The Past, Present, and Future of Field Services

From diagonal SaaS to hyper-specific SaaS

“There are more field services in Heaven and Earth, Horatio, than are dreamt of in your philosophy.”

The service industry is broadly tasked with keeping the economy oiled and ready to run. It comprises the essential services for both homes and businesses that cause havoc when things go wrong. After all, nobody has yet innovated out of the need for plumbing maintenance. Everything is bent towards entropy, and field and home services are tasked with mending it.

But much like other industries comprised of SMB/SMEs, the workflows of the entropy menders went unnoticed by tech for a while. Not anymore. And what’s exciting now isn’t simply the proliferation of software for basic workflows that carry across all service operators, but the rise of software devoted to each segment within the broad vertical.

So today, we trace the various waves of software that have come to characterize the industry.1

The First Wave: Diagonal SaaS in Home Services

It wasn’t until ServiceTitan and ServiceMax entered the scene that we started to see some of the core workflows in field services come online in a meaningful way.

Sure, there were plenty of legacy solutions, but as is the story in most of vSaaS, this sort of software didn’t make a fundamental dent in the workflows of the industry and thus there was plenty of stuff done on pen and paper.

These two companies operate at radically different ends of the service spectrum. Leaving aside ServiceMax for a bit, let’s talk about ServiceTitan.

ServiceTitan

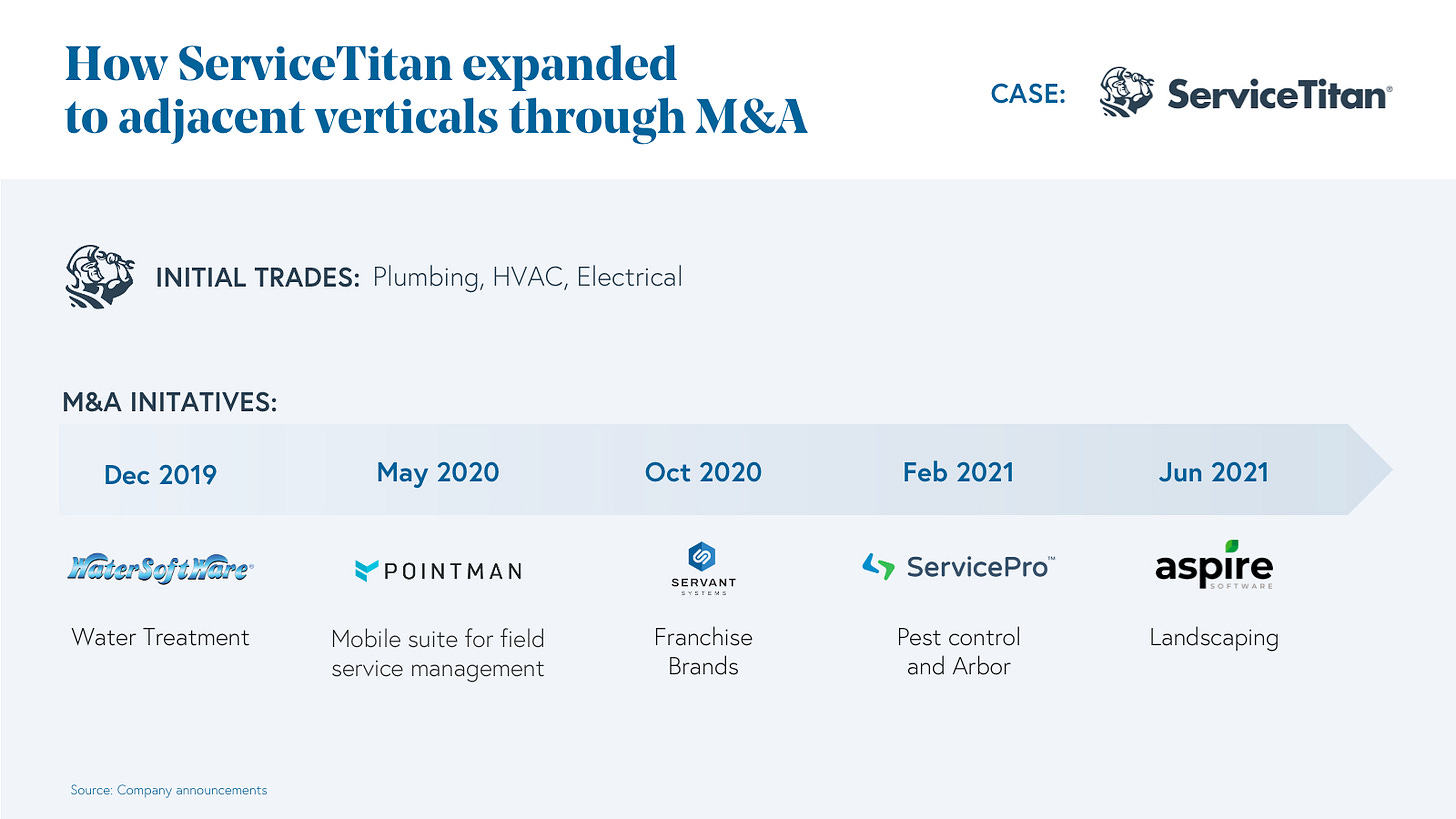

ServiceTitan is now synonymous with a wide range of field services, but at the very beginning, they were focused on three: HVAC, plumbing, and electrical. Even more specifically, they were focused on the residential side of the equation.

By attacking the long tail of SMB/SME residential servicers, ServiceTitan was able to identify plenty of common workflows across services. This is part and parcel of why they have been able to scale so effectively. Unlike in commercial where things gets far more complex, residential services are primarily characterized by their interactions with customers. Customers care about how seamless it is to book, the speed of response, and the efficiency of service. For ServiceTitan, all of that unites around products like SEO and marketing, dispatch, and booking.

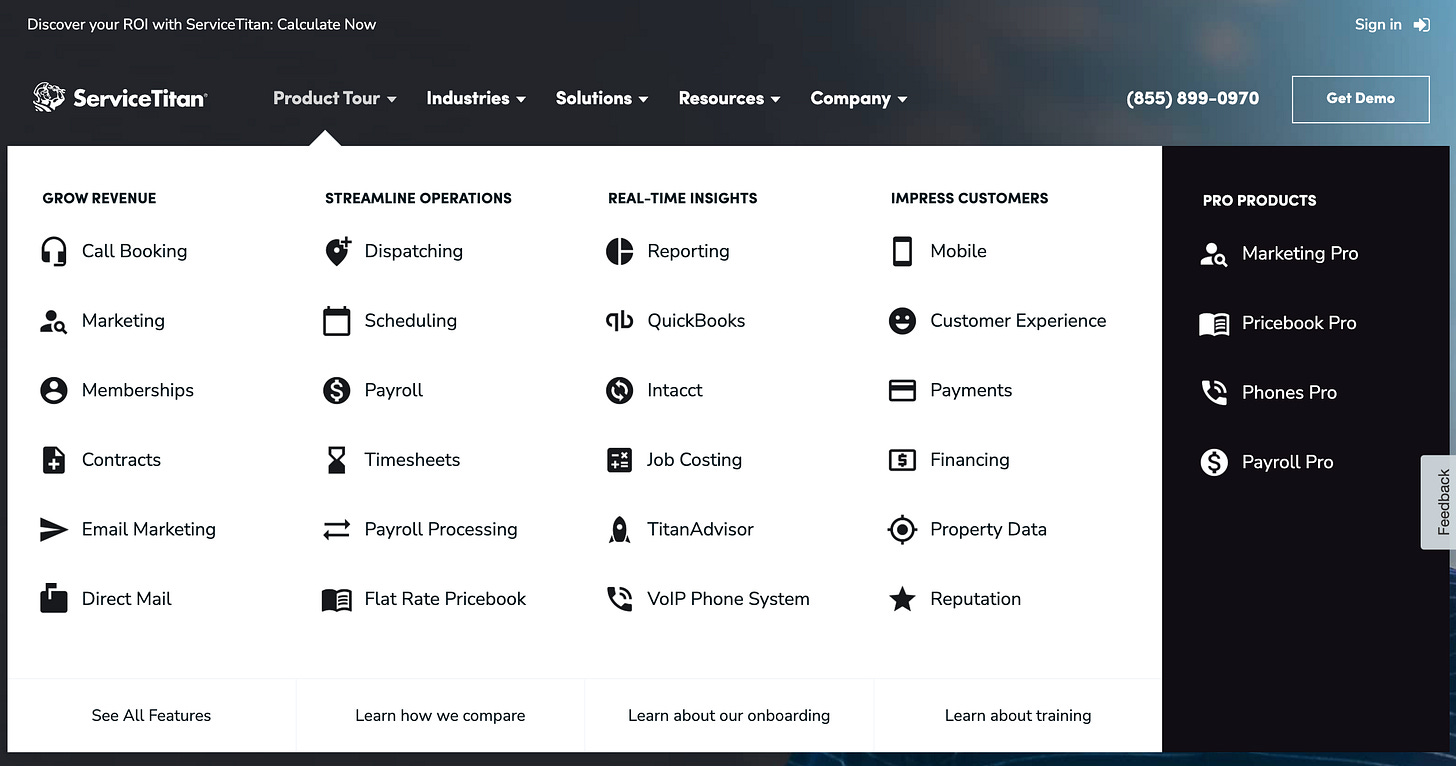

These commonalities have allowed ServiceTitan to build a product line that is neither fully horizontal, nor fully vertical.

Instead, ServiceTitan attacked field services diagonally.2 By this, I simply mean that ServiceTitan has both aspects of a horizontal SaaS tool in breadth (common workflows across multiple sub-verticals) and a narrowed focus in terms of depth (only field services). To that end, they have built and acquired solutions around a plethora of field services, with most of the product lines coalescing around the same features.

The 2023 edition of ST has products in pest control, arbory, lawn care, water treatment, and more.3

Most of the large field service softwares today all share this diagonal approach. Most of the differentiation comes from the business segments they serve.

For instance, Jobber, ServiceTitan’s counterpart and competitor, is far more focused on smaller SMB operators whom have limited need for more extensive management and reporting tools.

You can quite easily see the common workflows that the first wave brought online from perusing their menus: scheduling, dispatch, marketing, and more.

ServiceTitan has since scaled into commercial field services as well with some of the same bets around diagonal workflows. For a large portion of field services, this solves most of the complexity involved with the day to day operations and has unlocked immense value in the ecosystem.4

Wave 1.5: Industrial Services

At the same time ServiceTitan was attacking residential. ServiceMax was operating at at the other end of the spectrum: industrial services.

ServiceMax

While ServiceTitan has thousands of customers, ServiceMax has around 500.

The reason? ServiceMax serves the trickiest customers in field services - industrial equipment manufacturers that build and distribute complex medical devices, naval equipment, and more. And when you manufacture equipment worth hundreds of thousands or even millions of dollars, you don’t simply push their product into the market and leave. Their customers expect far more. When these machines malfunction, quick maintenance and repair is necessary and contractually stipulated.

Since dealing with these sorts of machines requires highly specialized knowledge, manufacturers mostly opt to have an in-house field service arm. This makes sense for all sorts of reasons. First, it’s the only real way to have a consistent product feedback loop and iterate from feedback/malfunctions in the market. Second, since the customer base is relatively concentrated (there are always limited buyers for high dollar equipment), it makes sense from a resource standpoint to build the service arm in-house.

Managing equipment and service teams post-sale is complex and what ServiceMax was designed to solve. The software comprises both field service management modules (dispatch) along with equipment and warranty ones.

That last set of modules turns out to be really important. No equipment (especially complex equipment) gets sold without an extensive warranty dictating when repairs are covered, requirements for preventative maintenance, limitations on the warranty, and more.

Often these servicers spend a good chunk of time verifying warranty information and tracking the lifecycle of the equipment they are servicing. This not only protects the OEMs from faulty claims, but serves a useful role in R&D. Information collected on the ground gets fed back to the manufacturer to make better products. In essence not only are these service teams mending entropy, they are also information conduits. ServiceMax helps OEMs and field service teams navigate this entire set of workflows.

This complexity is additionally why it’s really hard for ServiceTitan to cross the chasm into the larger enterprise service teams. It’s a totally different product set with its own unique requirements.

Wave 2: Specific Residential

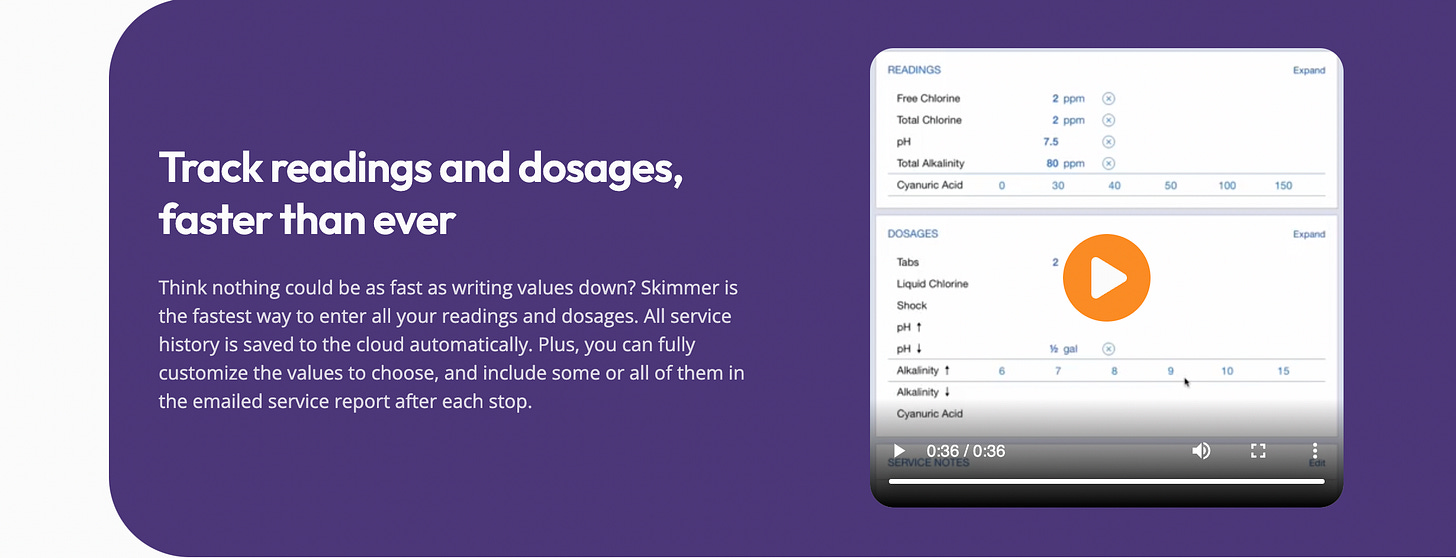

The second wave has been far more focused on uncovering the nuances of individual service verticals. Mending entropy takes many forms after all. Many of the workflows needed by different sub-industries don’t generalize very well. Roofr is focused on building estimator suites for roofers. Skimmer makes it easier for pool services to optimize routes and track pool dosages. Trashlab, Curbwaste, and Discovery are building software in waste management. Even poop scooping services are getting their own software.

And there’s a plethora of different services experiencing similar innovation. These companies attacking individual service verticals often start with a hyper specific and nuanced workflow. In the best industries for this strategy, often these workflows are onerous enough that a startup can crack open the industry even before reaching full feature parity with more fleshed out platforms like ServiceTitan.

There are some challenges for Wave 2. Given how small some of these verticals can be, it can become challenging to scale, especially if you have a mandate from your investors.

As a result, many of the more exciting verticals in wave 2 are finding ways to build financing into the product. Roofr is perhaps the best instance of this where their key estimator flows allow a perfect opportunity to bundle consumer financing for roofs on top.

Wave 2 is just getting started as more and more of these workflows get uncovered and more and more ways to build financial products on top get traction.5

Wave 3 and Beyond: Commercial Services and Ecosystems

There’s one interesting thing to note: many Wave 2 companies are still highly concentrated in residential services.

Commercial is right now going through its own sort of diagonal revolution. ServiceTrade has exited into PE. BuildOps is further modernizing plenty of workflows. And of course, ServiceTitan has now extended into the commercial side. And if you are interested in companies taking different approaches to some of the core diagonal workflows involved in the commercial segment: Convex is your company, whom have dialed in primarily around the revenue cycle.6

And while it’s early days for specific verticals and workflows, there are some really fun companies like Roopairs starting to figure it out.

The early signs point to a even further verticalization as entrepreneurs figure out some of the untouched workflows and move to create hyper-targeted solutions.

And while commercial verticalization happens, my guess is that we will also see a newfound focus on these software companies going deeper into the ecosystem around these service companies. Each commercial service is often one important player in a broader ecosystem that they must collaborate with in order to perform jobs.

Waste haulers need to interact with municipalities and brokers. Roofing contractors need to communicate with their materials supplier, even commercial HVAC companies are often navigating warranty processes with manufacturers. And while some industries might be better fits than others, currently there’s very little software that has been built to solve this gap.

In theory at least, by targeting a hyper specific sub-industry, vSaaS companies are afforded a ripe opportunity to take a different approach to ecosystem value than what Jobber and ServiceTitan provide. In going wide (and building incredible businesses), they simply can’t go as deep into the back office of any sub-industry. Instead, the third companies can think and design software for their entire value chain.

And as the commercial services revolution gets underway, my guess is that we will see some massive companies built. This segment in particular is one to watch.

I’m using waves here to paint broad categories, but as is the case in all software, some of the later waves are occurring simultaneously.

Thanks to David B. for the terminology.

For more on ServiceTitan’s acquisition strategy in other subverticals within field services, you can check out my piece here

In residential, my hunch is that most of these exit into the embrace of ServiceTitan or Jobber as the solutions mature. But these also strike me as fertile ground for smaller PE firms to make plays.

Convex is a great example of how vertical software can ultimately build better CRMs by first focusing on adjacent workflows that no horizontal player is going to touch. Their core competence is all this minutia around the sales process and obtaining commercial clients that is almost a building-oriented ZoomInfo.

Amazing article, Eli! Beyond excited for the future of the field services industry. Honored to be a part of the movement 😇