efficiency gains, but the traditional brokers are not content to go silently into the night as their market share gets eaten.

So DFM is beginning to be productized and vertically democratized.

Vertical Democratization for Brokers

I like this quote from Ben Gordon:

There are three types of players in DFM. First, there are the OGs, firms like Convoy, LoadSmart and Transfix that started early and have a head start. Second, there are the incumbents fighting back. Companies like C.H. Robinson, Echo and Everest Transportation… are traditional truck brokers who are investing heavily in technology.

And third, there are the arms merchants. Companies like Parade.ai and GreenScreens.ai are selling powerful tools to the truck brokers to give mid-sized companies the ability to compete with the giants. All three, as I see it, have an opportunity to succeed.14

So whether in-house or external software providers, there’s an arms race for DFM.

Parade and Greenscreens capture two different aspects of the value provided by the new brokers: dynamic capacity management and dynamic pricing.15

While neither are true platforms yet, by embedding themselves deeply within brokers feeling market pressure to implement DFM, they have massive potential to build out extensive platforms that could change broker operations.

Parade in particular is moving in this direction and already provides CRM tooling designed to optimize broker communications with shippers. That’s table stakes for the new world and it strikes me as a huge value add.16

Regional Marketplaces:

Importantly, brokers are highly regional players, dealing with the idiosyncracies of their locale.

And so there are plenty of regions without tech-enabled brokers where there is a massive opportunity to vertically integrate and build out better marketplaces for the region.

Kamion in Turkey and Frete in LatAm are examples of how this could come to fruition and will provide massive value to the ecosystem. They can become trusted intermediaries for entire regions as the need for DFM starts to go global.

The Global Players

Lastly, we come to the truly global players: freight forwarders and shippers tasked with managing complex global supply chains.

The same dynamic that characterizes freight brokers also characterizes the freight forwarding world. Rather than be redundant and go back into Flexport and that model, I’ll just go into the most interesting software/marketplace player out there: GoFreight.

GoFreight advertises themselves as the Shopify for freight forwarders. This essentially means that they are building out “storefronts” for the long tail of small freight forwarders in order to help them acquire customers in digitally native ways. On the backend, they develop key workflows to help manage customer relationships and more. Over time, much like any marketplace within a vertical ecosystem, they will most likely develop far more vSaaS for these freight forwarders and ultimately end up with functionality more akin to a freight forwarding TMS for the SMB segment.

What makes GoFreight interesting is that since they are heavily focused on the SMB segment of forwarding, they don’t have to face the same existential question that most other freight forwarding vSaaS companies will have to ask.

And since, I have never seen this question asked in any freight tech piece, I’ll just ask it.

What’s the advantage of using your platform for freight forwarders vs. using Cargowise?

Cargowise is a giant freight forwarding software platform used by something like 41 of the top 50 freight forwarders that has solutions for just about every need a global freight forwarder will have. Nobody really love Cargowise, but in part due to the strength of its integrations into customs and port community systems, it has an incredible moat.

And so even if your workflows are better, you face an issue, can you tackle the huge variety of integrations that Cargowise has mustered and prove reliability for the largest enterprise customers?

And yes, iPaaS platforms might lessen the burden here, but we are talking about hundreds of countries systems, burdensome document management, and more.

The path is probably to unbundle specific workflows in order to eventually rebundle all workflows within a better platform and that’s indeed what certain companies like Klearnow and Logixboard are doing. But it remains unclear to me if these companies have ambitions of becoming rebundled, modern platforms.

It’s a really tough problem to crack, and admittedly I haven’t dug into this as much as I would like. Cargowise is an interesting enough company that I may do a standalone piece on their history.17

As a starting point for a vSaaS company, I think you could look at what freight forwarding companies are eyeing as the weaknesses of the Cargowise platform:

The feature areas where forwarders are looking to supplement CargoWise, the flagship product of Sydney, Australia-based software company WiseTech Global, include everything from shipment visibility, reporting dashboards, and online quoting to internal coordination and remote syncing with customers. Many said that although WiseTech has acquired solutions in these areas, those solutions haven’t always been well-integrated into the core product.18

Visibility

And with that we head to the shipper side. Shippers, whether they use an intermediary like a freight forwarder or own the logistics operation entirely in-house, are craving one thing: visibility.

Real-time data for shippers isn’t merely a stress-reliever, visibility data comes with the promise of actionable insights. This ends up interacting with a wide variety of their other business systems, (ERPs, CRMs, etc.), but at the end of the day, there is now the possibility of shipper-centric platforms for supply chain management.

Visibility platforms like project44 and FourKites have historically been integrators (I’m sensing a theme) to provide this visibility.

But as has been the case throughout this entire piece… everyone is kinda doing the integration work. It’s becoming commoditized and so I think all these supply chain visibility platforms will arrive at the same conclusion: you ultimately have to move beyond pipes to advanced data analytics that are available to you because of all the integration work.

The next wave of supply chain visibility will be less around the actual visibility and more around what this visibility allows shippers to do. Can your platform help shippers with procurement cycles? What about with route planning?

Second, platforms built around visibility also have the ability to become the source of communication for shippers and freight forwarders to leverage.

This point is a bit nuanced, but essentially think about how Twilio can be viewed either as an iPaaS specialist for telecomms networks or alternatively as a communication platform for all sorts of use cases built on top.

This is the direction that these platforms will be forced to move in and nailing the transition will be core to their long term value.

And this perhaps brings us to a nascent category that somewhat transcends the shipper/carrier distinction.

Neutral Platforms

As data becomes unsiloed and integrations become commoditized, coordination in some important respects now can be elevated into the realm of collaboration between all parties throughout the value chain.

There’s companies like Sedna that are currently augmenting emails, messages, and more, but I don’t think this is the end state. My hunch is that we will see new neutral, meta-platforms platforms that are connected into all the relevant sources of truth throughout the value chain (TMS, yard management, etc.) that allow shippers and freight providers to coordinate and approve route changes, modify shipping information, and more without the back and forth of emails, while seamlessly updating all relevant systems.

I’m eager to see who takes a crack at it. As it stands right now, GoodShip looks like one of the better examples of what a neutral, collaboration platform could look like.

The integration winter is coming to an end, new meta-platforms are possible and pose an interesting solution to the back and forth that will still characterize most interactions throughout the industry.

Fintech

Lastly, we get to fintech where a whole gamut of fleet cards, trade financing, and invoice factoring solutions seek to solve financial reporting and cash flow management for the industry.

Fuel/Fleet Cards

About 2-3 years ago, entrepreneurs looked at the market cap of Wex and Fleetcor and realized “hey wait, there is massive money in building out fleet and fuel cards!”

And so they took the lesson from Ramp and Brex around combining financial tooling with cards and were off to the races.

There’s a lot in this category with AtoB, Coast, Mudflap, and Outgo all offering somewhat unique spins on standalone fleet cards, while a suite of tech-enabled trucking platforms like CloudTrucks and TrueNorth have chosen to embed fleet cards into their platform.

The make or break for these companies will be mainly around how they are able to drive successful GTM motions aimed at different market segments.

A lot of the fundamental innovation in this space is pretty much done, GTM will win the day.

Invoice Factoring

There’s a couple different approaches to invoice factoring and how vSaaS/fintechs are using it as a core piece of their product and service vs. a GTM and monetization strategy. Basicblock operates more like the former while others like MVMNT are using it as the fundamental GTM and monetization strategy.

At the end of the day, modern factoring and better financial tooling will help alleviate some of the cash flow issues that truckers and carriers face.

With that said, it’s really hard to build a venture-scale invoice factoring fintech given the current market saturation and thus I think the market will ultimately favor embedded offerings within platforms. Invoice factoring will then operate as an additional monetization and retention strategy while the core value is derived from the software.

Trade Financing

On the freight forwarding side, embedded trade financing captures most of the buzz. Given the vast swaths of data that the Flexports of the world possess, modern freight forwarders are quickly expanding into trade financing in an effort to help their customers solve inventory and cash flow management issues that brands face. Flexport in particular is looking to creating a large business off of this and is off to the races with a new 200m line of credit going into the business a couple months back.19

Payments

But at the end of the day, finally solving the complexities in freight payments is the real holy grail. There’s different approaches. Some like Paycargo or TriumphPay are looking to create payments networks that operate as the de facto payment option for regional or international freight networks.20

But there’s other approaches to payments orchestration that don’t involve building out a payments network in phase one.

In freight, the problem isn’t simply making and receiving payments; it’s far broader. The problem space involves receiving data from an invoice, matching it to shipping information, and ensuring proper payment accordingly. It’s a large financial coordination problem that stems from some of the same EDI issues as before.

And it’s why Loop is quite exciting. Loop is tackling the gnarly invoicing problem as a business mandate, creating an orchestration layer for freight companies, and offering financing/invoice factoring options on top. They don’t currently look like a payments network, but the end result could be close.

If Loop or another startup solves invoicing, they will end up indispensable to every player throughout the value chain and unlock massive enterprise value. A payments network will automatically become a viable second act.21

Wrapping it up

The next generation of logistics vSaaS faces tailwinds from the industry pressure to digitize and headwinds from the industries historic skepticism of software panaceas.

Great GTM and product minds will thus have their work cut out for them but realistically have shots at digital transformation.

Skepticism is warranted when we start to talk about the entire supply chain being digitized and automated. Self-driving trucks and robotics are still a ways off. But what vSaaS platforms can do and will do is bring all industry data online, solve the interoperability issues, and ensure that their customers have modular software that enables them to thrive in the current ecosystem.

In turn, we will have meaningful transformation across the entire value chain and far more legibility into the global coordination of goods.

And that is how the the new vSaaS end up indispensable to Alexander’s logisticians.

Peruse some logistics industry writings and you will quickly find wide skepticism at panaceas.

https://www.theverge.com/2022/9/20/23362021/flexport-supply-chain-crisis-logistics-software-tech

From the best resource on EDI: What Makes EDI So Hard?

https://flexport.engineering/how-the-flexport-ecosystem-team-is-helping-automate-global-trade-8fdc7ebceb27

Manufacturing ERPs, End Brand Logistics Platforms form the two ends of a goods lifecycle. They won’t be covered here.

This feels like an approach that might end up being deprecated. Flexport has thought a lot about TMS and came to the conclusion that they have to make trucking companies pay a nominal amount simply so they are invested in utilizing the tech.

MVMNT’s risk in the short term is that they don’t finance enough of a company’s invoices to generate meaningful software engagement and they lose interest in your TMS altogether. And you can’t exactly operate invoice factoring as a loss leader to get in the door without having really bad incentive misalignment long term.

I’m sure they’ve thought about this a lot more than me and have a clever GTM, these are just the questions that came to mind.

More on MVMNT here.

If I’m a small forwarder [referred to as an LSP going forward], tomorrow I could pull out my credit card and buy visibility software, rate management software, invoice auditing software, a TMS and an online quoting skin. Those are all vital but they aren’t the differentiator that internal customer knowledge capability is. The ability to know what a customer needs, when it needs it, how it likes to be reached, via what channels. That’s the differentiator going forward.

Again, let me reiterate that this isn’t a question of buy or develop a CRM and then ignore everything else. Rather, those operational tools should feed into the CRM, so that a relationship manager can pull information from the operational relationship an LSP has with a shipper directly into its interaction on the sales side. The question, as an LSP, shouldn’t be “what can we do for you?” followed by a list of services the LSP provides. It should be, “it looks like this is what you struggled with, and this is how we’ll solve that.”

There is like no modern platform that I am aware of here. Who is building this?

T-minus how long before Topicus buys Rail-Flow?

Ryan Petersen if he was czar:

From a starting point, if I’m the czar…then I am in charge. I would do a big buyout and take care of the union… We need technology and the union doesn’t want it. We need safety, we need efficiency, we need robotics, etc….

Now we are free to run this thing like a well-oiled machine with full robotics. Let’s go invest in awesome robots. Where is the giga crane? We still unload these ships one container at a time. There has to be a better design…”

If all this happens, perhaps then it’s time to delve more into port management systems.nyl

PCS systems also get built “in-house/in-country” internationally quite a bit.

Cargo.one is the player in this space. A lot of this applies to them as well.

Do they end up creating TMS systems or developing robust partnerships? either seems plausible.

There’s another interesting side question: how much better is Flexport’s system over what you can get out of the box as a freight forwarder with Cargowise?

No doubt, Flexport has a superior customer experience with better data availability. But

https://www.joc.com/technology/logistics-technology-providers/wisetech-global-cargowise/forwarders-charting-multi-system-path-meet-evolving-shipper-demands_20210212.html

https://www.bloomberg.com/news/articles/2022-10-20/flexport-receives-200-million-from-kkr-to-grow-trade-financing

TriumphPay is really interesting as they are essentially embedded within AscendTMS, the largest TMS systems in the US carrier space.

There’s some analogies that you could imagine some of the newer payments players doing. Perhaps direct implementation inside of TMSs to offer an alternative payments network to TriumphPay?

Great overview of the ecosystem, Eli. Many thanks! We need more people writing about this industry

Thanks Eli for this brilliant piece!